The years that immediately led to retirement must be a time when Americans can earn and save as much as possible before leaving the traditional workforce and trying to kick back.

Yet millions of people in their 50s and 60s are burdened with student debt – from their own schooling decades earlier or as loans taken out on behalf of children or grandchildren.

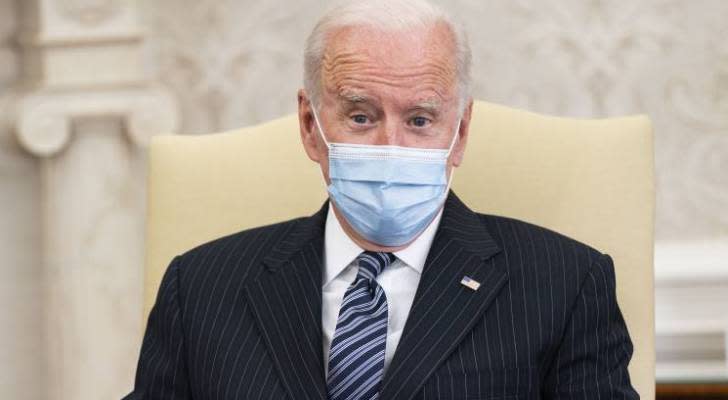

Some of the debt could be wiped out if President Joe Biden used his executive power to forgive as much as $ 50,000 in student loan debt per borrower. He’s facing increasing pressure to take action – and the alarming numbers of predecessors are among those hoping to provide relief soon.

The heavy weight of student loan debt on older Americans

Although the balance of student loans has increased among all age groups, the growth was greatest among those who close at retirement, according to a study by the AARP Public Policy Institute.

Borrowers over 50 owe $ 289.5 billion in student debt, up from $ 47.3 billion in 2004, the report said. That more than fivefold increase reflects sharp increases in the number of families borrowing and the amounts they borrow.

In the years before retirement, which according to GAAP is between the ages of 50 and 64, Americans need to set money aside and invest it for the next chapter in their lives. But older borrowers with student debt save less than their peers without it.

“To the extent that their budget is hampered by the need to repay student loans, it undoubtedly cuts their ability to save for other purposes,” said Lori Trawinski, lead author of the study, of AARP.

Student loans between the ages of 50 and 59 had a lower median amount in their retirement accounts than consumers without student loan debt, a 2017 Consumer Financial Protection Bureau report found.

Americans in their 50s and 60s Struggle to Save for Retirement and can pay off student loans, can get help from certified professional financial planner. Financial planning services can be surprisingly affordable today and are even available online.

Standard loan standards are expensive for pensioners

Default loan default has become a growing source of concern among members of the older generation.

According to the GAAP report, 6.3 million borrowers carried between 50 and 64 years of student loan debt. Nearly 3 out of 10 (29%) were in default, meaning their payments were over at least nine months.

And among the 870,000 people over the age of 65 who had student loan debt that year, 37% were in default. When pensioners do not have federal student loans, the government can take up to 15% of their monthly social security benefits.

Earlier this year, Senator Elizabeth Warren and Senate Majority Leader Chuck Schumer and Senator Elizabeth Massachusetts quoted the growing number of seniors with student debt in a report for CNBC.

“Older Americans do not have to restrict daily meals so that they pay monthly,” they wrote. “And they should certainly not let their hard-earned social security be robbed of them.”

President Biden said he was willing to cancel $ 10,000 per borrower on student loan debt, but he did not commit to the $ 50,000 forgiveness demanded by Schumer, Warren and others.

Options to improve your financial situation now

If you are one of those who are struggling with growing debt and can not afford to wait until the Biden government takes action, you need to consider other ways to strengthen your finances.

You can refinance your student loan debt into a new loan at one of today’s record interest rates. Moving your debt to a cheaper loan can help you save on monthly payments and pay off your balance faster.

Note: if you have a federal student loan, refinancing will switch to a loan from a private lender. It will also disqualify you from federal loan forgiveness, should this happen, and other protection.

If you own a home, you can refinance your mortgage with a payout option that allows you to borrow against your own capital to pay off the debt. If you set up your student loan debt in your mortgage, you can promote cash flow to pay other bills.

Or, to create space in your budget, you can simply do a traditional mortgage adjustment and save. Mortgage rates are still historically low, and refinancing can lower your monthly payment by hundreds of dollars if you’re looking for a good rate.

Finally, explore ways to increase the money you bring in. If you have been reluctant to stay in the stock market, then try a lower stakes approach. Use an app that helps you earn returns in the market by simply investing your ‘extra change’.