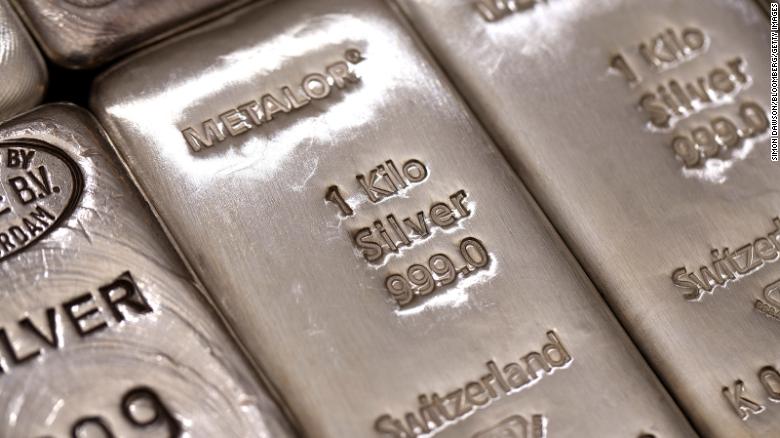

New York (CNN Business) – A fast-paced GameStop, the site of Reddit’s extension of the mercado de metales preciosos.

The futures of the lower plateau are up to 8.5%, at the rate of $ 29, the domestic at night, to the maximum of five months. This is also known as 6% registrado la semana pasada.

Thus, the minority sites advise clients during the end of the week that no longer can satisfy the growing demand for lingotes and coins. The “#silversqueeze” trend is on Twitter.

In recent operations, futures from the subieron plateau up to 6.5%.

The new, new objective from WallStreetBets

These moves are brindan or another example of the power of a group that has captured Wall Street and the inverse peoples: WallStreetBets. Reddit’s forum hizo that GameStop, AMC and other very modest actions take place last week, agitating the markets and applying some cobbler funds that have been posted against their actions. Robinhood, the free ‘trading’ application, was criticized after being able to restrict the trading of GameStop shares and others.

Last week, the WallStreetBets man was forced to take part in the iShares Silver Trust (SLV) ETF and fiduciary commission, and some suggested that it could be a form of giving to the large banks that they consider to be artificially priced.

“SLV will destroy the largest banks, not just some small fundraising funds,” wrote a WallStreetBets user.

Another affirmation that JPMorgan Chase has been “increasing (the prices of the metals) for a long time. This deberia will be epic. CHARGING ».

Various signals that, over the past year, JPMorgan has paid a record $ 920 million to eliminate the costs of participating in Treasury futures manipulative operations and treasury metals and bonuses.

Respaldo de los gemelos Winklevoss

Winklevoss ‘friends, who questioned Mark Zuckerberg on Facebook and made the first bitcoin patrons, followed suit on WallStreetBets’ offensive against the record.

“The #silversqueeze is a protest against the machinery,” said Tyler Winklevoss.

“If it is demonstrated that the record market is fraudulent, it will be better then that the gold market will be the next,” said Cameron Winklevoss.

The main minority sales sites publish advertisements during the end of the week that offer a large demand.

“Debt to demand without precedents for plate physical products, we can accept additional payments of a large quantity of products has that global markets abran the domino by night”, writes APMEX, which is autodenominated the minor in the largest line of world of beautiful metals, in a review on the superior part of its web site.

Preliminary Demand Probe

SD Bullion warns that “debit to a record request without precedents” should be allowed to accept payments within the night. Money Metals and other web publishing sites like similar.

“It will not be surprising to see that the force and abrupt response at the request of consumers will abort the physical offer of record months in power of shoppers in short supply,” said Ryan Fitzmaurice, chief strategist at Rabobank, a CNN Business in an electronic mail.

Without embarrassment, the difference between GameStop and other actions not deserved that he was white WallStreetBets, the futures of the record he showed recently. Coverage and other institutional investment funds are optimistic about the future of the record and the precious metal is looking for maximum years.

“It’s a dramatically different market configuration,” said Fitzmaurice. “There is no guarantee that this will be the case for this new Reddit commercial strategy in futures markets and especially in highly volatile prime markets”.