While the S&P 500 SPX,

and Nasdaq Composite COMP,

On Monday, setting new records with the $ 908 billion US stimulus bill finally signed, there were some segments that did not join the party.

For one, the Russell 2000 RUT,

closed lower after a three-month record in which the index rose 33%.

Another part that did not take part in Monday’s protest was recent presentations. The exchange-traded fund IPO in Renaissance,

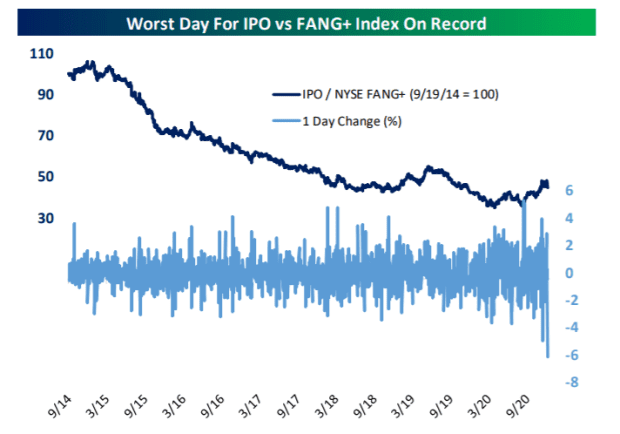

stumbled by almost 5%. Analysts from Bespoke Investment Group point out that the worst performance compared to the NYSE FANG + index is NYFANG,

– the grouping of Facebook FB,

Amazon AMZN,

Apple AAPL,

Netflix NFLX,

and Google owner Alphabet GOOG,

along with a few other technology giants, including Alibaba BABA,

and Tesla TSLA,

– in its history.

Companies, including exercise bike manufacturer Peloton Interactive PTON,

Zoom video communication ZM,

social media site Pinterest PINS,

and data analysis provider Palantir Technologies PLTR,

everyone struggled.

“This is by far the worst relative performance in the history of the NYSE FANG + index, and it could be a sign that the market is starting to judge aggressive bets on unproven companies, which also played as part of the SPAC craze,” he said. the analysts tailor-made. SPACs are specialty procurement firms, so-called blank check firms that plan to acquire other companies as a way to advertise it.

The Defiance Next Gener SPAC derived ETF SPAK,

with components, including the sports science firm DraftKings DKNG,

and space company Virgin Galactic SPCE,

also closed lower on Monday.

The buzz

The House voted to replace President Donald Trump’s veto on the defense bill, while Senator Bernie Sanders threatened to philosophize a move to do so in the Senate, unless a vote is taken on the $ 2,000 stimulus proposal that room cleaned.

Companies that have seen the decline in share prices strongly may see more pressure in the coming days as investors lock up losses for capital gains tax purposes.

U.S. hospitalizations from COVID-19 hit 121,235 on Monday, according to the COVID-19 detection project. Deaths have declined significantly since Christmas, likely a delay in holiday reporting.

According to a government minister, more Israelis received a vaccination than contracted coronavirus. In the US, 2.13 million people received a dose, according to the Centers for Disease Control and Prevention, or 11% of the number who contracted the disease.

The European Union and China conclude a trade agreement that will provide greater European access to Chinese manufacturing and greater access to the European energy space.

The market

US futures contracts ES00,

NQ00,

YM00,

pointed to further gains.

The FTSE 100 UKX,

has risen sharply in London in its first action since the UK agreed to a trade agreement with the European Union that will continue tariff-free access.

The dollar DXY,

was lower against key competitors, especially the euro EURUSD,

The yield on the ten-year treasury TMUBMUSD10Y,

was 0.95%. Bitcoin BTCUSD,

traded below $ 27,000 in further turbulent action.

Random reading

A Japanese company, Sumitomo Forestry 1911,

began manufacturing wood satellites to reduce space debris.

Two widowed penguins comfort each other as they look at the Melbourne skyline.

Need to start starting early and being updated to the opening clock, but sign up here to have it delivered to your inbox once. The version by e-mail is sent in the Eastern direction at about 07:30.