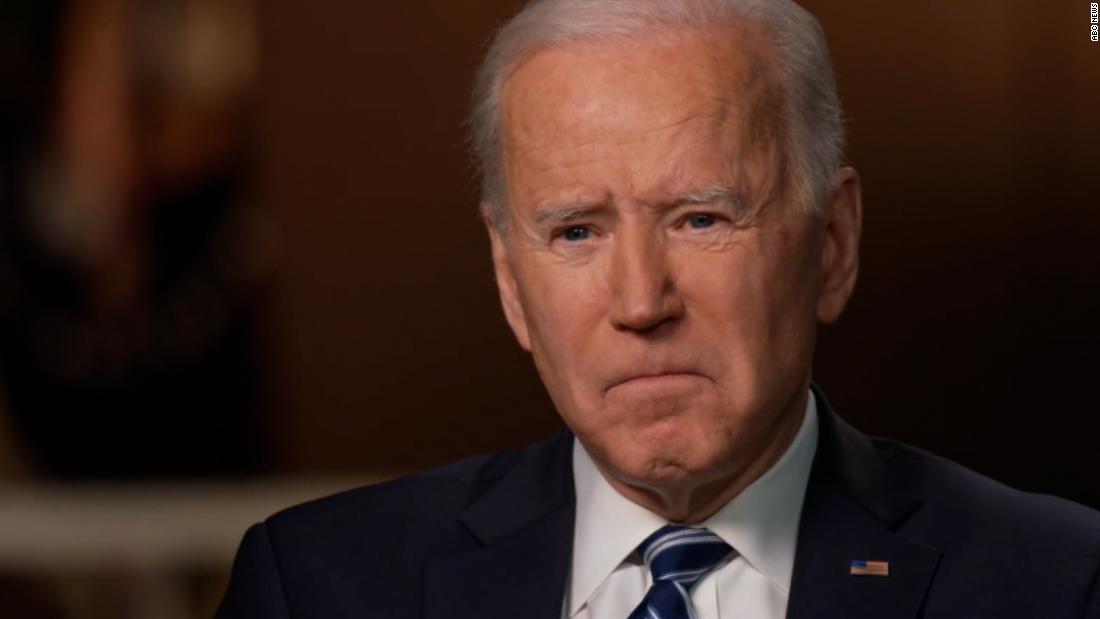

Biden was generally factually in the interview, many of which aired Wednesday. But he was wrong in three statistical allegations.

The context surrounding two of these inaccurate allegations suggests that they may have been comics rather than deliberate lies. And on the third claim, regarding the history of the Senate filibuster, Biden explicitly told Stephanopoulos that he did not think the figures he was using were correct.

After all, it is our job to correct the report if the president is wrong. Here is a fact check of the three inaccurate claims and two other claims Biden made in the interview.

Biden, who proposes the $ 1.9 billion US bailout plan tax benefits he signed last week, said: ‘60% of all these tax concessions go – all these tax concessions go to the bottom 60% of the population. ‘

Facts first: Biden ended up in the inaccuracy here. When asked by CNN where Biden gets this figure, the White House said that Biden was referring to a figure from the Tax Policy Center. But Howard Gleckman, senior fellow at the Tax Policy Center, explained to CNN that the center is actually found that 67.4% of the tax benefits of the new law this year will go to the bottom 60% of households – not that “all” the benefits will go to the bottom 60% as Biden said.

“He got the first half of the sentence right and underestimated it. But he got the second half of the sentence wrong,” Gleckman said.

Obama-era aid to Central America

Biden has been recognized for accepting an Obama-era initiative to increase federal aid to Guatemala, El Salvador and Honduras, countries from which the U.S. has experienced an influx of underage minors. He said: “I was able to claim a dual account for almost $ 800 billion to be the cause of why – why people are leaving.”

Facts first: The 2015 initiative that Biden spoke about – that he played an important role as vice president roll to be passed – provided up to $ 750 million in U.S. funding for Central American countries, not ‘$ 800 billion’ as Biden said. We would have slipped it if he had said “$ 800 million” instead of $ 750 million, but “$ 800 billion” is a significant mistake.

The funding of Central America was contained in a broader spending bill that did succeed with dual support.

The history of the filibuster

Biden endorses a change in the rules for the Senate filibuster and says senators should again be expected to stand on the floor and keep talking if they want to hamper legislation. The current filibuster policy allows senators to make filibuster without giving speeches.

Biden said: “Look, I think – do not stick to the numbers, George, but I think there were between 1960 and 2000 – I make up this number, I do not know – there were, like – you know, 50 filibusters “Now there are 200 since then …”

Facts first: As Biden himself said, he does not have his numbers right. Although experts believe that even for them it is difficult to determine the number of filibusters per year (here is an explanation of the complexity) it is clear that Biden’s figure for the past period as well as the present period was too low – although he accurate about its general point that the number of filibusters has increased significantly in the 21st century compared to the late 20th century.

Molly Reynolds, a senior fellow at Brookings Institution who studied the filibuster, said most scholars think the best proxy measure is the number of motions filed for a garment, a step toward a Senate debate. end. According to official Senate data, from 1961 to 2000, 755 stamp motions were submitted (which are on average less than 20 per year) and 1,516 stripping proposals were submitted from 2001 (which averages about 75 per year).

The Trump tax cuts

Biden says of the Republican opposition to his Covid relief plan: ‘They do not like it, because in reality their idea of a tax cut is the Trump tax cut, where 83% to the top 1% of the people in America. ‘

Facts first: It needs context. While it is correct to say in general that the richest Americans were the biggest beneficiaries of Trump’s tax cut in 2017, the figure “83%” is a prediction about what might happen in 2027 under certain circumstances, not about what is already happening do not have.

The Tax Policy Center estimated in 2017 that the best 1% in 2027 would receive approximately 83% of the benefits if the tax’s individual tax cuts (which were designed as temporary) expired and the company’s tax cuts (which were designed) as permanent) continues to exist. Conversely, the Tax Policy Center for 2018 estimated that the best 1% received 20.5% of the benefits, while the 95% -99% group received another 22.1%.

There is certainly a significant difference in how the new Biden Act and the 2017 Trump Act treat the rich and the poor. For example, the tax policy center has found that households earning $ 25,000 or less will receive an average tax cut of $ 2,800 this year from the new relief law, which increases their income after tax by 20%. Under Trump law, these households experienced an average decrease of $ 60 in the first year, or about 0.4% of their income after tax.

Ballot box on US rescue plan

Speaking about the U.S. bailout plan, Biden boasted that ‘78% of people say they support this program, 52% of Republicans. ‘ He admits that there may be some sort of voting error by saying, “Let’s assume it’s down by 15%.”

Facts first: This assertion is accurate enough; there was a public vote showing that overall support for the U.S. bailout plan was only shy of the 78% who demanded Biden and the support among Republicans even higher than the 52% he claimed. Other public polls, however, found lower support than Biden claimed, both for the general public and for Republicans. The result of the poll has seems to change with the wording of the polls’ questions.

A Morning Consult / Politico poll conducted on February 19-22 found that 76% of total support for the emergency relief plan was among registered voters and 60% support among Republican registered voters – after respondents were told of the poll plan’s cost of $ 1.9 billion and some key provisions, including direct payments of $ 1,400. In a Morning Consult / Politico poll conducted on March 6-8, 75% overall support for the plan and 59% Republican support found.

In a poll conducted by the University of Monmouth on February 25 to March 1, support for the plan is significantly lower than what Morning Consult did, especially among Republicans: overall support was 62%, while Republican support only 33% was. In addition to the standard differences in methodology and sampling (the monmouth survey among adults, especially non-registered voters), it is noteworthy that Monmouth mentioned the $ 1.9 billion cost of the plan before respondents asked for their opinion, but the payments of $ 1,400 only mentioned thereafter. question.