(Bloomberg) – The stock offering of Baidu Inc. in Hong Kong Tuesday is an unlikely revival for founder Robin Li, who has haunted him back to relevance in the Chinese technology industry after squandering an almost monopolistic waste.

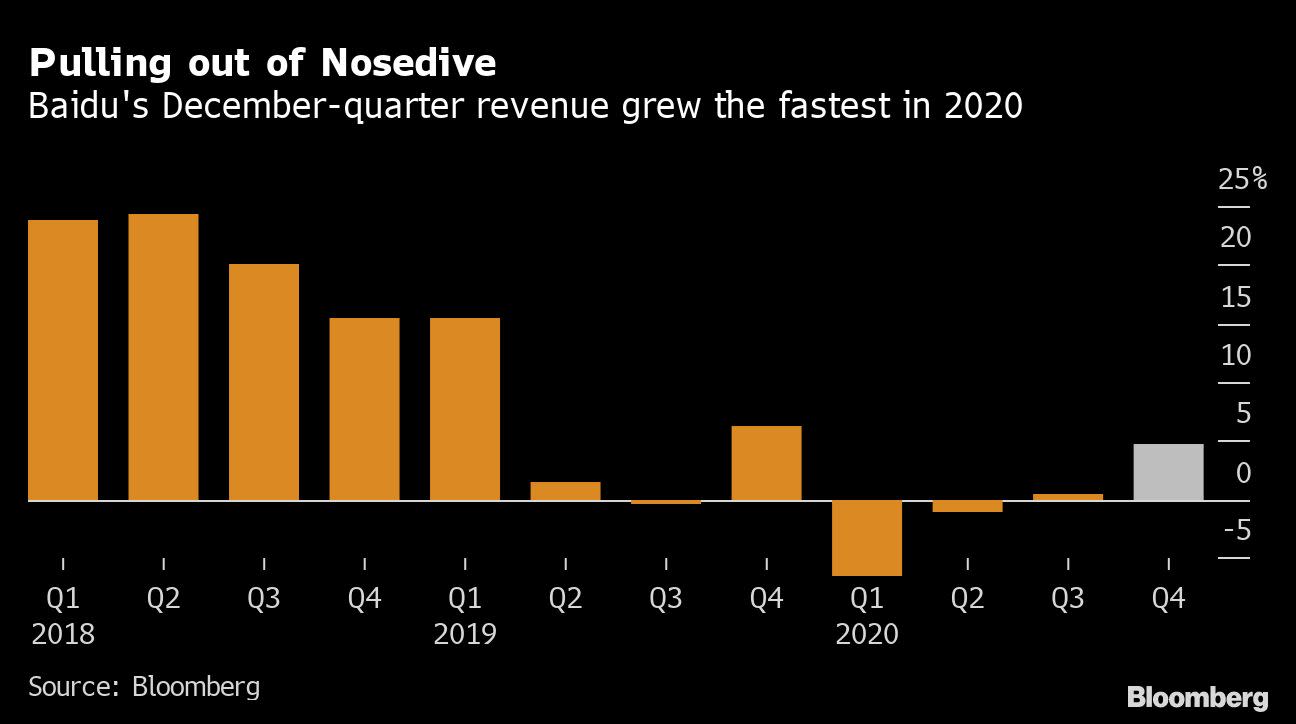

The internet giant has raised $ 3.1 billion in the largest homecoming by a US company in the city since JD.com Inc. in June last year. Li’s firm more than tripled its valuation in March last year, with about half of the profits coming over the past three months, as Baidu’s bets in AI eventually bear fruit in areas such as clouds and electric vehicles. This is a rare period during which the company outperformed its larger competitors Alibaba Group Holding Ltd. and Tencent Holdings Ltd., whose shares struggled following China’s campaign to curb its freewheel technology industry.

In an exclusive interview, the 52-year-old founder explained how Baidu turns into an AI venture and why he supports Beijing’s antitrust push. The firm will continue to work with automakers such as Geely to split a position in the world’s largest vehicle market, maintain a record pace of R & D investment despite the squeezing of margins, and strive for talent and to acquire technologies to promote AI development, Li said. Eventually, most of Baidu’s revenue will come from businesses outside of search and advertising, he added.

“We’ve been investing in AI for over ten years and have probably lost a lot of money by doing so,” Li said in an interview with Bloomberg Television. “Ultimately, we will be rewarded.”

Baidu made a muted debut in Hong Kong and traded about 1.2% higher early Tuesday. This compares with the first-day profit of 3.5% at JD.com and 5.7% for NetEase Inc., two other US-listed US companies that are turning to the city for secondary listings. .

Baidu, which along with Alibaba and Tencent once part of China’s internet triumph, fell behind in the mobile era, where the efficiency of its search service was paralyzed by super-applications like WeChat creating silo ecosystems. To compete, Baidu’s core search product transforms into an everyday platform that offers a variety of content, from news articles to live streams and short videos, which mainly follow the programs.

Meanwhile, Baidu has sunk billions of dollars over the past decade in areas from natural language processing to voice interaction, an attempt that initially got into trouble with the departure of key executives such as its popular chief scientist Andrew Ng. Until recently, investors questioned the company’s R&D spending, which accounted for about a fifth of 2020 revenue. But Li maintained confidence in his original vision and promised to maintain the investment pace for the next decade or two.

“For most of the last ten years, I think investors have not appreciated it,” Li said. “So we felt lonely. But it really aligns with our mission. ”

Now commercialization is finally coming to the fore. In January, Baidu launched a new venture with the Zhejiang Geely Holding Group that will produce smart EVs that will lead analysts to reevaluate the technology giant’s eight-year-old Apollo unit, whose software for self-management in the past lull had interest in car manufacturers. The venture with Geely will accelerate integration, Li said, with the goal of delivering its own EVs to the market within three years.

Semiconductors are another use case. As Alphabet Inc. Google and Amazon.com Inc., Baidu began designing chips for its own server farms and performing tasks such as search rankings. But what started as a cost-saving exercise has become a new venture, with nearly half of the Kunlun chips used by third parties last year. The new 7-nanometer iteration of the AI silicon has started with factories, despite the worldwide shortage of chips, Li said. The unit – which recently raised $ 230 million from investors such as IDG Capital – will direct more external clients in the direction of finance to education and energy, he added.

Through the use of chips and AI, Li enters businesses that have become a top priority for China’s Communist Party as it affects the world’s largest economies worldwide. Tensions between America and China, which trade in cybersecurity and investment, have already engulfed a number of Baidu’s counterparts. Many Chinese companies that previously considered a U.S. listing as the ultimate closet have delisted or added secondary listings elsewhere.

Baidu’s debut in Hong Kong is a hedge against the potential risks of trading in the US, Li admitted, but more importantly: it really gets Chinese investors involved in Baidu’s growth story. “

Domestically, Beijing has signaled its intention to end a decade of unbridled expansion by its technological giants, as behaviors such as market abuse and monopolistic data have been curbed since late last year. Although Jack Ma’s Alibaba and Ant Group Co. was the most visible target of regulators, the country’s antitrust watchdog this month also punished companies, including Baidu and Tencent, for not seeking approval for years-old acquisitions and investments. Li promised to ensure that the company does not make the same mistake in future transactions, which could be financed by the proceeds from the listing in Hong Kong.

In many ways, Baidu is better protected from China’s oppression than its fellow technological pioneers. Efforts to encourage private-sector businesses to share the data they have gathered are likely to benefit Baidu’s core service by breaking down the walls of the country’s most popular mobile applications. Its open platforms for self-management and deep-learning technologies are in line with Beijing’s efforts to open up data collected by private industries, Li said.

His firm also does not have the same kingmaker status as Alibaba and Tencent, both of which are an abundance of emerging ones. Some of their portfolio companies, such as Meituan, food delivery giant and leader Didi Chuxing, have been created by billion-dollar mergers. In 2017, Baidu sold its take-out business to rival startup Ele.me, which was later acquired by Alibaba, after losing a costly subsidy war in China’s gig economy.

‘You just can not imagine that the no. 1 and no. “Suddenly more than 90% of the US market share will merge,” said Li, a graduate of Buffalo University in New York. “But it has happened several times in China. This is not good for innovation. So I think the antitrust push is justified. ”

Read more: What’s behind China’s suppression of its tech giants: QuickTake

Thanks to the relative immunity to antitrust pressure, Baidu’s market capitalization rose by $ 66 billion last year before its listing in Hong Kong, where retail demand was 112 times the available stock. Institutions subscribed ten times the shares allotted to them.

Although the stock sale has temporarily boosted, investors are likely to focus more on the company’s search and content than the largest earnings drive in the medium term. This is where beginners like TikTok owner ByteDance Ltd. eyeballs lure away and market dollars. Baidu’s Netflix-style service iQiyi Inc. has seen revenue decline over the past two quarters as newer platforms such as Bilibili Inc. and Kuaishou Technology got its go-ahead.

In November, Baidu agreed to join the YY streaming service of Joyy Inc. for $ 3.6 billion in an agreement aimed at enriching the content offering. Revenue for the first quarter is expected to grow by at least 15% from last year, when Covid-19 plunged its advertising industry into a contraction.

“Baidu’s efforts to commercialize its artificial intelligence initiatives are positive. “Investors now have better visibility returns, after years of heavy investment,” said Vey-Sern Ling, senior analyst at Bloomberg Intelligence. ‘However, it will be necessary to reinvest increasing revenues from these efforts to promote growth, and the profitability of these businesses may remain low until sufficient scale is achieved. Therefore, Baidu is likely to rely on its core search equipment in the short term. ”

With Baidu still in the midst of transformation, Li is in no hurry to relinquish control after 21 years, unlike other Chinese technology powers, including the founder of Alibaba, Ma and Colin Huang, Pinduoduo Inc.

“I always wanted to find someone who could replace me as CEO,” he said. “But in the meantime, I enjoy my current job. I like technology. I like to see all the changes happen. ”

(Updates with Hong Kong shares traded in fifth paragraph)

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP