It’s been a year since the pandemic blinded the United States for the first time, making many jobs, forms of education and ways to socialize, home events.

But it is only about 11 months since the new bull market for the S&P 500 began.

This is one of the two main reasons why analysts at Truist Wealth think a sustained upswing for the S&P 500 index SPX.

still has room to run.

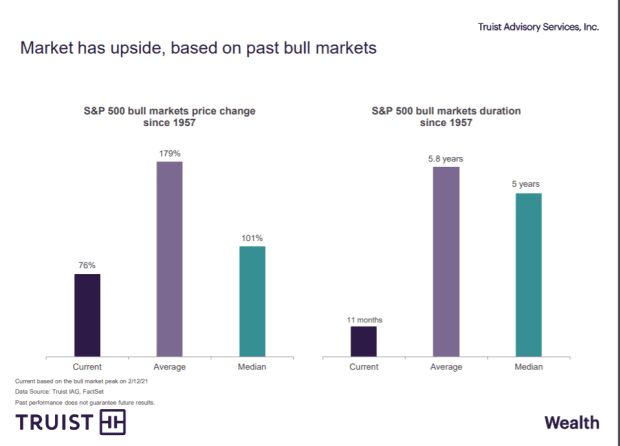

This graph shows that the current bull market of the S&P 500 may be too short and too limited to allow price increases to take place soon, at least if the performance of the past six decades during a pandemic applies.

Today’s S&P 500 bull market is too short and lean in the yield section.

Truist Wealth

The bars show that the average S&P 500 bull market since 1957, when the benchmark was first introduced, has led to price increases of 179% and that the good times have lasted an average of 5.8 years, which can be compared to the yield of today for the benchmark in 76% less than a year.

US equities began to plummet in the right lane about twelve months ago, after the coronavirus pandemic first began to cut off travel and trade worldwide, a rocky period followed by major US equities taking fresh lows at the end of March has.

But after recovering quickly from their losses in 2020, equities still touched a series of all-time highs, thanks in part to billions of dollars in fiscal and monetary stimulus weakened by the economy, as policymakers look at households hit hard by the crisis, and to keep confidence and liquidity high on Wall Street.

Recently, the same forces have also raised concerns that the good times, after COVID, may already be embedded in stock prices and other financial assets, and that high-yield stocks and riskier parts of the debt market could be at stake. if runaway inflation picks up, or borrowing costs for companies and consumers become too high.

The S&P 500, Dow Jones Industrial Average DJIA

and Nasdaq Composite Index COMP

was hit by volatile spots last week as the 10-year-old treasure chest BX: TMUBMUSD10Y

the return higher and Wednesday again when the returns on the standard bond are about 1% higher than a year earlier, or almost 1.47%.

All three major stock indices closed lower for a second day in a row on Wednesday as bond yields climbed and technology stocks rebounded.

Related: Cathie Wood’s high-flying ARK ETF has just entered a bear market – a sign of the times?

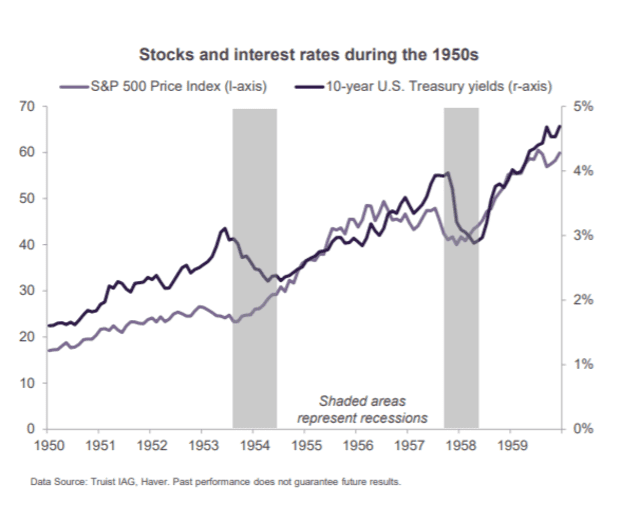

How does today’s rise from a low-rate environment compare to the ’50s?

Trust analysts also have a chart showing that the S&P 500 and ten-year treasury yields rose jointly during the 1950s.

Stocks, bond yields climb together.

True

“Although there are many differences between the 1950s and today, there were some similarities, such as very high US debt levels due to the war, an activist Fed and a post-war economic boom,” Keith Lerner said. chief market strategist, written at Truist, in a Wednesday note. “Interest rates rose from 1.5% at the beginning of the decade to almost 5% towards the end. Despite two recessions, the S&P 500 rose by 257% on the basis of price and 487% on a total return basis during the decade. ”

This time, Federal Reserve officials have also repeatedly vowed to avoid tightening money conditions while keeping policy rates close to zero and opening its $ 120 billion-a-month bond buying program until the economy fully recovers from the pandemic.

And yield-hungry bond investors welcome the rush between companies highly rated for lending, amid the prospect of higher borrowing costs.

See: Companies strive to borrow after extreme rates rose last week calmed down