An unprecedented pandemic has not stopped the US stock market from trading on a high note by 2020. The S&P 500 ended an extremely volatile year at an all-time high, rising 16.3%. Meanwhile, several stocks in the healthcare sector have attracted attractive returns for investors. However, the list did not include Gilead Sciences and Biogen.

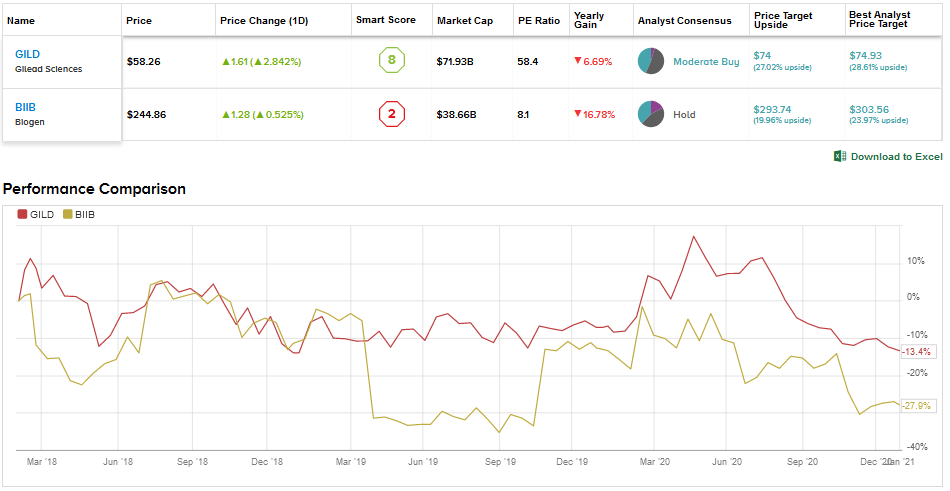

Does Wall Street expect these stocks to recover this year? We used TipRanks’ stock comparison tool to determine if analysts see upside potential in Gilead and Biogen and select the stocks that offer a better investment opportunity.

Gilead Sciences (VALID)

Gilead Sciences was hit last year when its antiviral drug remdesivir (sold under the brand name Veklury) was approved by the US Food and Drug Administration in May for the treatment of COVID-19. In October 2020, remdesivir becomes the first FDA-approved treatment in the US for COVID-19 patients.

The company delivered better-than-expected results in 3Q, mainly due to brake derivatives, which generated $ 873 million in sales and increased more than 17% in total 3Q revenue to $ 6.6 billion. The 3Q-adjusted EPS for Gilead rose 29% year-over-year to $ 2.11. (See GILD stock analysis on TipRanks)

However, the company cut its revenue forecast for 2020 to $ 23 billion to $ 23.5 billion, compared to the previous outlook of $ 23 billion to $ 25 billion, and warns that revenue from brake assets is subject to significant volatility and insecurity. The hepatitis C virus (HCV) is still under pressure amid the pandemic.

Gilead has a strong HIV portfolio, including its main medicine, Biktarvy. Sales of HIV products grew by 3% to $ 4.5 billion in 3Q and accounted for 70% of the company’s total product sales. There are concerns about the sale of HIV drug Truvada due to the loss of exclusivity.

Meanwhile, the company is strengthening its business through strategic acquisitions in key growth areas such as oncology. Last year, Gilead acquired Immunomedics for $ 21 billion. This acquisition added Trodelvy, an FDA-approved metastatic triple negative breast cancer treatment, to Gilead’s portfolio. The company also acquired the clinical stage of immuno-oncology firm Forty Seven for $ 4.9 billion in 2020.

Gilead recently announced an agreement to acquire German biotechnology MYR GmbH, which focuses on the development of therapeutic agents for the treatment of chronic hepatitis delta virus.

Investors were disappointed when Gilead announced in December that he would not pursue FDA approval for filgotinib as a treatment for rheumatoid arthritis in the US, following a meeting with the regulator. The company has entered into a new agreement with partner Galapagos, under which the latter will assume sole responsibility in Europe for filgotinib, where doses of 200 mg and 100 mg are approved for the treatment of moderate to severe rheumatoid arthritis, and in all future indications. .

In response to this development, Oppenheimer analyst Hartaj Singh lowered his price target to $ 100 from $ 105. However, the analyst reiterated a buy rating on Gilead, as he still believes in his thesis of ‘(1) a reliable inhibitor / other drug company against SARS-CoV flares, (2) a base company (HIV / oncology / HCV) which is growing low single figures over the next few years, (3) industry tree financing offering greater earnings growth, and (4) a dividend yield of 3-4%. ”

Right now, the rest of the street is cautiously optimistic, with a moderate buy-analyst consensus based on 10 Buys, 12 Holds and 1 Sell. The average price target of $ 74 indicates an upward potential of 27% from current levels. Shares decreased by 10.4% in 2020.

Biogen (BIIB)

2020 was a difficult year for Biogen, which specializes in treatments for neurological disorders. The company faced a setback in November when the FDA’s advisory committee on peripheral and central nervous systems voted against the efficacy of aducanumab, an antibody for the treatment of Alzheimer’s disease.

The news has led to a big sell-out in Biogen shares as investors view aducanumab as a potential lure for the company. The Advisory Committee’s recommendations are not binding for consideration by the FDA and the company has announced that the FDA will continue the review process, with a decision approving aducanumab by March 7, 2021. (See BIIB stock analysis at TipRanks)

To allay investor concerns, Biogen lost a patent dispute with Mylan in June 2020 for its top-selling multiple sclerosis drug, Tecfidera, exposing it to competition from Mylan’s generic version. Tecfidera’s revenue fell 15% to $ 953 million in 3Q, reflecting the impact of multiple generic entrants in the US.

In addition, Biogen’s spinal muscle atrophy drug, Spinraza, is feeling the impact of Roche’s Evrysdi, with sales of the drug declining by 10% to $ 495 million in 3Q. Overall, the company’s 3Q revenue fell 6.2% to $ 3.4 billion and the adjusted EPS fell 3.6% to $ 8.84. Biogen lowered its full-year revenue outlook to $ 13.2 billion – $ 13.4 billion from $ 13.8 billion – $ 14.2 billion, assuming “significant erosion of TECFIDERA” in 4Q.

Biogen has entered into strategic collaborations to gain access to drugs with promising potential. He recently announced a $ 1.5 billion agreement (plus potential milestone payments) with Sage Therapeutics to co-develop and sell zuranolone (SAGE-217) for major depression (MDD), postpartum depression (PPD) and other psychiatric disorders. and SAGE-324 for essential tremor and other neurological disorders.

Following the SAGE deal, Oppenheimer analyst Jay Olson reiterated a $ 300 buy rating on Biogen. Olson explained: “Zuranolone is a potential first-class oral therapy for the treatment of MDD and PPD that is currently in use. multiple Ph3 studies, given our view that zuranolone is an active drug and the great market opportunity in MDD / PPD, we believe that the BIIB agreement provides much-needed revenue growth in the medium term, and BIIB better positions, regardless of the aducanumab outcome . ‘

Meanwhile, the street on Biogen is tilted with a consensus from Hold Analyst based on 11 Buys, 13 Holds and 5 Sells. The average price target stands at $ 293.74, which implies a possible increase of 20% in the coming months. Biogen shares fell 17.5% last year.

Closure

After a rocky 2020, the street’s sentiment for Gilead looks better than Biogen’s, backed by factors such as the company’s HIV portfolio and prospects in oncology. Unlike Biogen, Gilead also pays dividends and has a dividend yield of 4.67%.

To find great ideas for stocks that trade at attractive valuations, visit TipRanks’ best stocks to buy, a newly introduced tool that unites all the insights of TipRanks.

Disclaimer: The opinions expressed in this article are solely those of the proposed analysts. The content is for informational purposes only. It is very important to do your own analysis before investing