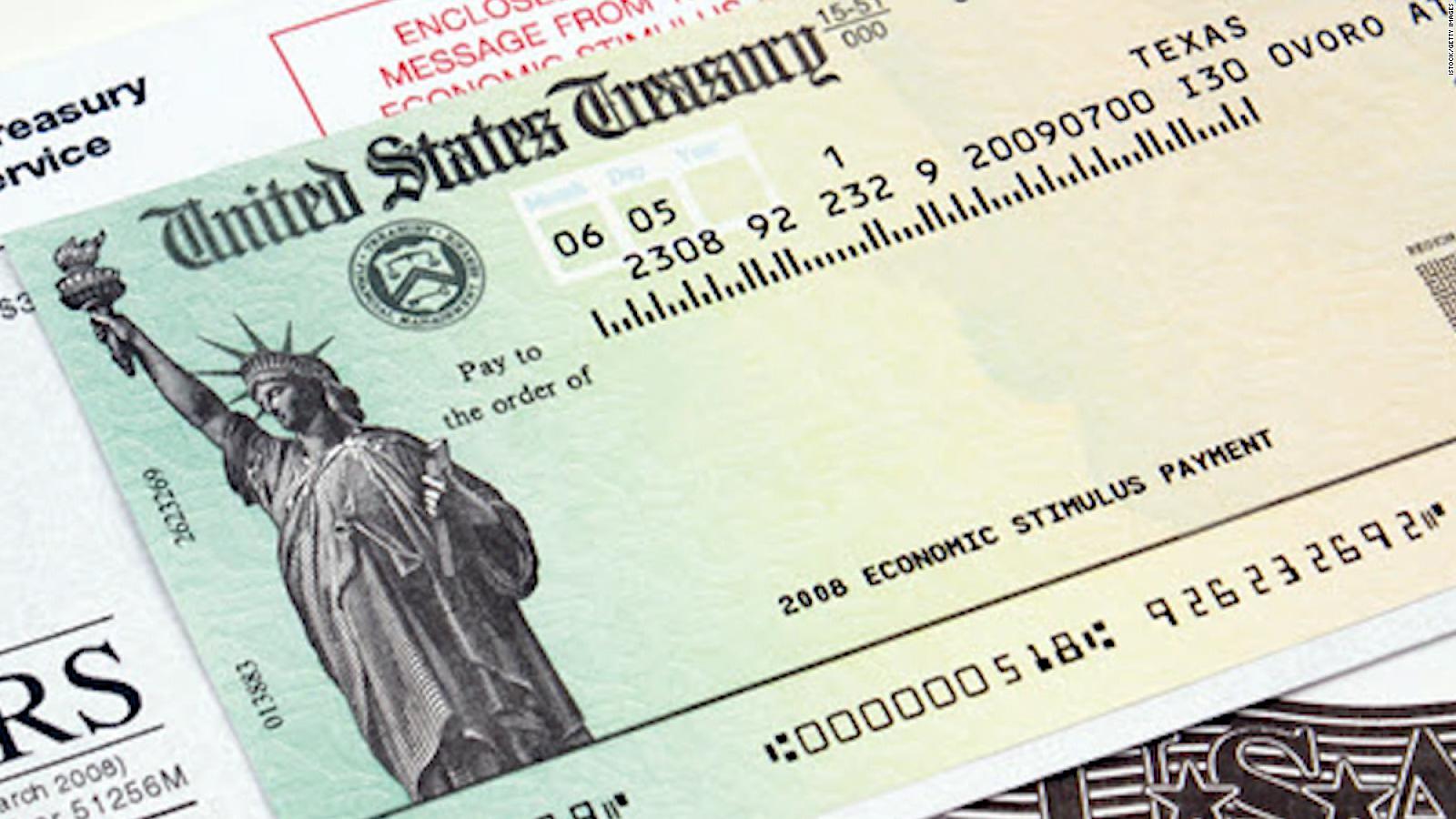

Washington (CNN) – The next round of checks will begin to read the bank accounts of the estates this week, the House of the House of Representatives of the White House, Jen Psaki.

The payouts will be up to US $ 1,400 per person and will be included in the US $ 1.9 covid-19 aid bill project signed by President Joe Biden.

The plaza is in line with the speed with which it will pay the December paychecks, which will begin to process three days later that President Donald Trump’s entities sign the bill.

But all the pages will be displayed at the same time. This bank information is archived in the Internal Tax Service (ISR, by its English terms) it is likely to receive the first money, because it is deposited directly in its accounts. Others can receive checks on paper or debit card prepaid cards.

It is hoped that the dinosaur will raise 90% of the families, according to an estimate by Penn Wharton’s Model of Presumption. The families receive US $ 1,400 additional depending on dependency, for which a couple with these children can receive up to US $ 5,600. Different from the previous rounds, the families will now receive the additional money for the major adult dependents of 17 years.

El monto’s total destination is a load of menus of US $ 75,000 for the entrance of gross adjusted, los jefes de familia (como madres o padres solteros) for the entire menus of US $ 112,500 and the parejas of the casados Which contains the menus of US $ 150,000. . But the pages are gradually reduced to mean that the increments are increased.

Legislators are reducing the amount of payments this year, in a way that not everyone who receives a check before will receive one now. Eliminate people who spend less than US $ 80,000 on gross adjusted income, family members who spend less than US $ 120,000 and couples who spend less than US $ 160,000 independently.

The first round of payments made in the past $ 1,200 and excluding people who are less than US $ 99,000, hogar hefar con un hijo who are worth more than US $ 136,500 and their married couples that ganaban more than US $ 198,000, pero families that ganaban a few more than eran eligible and tenian hijos. There are already 160 million homeless, and 94% of families receive the money.

The reduction in the second-round eligibility, up to US $ 600, was due to the mayor increasing the total amount below. It is eliminated in full to the only contributors who have a debt of up to US $ 87,000 and the caseworkers who have a joint statement of up to US $ 174,000. One more time, those who carry a few more are eligible if they are married. A total of 158 million pagons were realized and 92% of the families received them.

The new umbrellas of ingresses are bazaar in the most recent declaration of the contributor. If a 2020 declaration is presented when the page is sent, the IRS will base the eligibility on its gross adjusted 2020s. On the contrary, it will be based on the 2019 declaration or information sent through a line portal created the year passed for persons who no suelen present declarations of taxes.

If you enter 2019, lower your salary in 2020, you will not receive any money. Pero si tus ingresos cayeron en 2020, present tu declaration de impuestos ahora, antes de que real realis des pagos, podría signar que receibas un check grande grande.

The Mayor of the persons receiving the pages of the estimate automatically, but there are many who are lost, by a variety of reasons. It is estimated that 8 million eligible people will not receive the first round of payments that will take place this year.

Many of these individuals have very strong incomes and are generally not required to present tax returns. Last year, the IRS created an online portal where you can register to receive the money. But it is not clear if the agency will open the new portal for the third round of pages.

It is possible that the persons who changed the bank account from the last time presented tax returns also paid the balance.

Those who have received money during the first round of payments and have not been able to claim tax credit, known as Reimbursement Reimbursement Credit, in their 2020 tax returns.

Allie Malloy de CNN contributes important information.