(Bloomberg) – A setback in the Nasdaq 100 that recovered up to half of its $ 1.5 billion losses from its February high was not enough to deter skeptics. In fact, analysts warn that the index may experience even more beats.

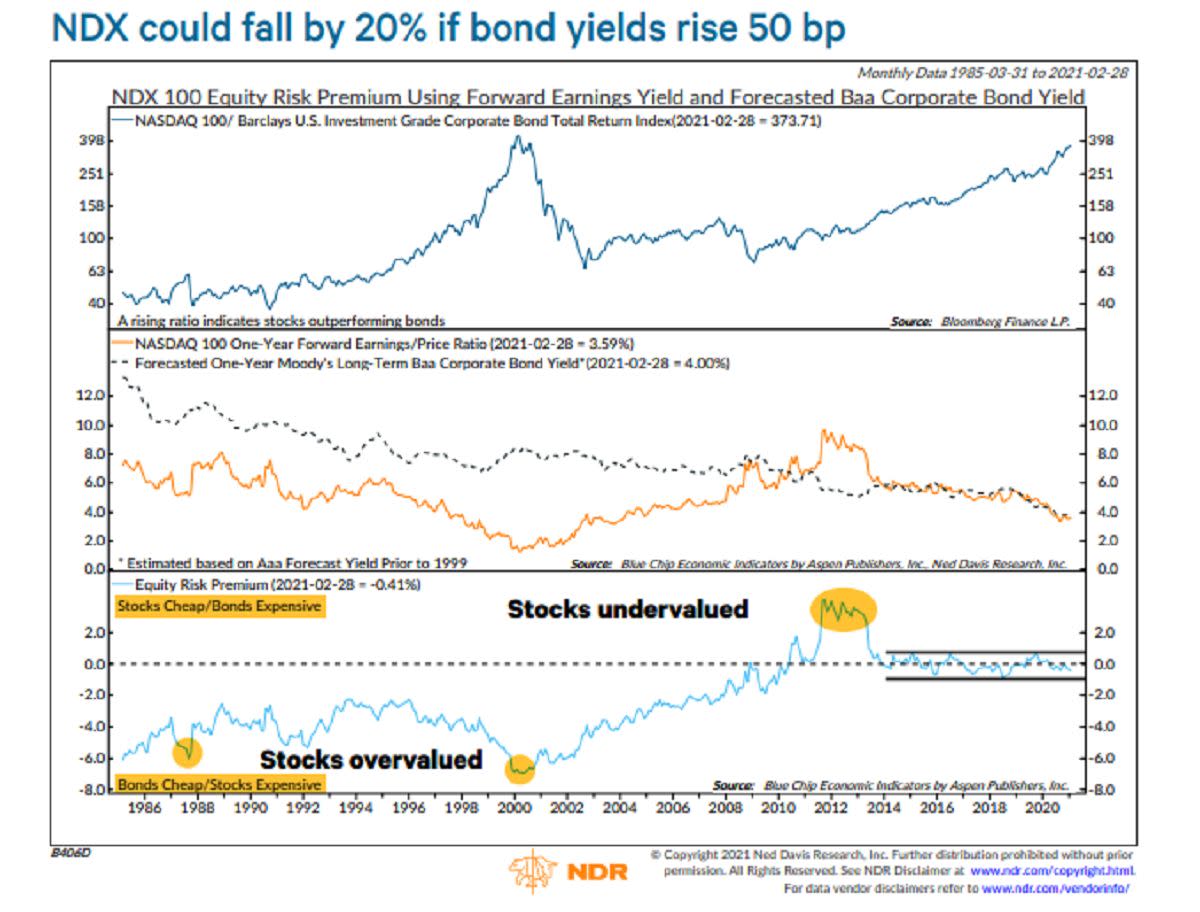

Their concerns come from the bond market, where rising yields are putting pressure on richly valued stocks, such as the tech companies that populate the Nasdaq benchmark. According to a study by Ned Davis Research, ten-year treasury yields of 50 basis points to ten-year yields could lead to a bear market for the index, or to a decline of as much as 20%.

And as the economy heals, investors are embracing sectors such as energy that are likely to benefit. One way to see the impact of the rotation from technology is to plan the relative height of Nasdaq against the S&P 500, a gap that recently briefly exceeded its 2000 level. For DoubleLine Capital MP founder Jeffrey Gundlach, it’s a sign that another collapse is imminent.

While one-day rallies – Tuesday 4% and Thursday 2.4% – raised the Nasdaq 100 to its first profit in four weeks, it is not the nerves that calm them. After all, big days are not uncommon during a deteriorating trend. In 2000, when the market started with a three-year collapse, the index had 27 sessions where it rose by at least 4%. This is compared to six such days in 1999, when prices doubled.

“The early stages of a bear market are usually marked by brutal rallies, and in the end it’s important how far the marches go and not how fast they move within a single session,” said Marketfield CEO Michael Shaoul Asset Management, said. LLC. “Evidence is growing that the technology sector has finally relinquished its position as a global leader.”

The Nasdaq 100 is poised to follow the S&P 500 for a second month in a row. In a week in which the technological benchmark fell into a 10% correction, other indices kept track of everything from small capitals to banks, transportation to industry, to records. On Wednesday, a version of the S&P 500 that removes the bias of market capitalization – which Apple Inc. treated the same as News Corp – an all-time high, even though the Nasdaq 100 was about 8% lower than its February record, a difference not seen in two decades.

This raises alarm for everyone who has lived through the dot-com crash. At the time, when the Nasdaq 100 began to fall in March 2000, the equivalent S&P 500 was still moving forward and only peaked 14 months later – a sign that money was being pushed away from the technological tables that had risen on the internet. bubble. Eventually, the Nasdaq 100 lost half its value.

“People should not be comforted by the fact that almost all the other products except the technology group are performing well,” said Matt Maley, chief market strategist at Miller Tobacco + Co. ‘If the technology group underperforms, it’s ultimately going to the rest of the stock market. ”

To be sure, as expensive as it looks now, software and internet stocks do not match the extremes seen 20 years ago. And thanks to innovations such as cloud computing and automation, their earnings are expanding, as opposed to shrinking or non-existent, as in 2000. But the booming economy, backed by vaccines and government support, coupled with rising effects, could create problems for the market means largest sector.

While some strategists have dismissed the return risk, saying that tech stocks have shown a volatile relationship with the treasury over time, Joe Kalish, global macro strategist at Ned Davis Research, found that the Nasdaq 100’s returns from the Nasdaq 100 – the inverse of its price-to-earnings ratio, the higher it is, the cheaper the stock – has almost moved in line with the forecast rate for corporate bonds.

In its model, if the Treasury’s ten-year interest rate rises to 2% this year, it could again raise the long-term Baa rate to 4.5%, a scenario where the Nasdaq will have to fall 100 to 20% to stay attractive, all equal. If yields climb but the Nasdaq does not move, it would indicate an overvaluation, Kalish said, adding that its model warnings flashed correctly in 1987 and 2000.

Based on the price-to-earnings ratio, the Nasdaq 100 is not cheap compared to other stocks, even after the recent setback. With a multiple of 28, the premium on the S&P 500 was about 7% above its five-year average.

In addition, the growth advantage that sustained the performance of technology in 2009 for more than one year is poised to disappear – at least for the next two years – as companies such as airlines and automakers strike back in a pandemic. The profit of software and internet companies is expected to increase by 22% this year and by 12% in 2022. Both are behind the broad S&P 500, where earnings forecasts are set to rise by 24% and 15% respectively, according to data compiled by Bloomberg Intelligence.

With the adoption of the latest federal emergency relief package, cash can naturally flood into stocks again, thus preventing snowball losses. But if Nasdaq 100 knocks on the door of its relative peak, it would be a mistake not to consider the downside risk, according to Jim Paulsen, chief investment strategist at Leuthold Group.

“Investments in the new era are at a major crossroads,” he said. “After a long period of extensive performance by Nasdaq and technology stocks, it is not unreasonable to foresee a phase of underperformance, consolidation or even a direct collapse.”

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP