(Bloomberg) – According to Deutsche Bank AG strategists, US stimulus controls could unleash a $ 170 billion wave of new retail inflows into the stock market.

A survey among retail investors showed respondents planned to put 37% of their stimulus cash directly into equities, a team including Parag Thatte wrote in a note on Wednesday. With a possible direct stimulus of $ 465 billion, it is planned to amount to $ 170 billion, they said.

“Retail sentiment remains positive across the board, regardless of age, income or when the investor starts trading,” the strategists wrote. “Small investors say they expect to maintain or add to their stocks, even when the economy reopens.”

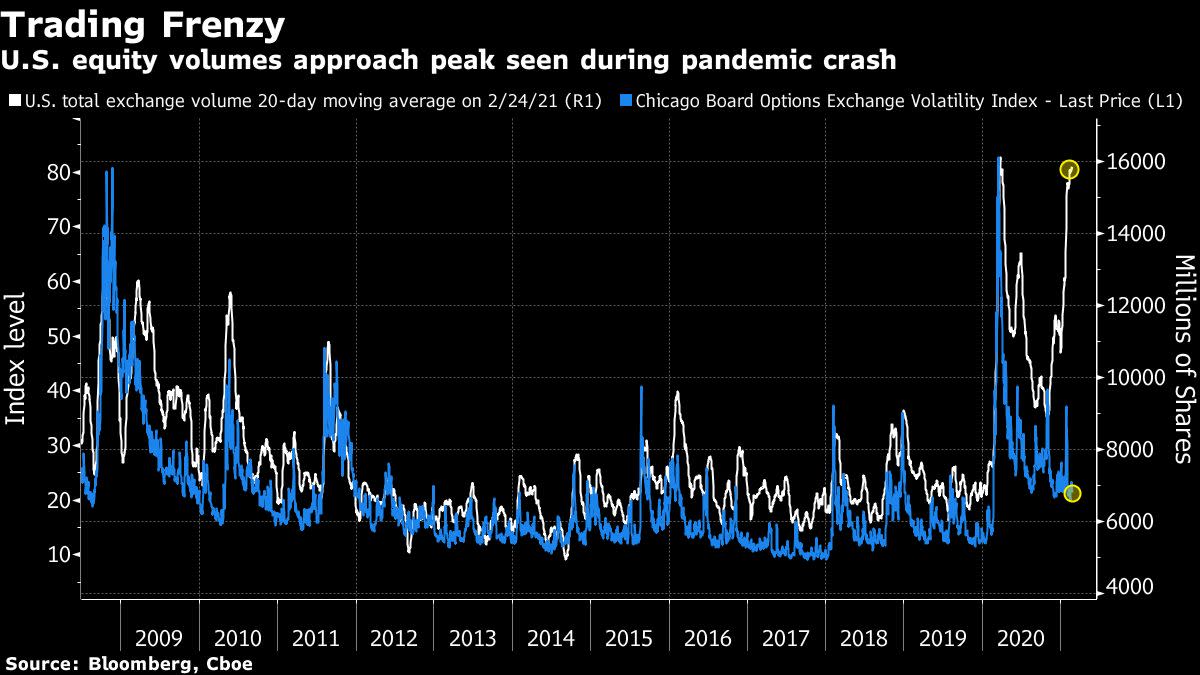

A combination of free trade programs and direct government stimulus has helped fuel a boom in retail stock market engagement, especially by first-time investors. Their influence began to affect markets, including the world of options, and trading volumes skyrocketed.

Democrats rush to pass President Joe Biden’s $ 1.9 billion pandemic aid package without Republican support, a bill that includes $ 1,400 checks for many Americans. Congress has already approved two rounds of direct payments, first in March last year and then at the end of December.

According to Deutsche, new investors are younger and more aggressive, and they are likely to trade options more frequently compared to more experienced traders. In a hypothetical modest sale, a majority of respondents said they would increase their investments, the note reads – although they would withdraw net money if sales exceeded 10%.

Meme Stock Mania Restarts After GameStop Triple Shared

GameStop Corp. shares reminiscent of the heyday of retail investors last month, GameStop Corp shares have nearly quadrupled since the close on Tuesday and a number of other so-called meme shares have risen.

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP