The coronavirus pandemic has been linked to a varicose vein in the capacity of the Tributary Agency during 2020. So far, the debacle of public aggression has been seen in particular on the calendar of the liquidation of taxpayers. This is the case of the IRPF, in which the Campaign of the Rental of the Passover will receive an increase in the declarations resulting in the payment of three times higher in advance of the developments, to correspond to ownership 2019, preview of the crisis of Covid.

There is a derivative of the data of recidivism by the Tributary Agency, which practically culminates in the Celebration of the Rent during the past ownership on the tax dates of the previous year. The campaign concludes with the 10,400 million euro revolution to 14 million contributors to a market share in view of the telematic declarations in the coronavirus pandemic market.

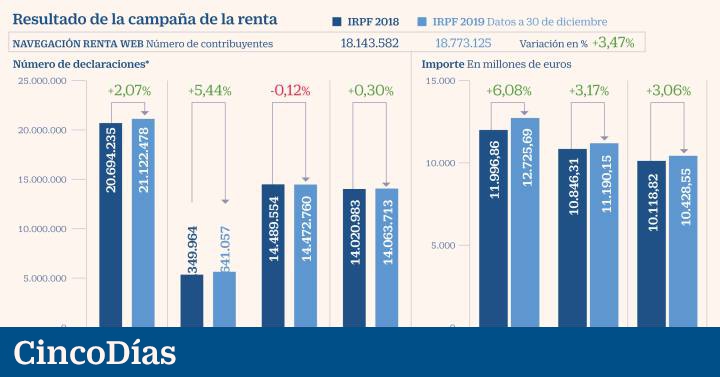

To empress, the number of declarations presented experimentally an increase of 2% has set a new historical record, surpassing the 21.12 million. Of these, 68.5% including a resolution of devolution (14.47 million) while the remaining 31.5% (5.64 million) held as a result of a subscription to fisco.

However, the Campaign is committed to a higher increment on the subject declarations to be paid, as well as to the imports to be increased by the tax authorities, which, among other things, resulted in the favor and cobrar of the Tributary Agency. To understand this phenomenon, it is worth noting that the campaign will have a fiscal year, 2019, in which the economy will be accelerated by a 2% increase in the number affected by the Covid-19 pandemic. Its liquidation, without embargo, will be produced in one year in which the economy will suffer a decline of 11.2%, according to Gobierno’s official forecasts.

In this form, the number of declarations to increase creation by 5.44% before the previous year, up to 5.64 million, and the imports to be obtained by the tax increase by 6.08%, up to 12,725 million euros .

For its part, the declarations devolve caen a 0.12%, up to 14.47 million, while the devolution rate was 11.190 million euros, an advance of 3.17% on the result of the previous campaign, corresponding to owner 2018.

Among them, the tax rate is 93% of the advertised imports (10,428 million) to 97% of the interested parties (14,06 million contributors).

Incidence in the caja

This evolution, with a mayor incrementing the balances to increase in the public caja that in which he holds devoted to the contributors, explains why the Ministry of Health aspires to close a double-digit GDP year with a discount of only 7.6%.

As of November, the public arcas have carried out a 9% tributary recovery, from 197,853 million in the first 11 months of 2019 to 179,996 million in the 2020 fiscal year. Without embargo, in in the case of the IRPF the comparative arrojaba un alza interanual of 1%, has the 82,358 million. Including a homogeneous comparative term to calendar effects limits the period of the IRPF commitments during 2020 to 0.3%, as of November. A limited impact is due to the duration of the economic crisis caused by the pandemic and the hecho of which, recognizes the Agency Tributary, with the activation of the ERTE as a redemption of employment “is not to keep salaries related to retention and performance benefits with little or no retention ”.

Distance statements

The 2019 Pension Campaign was characterized, in turn, by the increase in telematic declarations. Gather record that the process is arranged in the mark of the office of the Tributary Agency, during the state of emergency last night. Well, Hacienda descartó will return to the campaign. As such, the statements made in connection with the telephone service “Le llamamos” are multiplied by six to 1,155 million.

For its part, the statements made to the web of the Tributary Agency (19.28 million, 6.9% more) and the effects of the mobile application (another 365.000, 25.8% more) alcanzaron 93% of the total to all present, compared to 88% who are suspicious of telematic statements in previous ownership.

New requirement for the Sicav to pay tribute to 1%

The PSOE has presented various amendments to the Fiscal Anti-Fraud Act which preclude the Congress of Deputies which includes a recourse to the requisites for collective investment firms, the Sicav tributes, to 1% in companies. Although a minimum of 100 companies is required to ensure that this taxable benefit does not benefit from any type of vehicle, the socialists plant a minimum participation of 2,500 euros per shareholder (12,500 euros in the case of Sicav per compartments) for avoid the existence of the “mariachis” participle participants, which only figure to allow the main investor to pay less taxes. The PSOE proposes that the cambia be accompanied by a six-month transitional regime, a passage in which the dissolution and liquidation of a Sicav for this cause is agreed upon by the Tax Transmissions and Documented Legal Acts. In addition, societies do not tend to integrate into the IRPF’s impressive base, the Taxation on Societies or on the Rent of those Residents which are derivatives of the liquidation at the same time as the money is repaid before the month. It is used for the purchase of valuables will be a gift from the new Tobin bag.