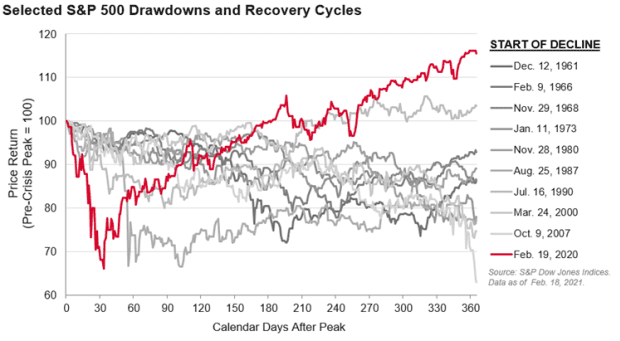

There has never been such a stock market recovery.

Analysts at Standard & Poor’s have noted the previous ten times since 1957 that the S&P 500 has fallen 25% or more from an everyday high. The graph shows that this is the best response to a withdrawal since World War II.

It was exactly one year ago, on 19 February 2020, that the S&P 500 SPX,

reached an all-time high, and the VIX Volatility Index VIX,

was at a low of 14. It turned quickly in light of the COVID-19 pandemic that spread outside China to the entire world.

‘Since then, business clothes have been gathering dust worldwide, while it’s positive that we all work better with telework. Now, 366 days later, there are strong grounds to hope that we are closer to the end than to the beginning, ‘says Tim Edwards, managing director of the index investment strategy for S&P Dow Jones Indices.

The S&P 500 has risen 75% from its lows in March. The technology-heavy Nasdaq Composite COMP,

has more than doubled.