(Bloomberg) – Beijing’s fight over its most powerful Internet businesses is blurring prospects for Tencent Holdings Ltd. and its $ 120 billion financial services industry, just as it seeks new sources of growth.

China’s leading watchdogs have stepped up oversight of the country’s most valuable company and explored everything from Tencent’s insight into the online behavior of a billion people to an investment portfolio spanning hundreds of startups. Regulators are said to be considering forcing Tencent to revamp a promising fintech division, folding operations into a holding company, just like Jack Ma’s Ant Group Co.

The uncertain outcome of the extensive effort will overshadow Tencent’s huge player arm when it reports its quarterly earnings on Wednesday. Billionaire founder Pony Ma and his lieutenants face questions about Beijing’s intentions and how it could work to revamp China’s largest online banking and lending operation to Ant’s. The threat of an investigation has already wiped out $ 170 billion of the company’s value since a peak in January. The shares remained largely unchanged on Wednesday.

Mom met with the state administration for market regulation officials earlier this month to discuss compliance with Tencent, Reuters reported on Wednesday. Officials at the meeting, initiated by Ma, expressed concern about some of Tencent’s business practices and asked the group to adhere to antitrust rules, Reuters said, referring to people with knowledge of the case. According to the report, the antitrust watchdog gathered information and investigated possible monopolistic practices by WeChat. Tencent did not immediately comment.

“Tencent is all too familiar with the spectrum of additional regulation over its gambling industry,” said Michael Norris, research manager at Shanghai Agency Agency in Shanghai. “Investors may inquire about the extent to which the monopolistic inquiry could hamper Tencent’s investment activities, in game or other verticals.”

Read more: Tencent says China’s widespread collapse over Fintech, Deals

In the short term, investors are betting on another solid performance from a company whose profits in three of the past four quarters have exceeded expectations. Things to look out for on Wednesday include:

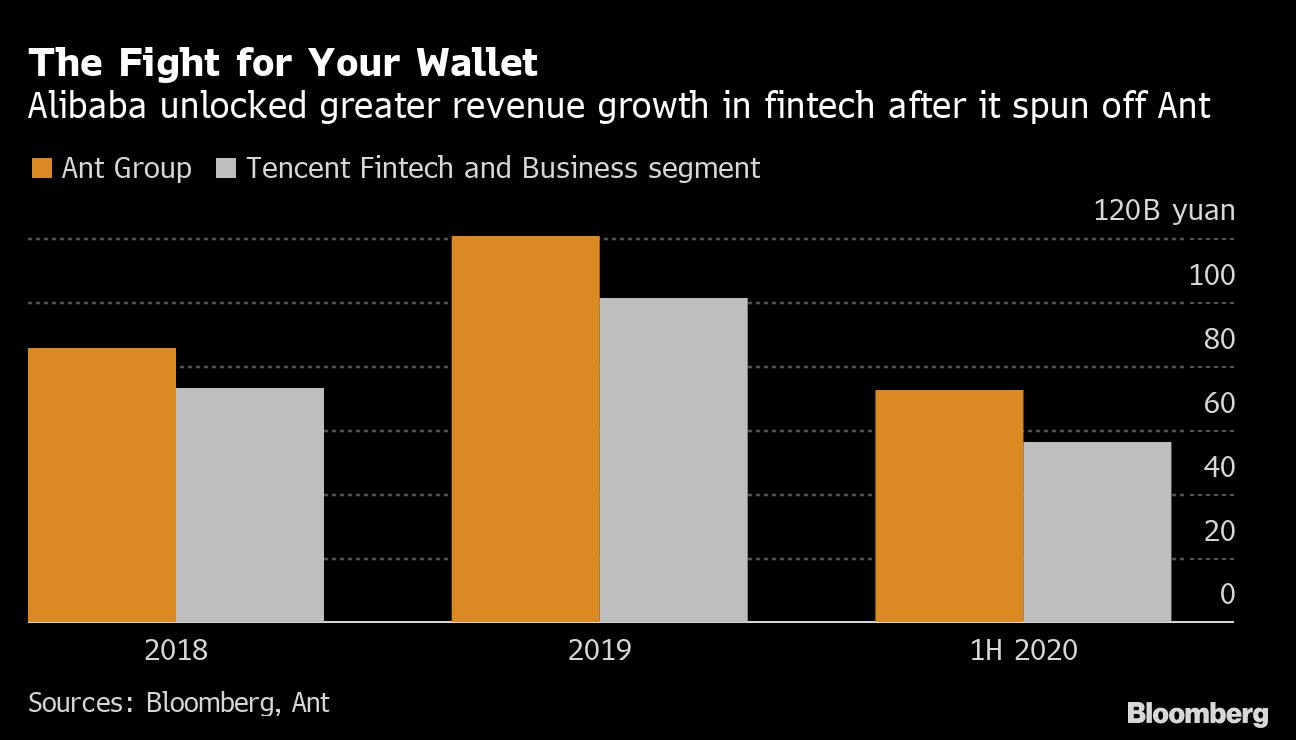

Plans for a makeover. The restructuring of the fintech equipment can be much more complicated than with Ant. Unlike Jack Ma’s company – which runs its fintech business through a single business – Tencent’s payments, money management and lending services are spread across different units. Everyone relies on WeChat, the way Tencent reaches users and markets products, including games from Honor of Kings to League of Legends. Comments on a suppression of several fronts. China’s antitrust watchdog has penalized Tencent and its counterparts for failing to seek approval for previous investments and acquisitions. Lawmakers again raised gambling addiction among young people during a rally of top Chinese leaders in Beijing in March. And Tencent is awaiting approval to complete a proposed merger of giant Huya and DouYu games, which will create a leader in the sector. The company is expected to grow 52% net revenue, the second fastest in almost three years. Investors would like to see Tencent keep spending, while Alibaba and Baidu Inc. in cash-strapped arenas such as video streaming. Tencent must eliminate the hits to maintain a growth rate that exceeded 45% in the September quarter. The last incredible Moonlight Blade should have helped during the holidays, but future titles remain important: it has 43 new games planned for 2021, said Binnie Wong, an analyst at HSBC. Some analysts call it the two most important drivers for future growth, as Tencent avoids advertising users with ads and does not yet earn WeChat Pay earnings. China’s dominant messaging service is expected to offer $ 240 billion in transactions for 400 million daily users of its small apps by 2020. Progress has been made overseas with the mobile versions of Call of Duty and PUBG.Fintech. Fintech and the business division, which includes cloud computing, generated $ 4.8 billion in revenue for the September quarter, more than a quarter of total sales.

Read more: Xi warns against technical excess in the suppression of signs will increase

It is the financial operation – according to Bernstein estimates – between 105 and 120 billion dollars, which can be investigated immediately. China launched an advance campaign in November to keep its largest corporations in check, with the first focus on the twin pillars of Jack Ma’s empire, Ant and Alibaba Group Holding Ltd. Tencent executives quickly promised to work with regulators and maintain a prudent financial strategy. But this month, Xi Jinping warned that he would oversee ‘platform’ companies that gather data and market power, a sign that the internet attack is intensifying.

What Bloomberg Intelligence says

The increasing repression of China in Tencent’s businesses could spill over to other fintech recipes, which could limit online credit, wealth and payment markets growth to 2025% to high single figures by 2025, based on our scenario. Dominant names like Ant, Tencent’s fintech, Duxiaoman and JD Tech can be scrutinized more closely than smaller competitors.

– Francis Chan, analyst

Click here for the research.

The most visible of Tencent’s money services is WeChat Pay, which is inextricably linked to the messaging service of the same name and the payment method of choice on the ride platform Didi Chuxing and the food delivery Meituan. But like Ant, it also manages services that challenge the state-owned banking sector.

The fintech business had revenue of about 84 billion yuan in 2019, about 70% of Ant’s sales for the year. The Corporate Development Group, which oversees newer initiatives, manages wealth management, including investment options in investment funds offered via WeChat and QQ, Tencent’s other social hit.

One potentially thorny area is the so-called micro-lending business, which is 30% owned by WeBank. According to the requirements imposed when Beijing scrapped Ant’s IPO, online lenders must keep 30% of all loans in its own books, not from partners such as banks. While Tencent now only acts as a pipeline instead of a co-lender, and the rules are still unclear, it may have to inject capital if it has to co-finance 30% of all financing. However, management said the rules for microloans should not affect Tencent’s flagship Weilidai consumer product.

“Tencent’s regulatory risk is largely due to the ‘greatness’,” Bernstein analysts, including Robin Zhu, said in a March 23 note. But its “competitive position in its main businesses remains very solid.”

Read more: Tencent Bulls looks at earnings as record stocks rise

(Updates to Reuters’ fourth paragraph report)

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP