2021 proves less of a free ride for EV shares. Last year, profits became fast and furious for the stars of the rising industry, but so far this year it has been harder to achieve. Nine (NIO) is a good example. The Chinese EV manufacturer achieved a share gain of 1172% in 2020, but the 2021 run has now turned negative.

The swing to the red comes after Nio had mixed earnings in the fourth quarter. The company generated revenue of $ 1.02 billion, a year-on-year increase of 149.3% and roughly in line with estimates. However, the non-GAAP earnings of – $ 0.14 are a larger loss than the loss of 7 cents per share that analysts expected.

For 1K21, Nio expects to deliver 20,000-20,500 vehicles, delivering more than a 400% year-on-year increase and a successive 15-18% profit, fueled by better-than-expected sales in February – the company has 5578 units delivered last month, bringing the total from Jan-Feb to 12,803.

The company said it now has the capacity to manufacture 10,000 vehicles per month, but due to the worldwide shortage of chips and the limited amount of batteries, it is currently limited to 7,500 vehicles. By July, however, the company believes that this headwind should subside, which will enable the company to reach its target.

The market’s negative reaction to Nio’s quarterly statement is not shared by Deutsche Bank’s Edison Yu. The analyst remains stuck in Nio’s corner, saying there is a ‘very real road to> 100,000 deliveries in 2021E.’ However, Yu is keeping a lid on such expectations by estimating that Nio could deliver 96,000 units this year. Yet the figure is 6000 more than its previous estimate.

Yu believes that there is a “growing awareness and appreciation for [the company’s] aspirational brand and ecosystem, which puts NIO on the right track to be a market leader in the Chinese premium segment. ”

Further down the line, Yu sees ‘several areas of untapped growth’.

A possible partnership to develop another brand that caters to the middle / mass market is a possibility and also the recurring software subscriber sales of NAD – the NIO Autonomous Driving service.

Yu also thinks investors are underestimating the potential of ‘incremental volume in Europe’, where sales will start later this year.

“With enough capital after 2020, we believe the company can invest aggressively to expand its capacity / service network and enhance its autonomous management software / engineering capability,” Yu summed up.

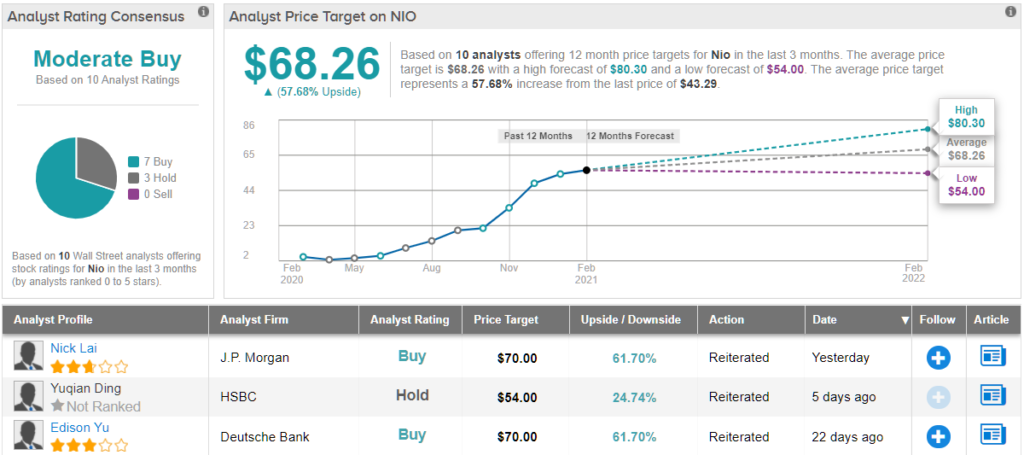

Consequently, the analyst views the recent weakness of the stock as a buying opportunity and repeats a buy rating and $ 70 price target for the stock. Investors can pocket a profit of ~ 62% if Yu’s dissertation plays out over the coming months. (To see Yu’s record, click here)

What does the rest of the street look like for Nio this year? The stock has a moderate buying consensus rating, based on 7 buys and 3 stocks. The average price target is just below Yu’s and indicates $ 68.26 a gain of ~ 58% in the coming year. (See Nine Stock Analysis on TipRanks)

To find great ideas for EV stocks that trade at attractive valuations, visit TipRanks ‘best stocks to buy, a new tool that unites all of TipRanks’ insights.

Disclaimer: The opinions expressed in this article are those of the proposed analyst. The content is for informational purposes only. It is very important to do your own analysis before investing.