(Bloomberg opinion) – One of the most disturbing developments in the business world in 2020 was the tendency for electric vehicle companies to list on a stock exchange before they have their first income. Although standard practices for research-intensive life science ventures, it is quite uncommon in the automotive world, before you can buy a product,

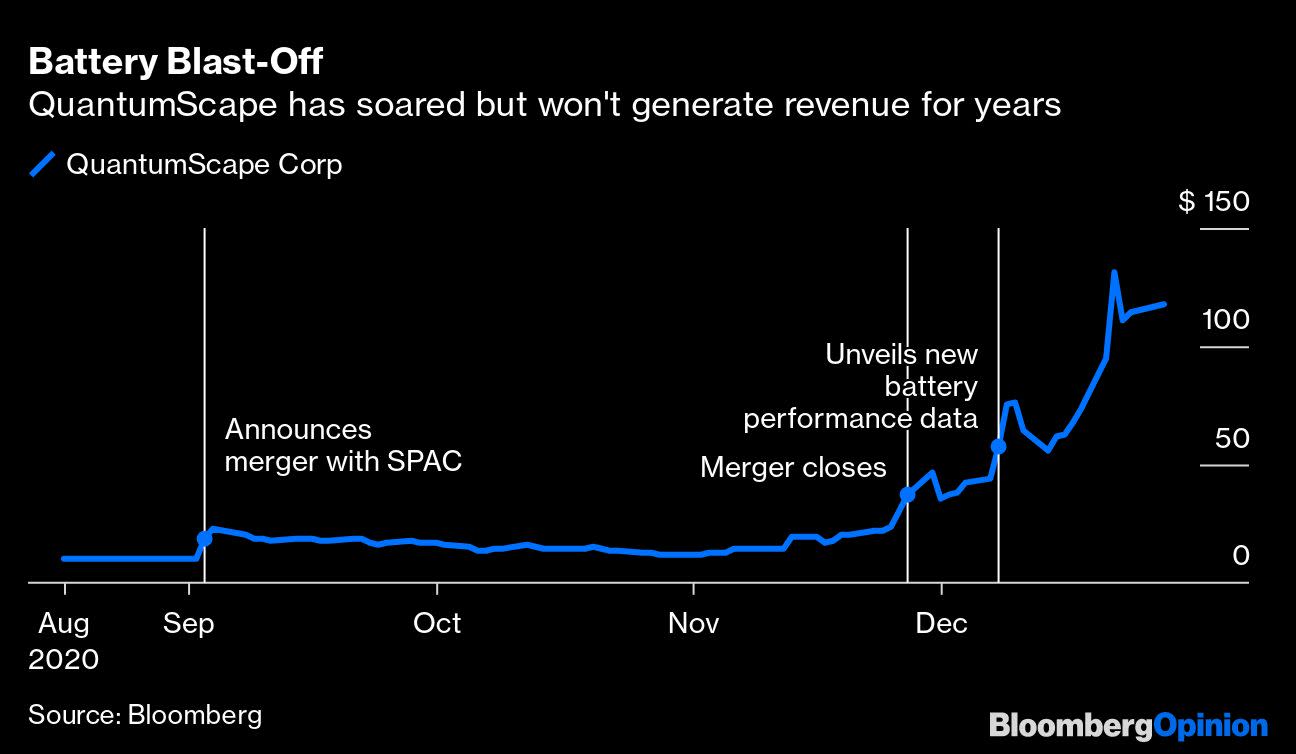

And yet, pre-revenue companies like Nikola Corp. and Fisker Inc. achieved multi-billion dollar valuations. Now the California battery startup QuantumScape Corp. increases electric vehicle mania to a new level.

Founded a decade ago by Stanford University scientists, with financial support from Volkswagen AG, QuantumScape became a public company after merging with Kensington Capital Acquisition Corp., a specialty procurement company. The company will only generate significant revenue in 2026, but it is already valued at $ 43 billion or $ 51 billion on a fully diluted basis. (1)

From a climate perspective, it’s great that investors are committing capital to electric transport. The promise of such riches will encourage others to join in the cause of emissions. The same speculative fever that Tesla Inc. and China’s NIO Inc. powered, however, seems to have gripped QuantumScape investors.

Over the past week, an average of $ 2.8 billion of the batteries’ shares have been traded daily. This is more than the volume for Alphabet Inc., whose market capitalization is $ 1.2 billion. Technical factors may have contributed to the rise of QuantumScape: only a small percentage of the shareholder register is available for trading. (7) For retail investors buying stocks at these levels, there is a long way to go.

First the good news. In laboratory tests, QuantumScape’s “solid state” battery cells have achieved very encouraging results, suggesting that the innovative chemistry could one day enable electric vehicles to drive farther and charge faster at lower cost. (2) This is exciting because it has become more difficult to extract significant performance gains from conventional lithium-ion batteries. CEO Jagdeep Singh’s scientific team appears to be delivering a real feat.

However, when the SPAC agreement was announced in September, the parties decided that a valuation of $ 3.3 billion was appropriate. (6) It seems sufficient for a company with less than 250 employees and one that does not have a final product or factory. After a brilliant stock market, QuantumScape is now worth more than ten times its initial value, and more than car manufacturers like Ford Motor Co. and battery giants like Panasonic Corp. and Samsung SDI.

Those who bought shares in the Kensington SPAC in August returned 1,060%, while QuantumScape warrants, once sold for 80 cents, are now worth 50 times as much. (3) The three founders of Stanford – Singh, Fritz Prinz and Tim Holme – became paper billionaires. Volkswagen, which has invested about $ 300 million in QuantumScape, will own a 23% stake worth nearly $ 10 billion. (4)

As usual with SPACs, the Kensington sponsor – which is controlled by Justin Mirro, a former Moelis & Company and RBC Capital Markets investment banker – also performed well. It received shares and warrants worth more than $ 900 million, a large return on its investment of about $ 7 million and which was achieved with only a few weeks of work. (5)

Other prominent supporters of QuantumScape include venture capital firms Khosla Ventures and Kleiner Perkins, co-founder of Microsoft Inc. Bill Gates, Quantum Partners hedge fund billionaire George Quantos and investor Jeremy Grantham. JB Straubel, a former chief technology officer at Tesla, is on the board. Such endorsements, and the years of R & D that have gone into the batteries, suggest that here is more than just hype. The contrast with Nikola, whose own technology (or lack thereof) was the subject of a serious report by the short seller, seems clear. (8)

Volkswagen’s production expertise should pave the way to commercialization. The partners plan to start in 2024 with a small pilot facility, and then two years later at a much larger factory. But success can not be guaranteed.

So far, QuantumScape has only produced single-layer cells and still need to find a way to stack more than 100 on top of each other to create a battery pack. Participants such as China’s Contemporary Amperex Technology Co., will not feel like it. CATL’s shares also rose this year, valued at around $ 110 billion.

One advantage of SPACs is that they are allowed to publish detailed multi-year financial forecasts, while companies that, through a traditional initial public offering, usually only publish historical finances. Given QuantumScape’s significant production barriers, it would be inconsiderate for investors to rely too much on these estimates, but whatever happens, they wait a long time:

Even if we assume that QuantumScape’s predictions are accurate, the valuation does not seem to be true. The market capitalization is equal to 13 times the revenue the company hopes to generate in 2027. Tesla shares are also incredibly frothy, but that’s a comparison to expected earnings in the next 12 months. Volkswagen, which will initially be QuantumScape’s largest customer, will be rated just 0.3 times next year.

QuantumScape’s batteries could eventually power the next generation of electric vehicles, but maintaining valuation can be even more challenging than advanced battery chemistry.

(1) The total diluted 447.5 million shares include unexercised share options, restricted share units and additional shares that may be issued to Volkswagen.

(2) The public shareholders of the SPAC comprise only 5% of the shareholders’ register. Existing QuantumScape shareholders own 82%, some of which are not sellers or subject to closures.

(3) The design of QuantumScape does not require a manufactured anode, which keeps the cost low. The lithium metal anode is formed when the cell is charged.

(4) If adjusted for QuantumScape’s cash

(5) If QuantumScape decides to redeem it, the warrants will convert to a maximum of 0.365 shares

(6) Volkswagen owns 71 million shares in QuantumScape, but according to the S-1 another 15 million will be issued, subject to a milestone for technical performance.

(7) Kensington sold shares in a stock exchange on June 30 and just three weeks later signed a non-binding intention with QuantumScape.

(8) QuantumScape, for example, also has many more patents.

This column does not necessarily reflect the opinion of the editors or Bloomberg MP and its owners.

Chris Bryant is a columnist for Bloomberg Opinion covering industry ventures. He previously worked for the Financial Times.

Visit us at bloomberg.com/opinion for more articles like this

Sign up now to stay ahead of the most trusted business news source.

© 2020 Bloomberg LP