(Bloomberg) – Saudi Arabia has only made a high commitment that the glory days of American shale, which has changed the global energy map in the past decade, will never return.

By approving the offer at Thursday’s meeting of the OPEC + alliance of oil producers, Saudi Energy Minister Prince Abdulaziz bin Salman has shown he is committed to raising prices – and trusts that it will producers this time will not encourage moving back and stealing market share.

“Drill, baby, drill ‘is over forever,” said Prince Abdulaziz, who orchestrated the revival of the oil market after last year’s catastrophic collapse.

His swing comes mixed with a good dose of diplomatic tension: Russia, Saudi Arabia’s main OPEC + partner, has been trying to persuade Riyadh to increase production for several months, fearing rising oil prices will eventually wake up competing shale producers. The Saudis are sure that American industry has reformed itself.

If the prince is right, OPEC + will be able to increase both prices now and later recover market share, without worrying that competitors in Texas, Oklahoma and North Dakota will flood the market. But if Riyadh miscalculated – and there was a shale wrong before, the danger is lower prices and production.

The Saudis have so far convinced their allies that the strategy will work. After a quick virtual meeting on Thursday, OPEC + agreed to extend its production cuts, and to face expectations of a production increase. However, Russia has obtained an exemption for itself and Kazakhstan and will increase production slightly in April.

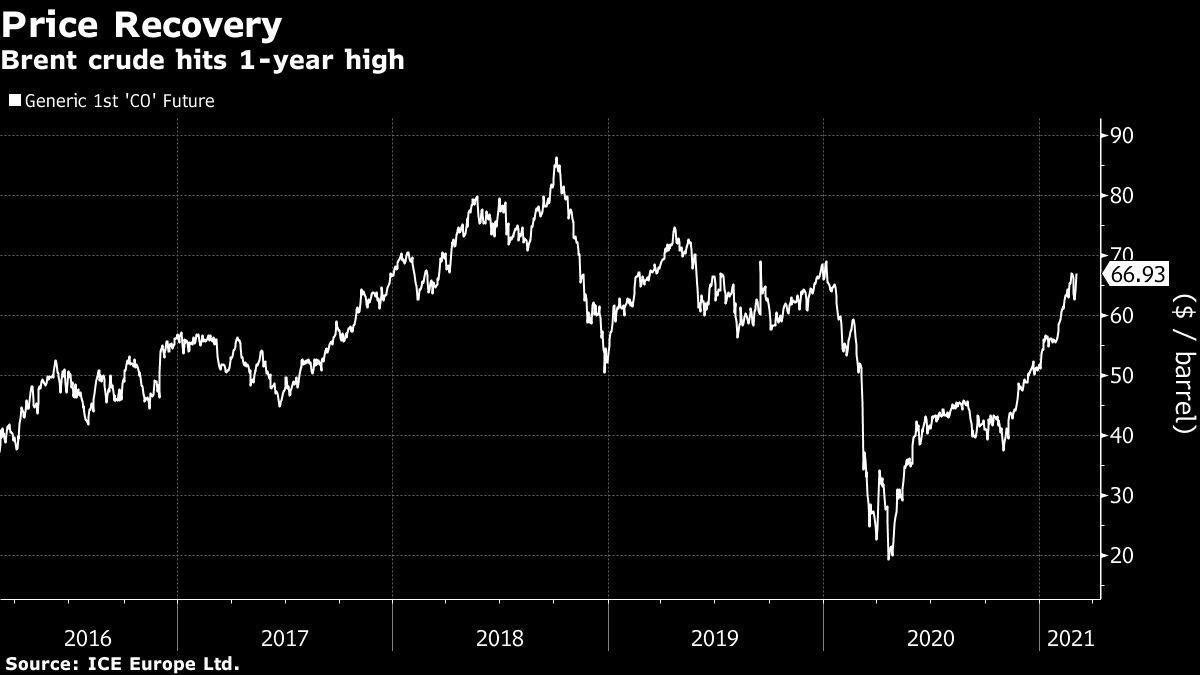

Brent crude jumped 5% to an annual high of almost $ 68 a barrel after the decision. The futures contracts on the previous month extended gains on Friday and a number of banks updated their price forecasts, including Goldman Sachs Group Inc., which raised its estimates by $ 5 to $ 75 in the next quarter and $ 80 in the following three months.

“This is an incredibly bold step by OPEC + to extend the oil price march,” said KPMG, leader of the Global Energy Sector, Regina Mayor.

However, if history is a guideline, problems can arise. The OPEC + coalition, which groups Saudi Arabia, Russia and nearly two dozen other oil producers, underestimated its American rivals, who produced more than most expected year after year. From a low of less than 7 million barrels per day in 2007, US total petroleum production more than doubled to a peak of almost 18 million barrels per day by early 2020, forcing the cartel to cut market share to stand.

Risky move

“This is a risky take,” Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd., said in a Bloomberg Television interview on Friday. While U.S. oil companies are unlikely to increase production this year, in 2022 “there is nothing that will really stop them, especially the small and medium-sized producers.”

Sen sees that prices will already hit $ 70 a barrel next week, by the end of the year $ 80 and a possible rise to $ 100 in 2022.

Total oil production in the US currently remains limited and hangs at 16 million barrels due to the impact of last year’s slump, which left standard prices trading just below zero.

Under pressure from shareholders, shale producers promised self-control and put their profits ahead of the growth they relentlessly pursued during the heyday. Although drilling has risen to lower from 2020, it is well below previous levels. In addition, President Joe Biden is trying to temper the worst excesses in the industry, including the indiscriminate natural gas burning that is a by-product of the success of shale.

Under another oil minister, Saudi Arabia attacked shale producers in 2014 and 2015, flooding the market and forcing prices down – a strategy that ultimately failed. Prince Abdulaziz does the opposite, as higher oil prices will ultimately benefit shale producers. Yet he is convinced that the industry will not repeat the excesses in the past.

“Shale companies are now more focused on dividends,” Prince Abdulaziz told the OPEC + meeting in an interview with Bloomberg News, saying the kingdom wishes the US industry strength. ‘We’ve never had a problem with shale oil. It is the shale businesses that are changing themselves. They have had a great deal of their adventure and are now listening to the call of their shareholders. ”

Shale executives agree with him – at least for now.

“A few years ago it was ‘drill, baby, drill,'” Hess Corp. chief John Hess said earlier this week in Houston. “Well, it’s ‘show me the money.'”

ConocoPhillips CEO Ryan Lance confirms the sentiment: ‘I hope there is discipline in the system. The worst thing that can happen right now is that U.S. producers are starting to grow rapidly again. ”

As the industry reduces spending to pay dividends better, there is not much left to finance increased production. Even Big Oil is reducing its ambitions in shale. Exxon Mobil Corp. has 55 oil rigs in the Perm basin running across western Texas and southeastern New Mexico, part of an effort to increase production to 20 million barrels per day by 2025. just 10 rigs, and reduced its 2025 production target by nearly a third to 700,000 barrels per day.

Yet there are also signs that higher oil prices will eventually be able to reactivate the US shale industry. As West Texas Intermediate’s benchmark now changes more than $ 60 a barrel, some companies believe they can grow shareholders and keep them happy. EOG Resources Inc., the largest producer in the Permian, has announced a major increase in spending for next year. And others follow it.

But the reaction of the stock market made the case of Prince Abdulaziz: investors punished EOG for spending more on drilling, and demarcated its stocks compared to more disciplined competitors.

(Updates with comments from Energy Aspects in the 10th, 11th paragraphs.)

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP