A hedge fund manager who famously cried over a Democratic tax proposal – and then voted for Joe Biden anyway – complained to Robinhood investors that they were buying GameStop shares as ‘losers’ that the government was paying spend gambling on the markets.

People “Sit at home to get their checks from the government and trade their shares” is the problem, Leon Cooperman said Thursday.

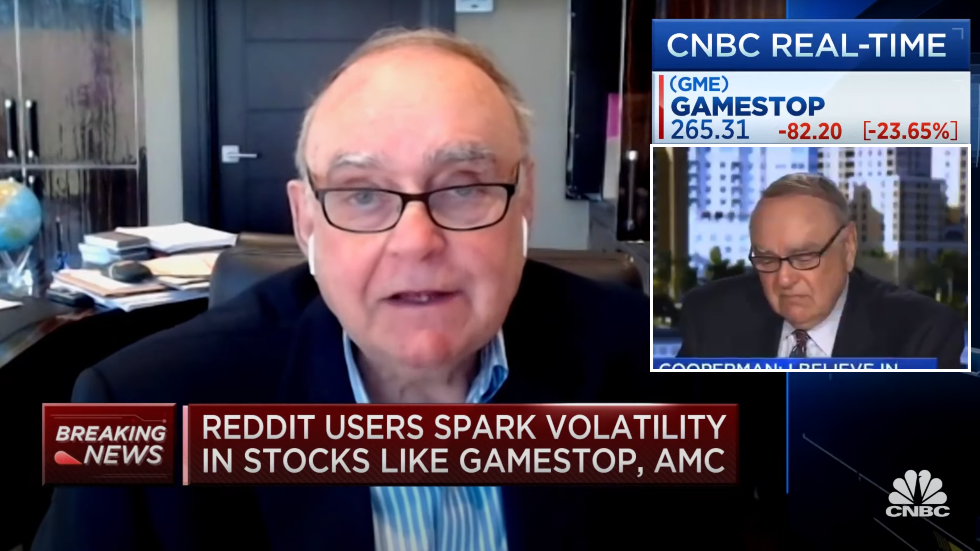

In a long appearance on CNBCs Fast money: rest time report, the CEO of New York-based Omega Advisors aimed at the small investors who buy shares “Experts” underestimated short sellers, and blamed the Federal Reserve’s low interest rates and even the government’s coronavirus stimulation control.

GameStop is too high because there are “Speculators playing around,” says Cooperman, who added that his hedge fund was not involved with the company in any way. The Robinhood investment is a “Losers’ game,” he added, and the people involved “Have no idea what they’re doing.”

Over the past week, small investors have been using brokers like Robinhood to buy shares of GameStop and several other companies, after realizing that hedge funds were “Naked” to sell it – to borrow more than 100 percent of the company’s shares to bet on the failure – to make a profit. As a result, hedge funds have so far taken over $ 70 billion in losses.

Also on rt.com

Mega Investors Penalized with $ 70 Billion Loss As GameStop and Other Short-Circuit Enterprises Live Stocks – Data Analysts

Earlier in the day, Robinhood actually blocked further purchases of GameStop and several other shares while leaving the option to sell them open – causing a lawsuit in New York that caused the brokerage of “Manipulate” the market.

Later in the show, Cooperman seized on the market conditions that led to this situation and denounced the calls of the ruling Democrats to pay the rich “Fair share” a tax.

“I hate the expression with a passion!” Cooperman said. “What does fair share mean?” He said he is willing to accept a marginal tax rate of 50 percent, but in places like California, Connecticut, New Jersey and New York. “You’re over it already.”

This fair share is a nonsense concept! It’s just a way to attack wealthy people.

Listen on CNBC to the annoying New York hedge fund billionaire Leon Cooperman on CNBC and now complain to people who ‘sit at home to get their checks from the government and trade their shares.’ to attack rich people. ‘ pic.twitter.com/zFW6o1MFND

– Jake Offenhartz (@jangelooff) 28 January 2021

Cooperman famously cried in another CNBC action, in 2019, when he objected to the wealth tax proposed by Senator Elizabeth Warren (D-Massachusetts) as part of her primary presidential bid. Sen. Bernie Sanders (I-Vermont) even featured the segment in a campaign ad, which Cooperman called a “Sad billionaire” unwilling to pay more taxes.

Ironically, Cooperman denounced exactly Donald Trump in the same appearance because he was not “Presidential” even though he praised his economic policies. On Thursday, he revealed that he had voted for Democrat Joe Biden, whose government is now considering a Warren tax plan.

In all their talks about standing up for the guy against billionaires and bankers, both Sanders and Warren approved that Biden would prefer the nomination of Janet Yellen, former Fed chairman, as head of the treasury. Yellen stopped more than $ 800,000 worth of Citadel, the same hedge fund, that affected its client – the brokerage Robinhood – to stop buying GameStop shares Thursday to stem the hedge fund losses.

Janet Yellen received $ 810,000 in cash from Citadel, the hedge fund included in the GameStop saga, in 2019 and 2020. Citadel spent $ 240,000 a year on Congress and the Treasury Department. https://t.co/nf5gHJ18o3

– Chuck Ross (@ChuckRossDC) 28 January 2021

Do you think your friends will be interested? Share this story!