Robinhood narrows its list of restricted shares, but will still place restrictions on buying shares of the heavily short-played GameStop Corp and AMC Entertainment Holdings Inc. when the stock market opens on Monday.

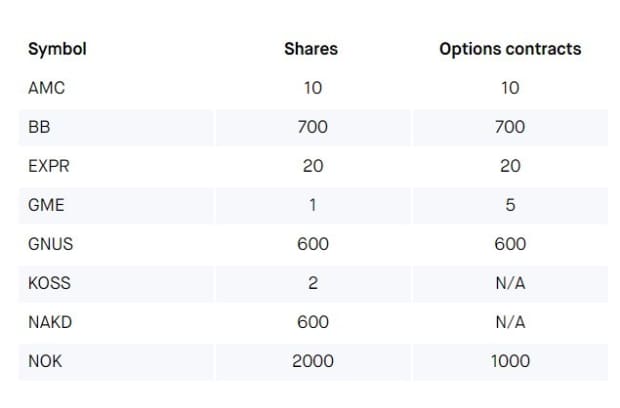

On its website, the online brokerage on Sunday adjusted its list of restricted shares from 50 to eight: GameStop GME,

AMC AMC,

BlackBerry Ltd. BB,

Express Inc. EXPR,

Genius Brands International Inc. GNUS,

Koss Corp KOSS,

Naked Brand Group NAKD,

and Nokia Corp NOK,

Robinhood’s limited shares.

Robin Hood

Robinhood users can only buy one share of GameStop (and up to five option contracts) and up to 10 AMC (and 10 option contracts) per limit.

‘Note: this is merged limits for each security and not per-order limits, and includes shares and option contracts you have already hold, ”Robinhood said. “These limits may change during the day.”

Read: The biggest losers from the GameStop unrest? An early list

Robinhood said positions will not be sold or closed to users whose stake is already over. “However, you will not be able to open positions of any of these bonds unless you sell enough of your shares so that you are below the relevant limit,” Robinhood said.

Last week, Robinhood unleashed anger and lawsuits from some users by restricting the trading of a number of very volatile stocks that were very short.

Also look at: Advice: Why regulators should not be quicker to try to suppress GameStop’s stock mania

GameStock shares rose more than 400% last week, rising more than 1,600% this year after an effort by online retailers to encourage short sellers on Reddit message boards. AMC shares rose 280% last week and are 525% higher so far.