(Bloomberg) – After China Alibaba Group Holding Ltd. Imposing a record fine, the e-commerce giant did an unusual thing: he thanked regulators.

“Alibaba would not have achieved our growth without sound government regulation and service, and the critical oversight, tolerance and support of all our constituencies has been crucial to our development,” the company said in an open letter. “We are full of gratitude and respect for this.”

This is a sign of how strange China’s onslaught on the power of big technology has been compared to the rest of the world. Mark Zuckerberg and Tim Cook are unlikely to express such public gratitude as the U.S. government Facebook Inc. of Apple Inc. with a record of fines on antitrust would not strike.

But almost everything about China’s regulatory pressure is extraordinary. Beijing regulators have completed their special investigation in just four months compared to the years that such investigations take in the US or Europe. They have sent a clear message to the biggest companies and their leaders in the country that competition against competition will have consequences.

For Alibaba, the $ 2.8 billion fine was less severe than many feared, helping to lift a cloud of uncertainty hanging over founder Jack Ma’s internet empire. The fine of 18.2 billion yuan was based on just 4% of the internet giant’s domestic revenue from 2019, regulators said. Although this is the previous high of almost $ 1 billion that the American disc maker Qualcomm Inc. handed over in 2015, tripled, it is much less than the maximum 10% allowed under Chinese law.

The fine was accompanied by a plethora of “corrections” that Alibaba would have to impose – such as restricting the practice of forcing traders to choose between Alibaba or a competing platform – which the company had already promised to establish.

Read more: China fines Alibaba record of $ 2.8 billion after monopoly probe

Alibaba CEO Daniel Zhang said on Saturday that his company was ready to continue its ordeal, while the People’s Daily spokesman People Daily of China gave the assurance that Beijing was not trying to stifle the sector.

The company in Hangzhou “escaped possible results such as a forced break-up or sale of assets. The fine will also not shake up his business model, ”said Jet Deng, an antitrust lawyer at the Beijing law firm Dentons’ law firm.

Nevertheless, neither Zhang nor the state media have addressed lengthy questions about the extent to which Beijing is still planning to enter its internet and fintech giants, a broad-based campaign that has wiped more than $ 250 billion from Alibaba’s valuation since October. The rapid capitulation of the e-commerce giant also underscores its vulnerability to further regulatory action – very far from just six years ago, when Alibaba openly challenged the wait of one agency on counterfeit goods on Taobao and eventually forced the state administration for industry and trade to return to his allegations.

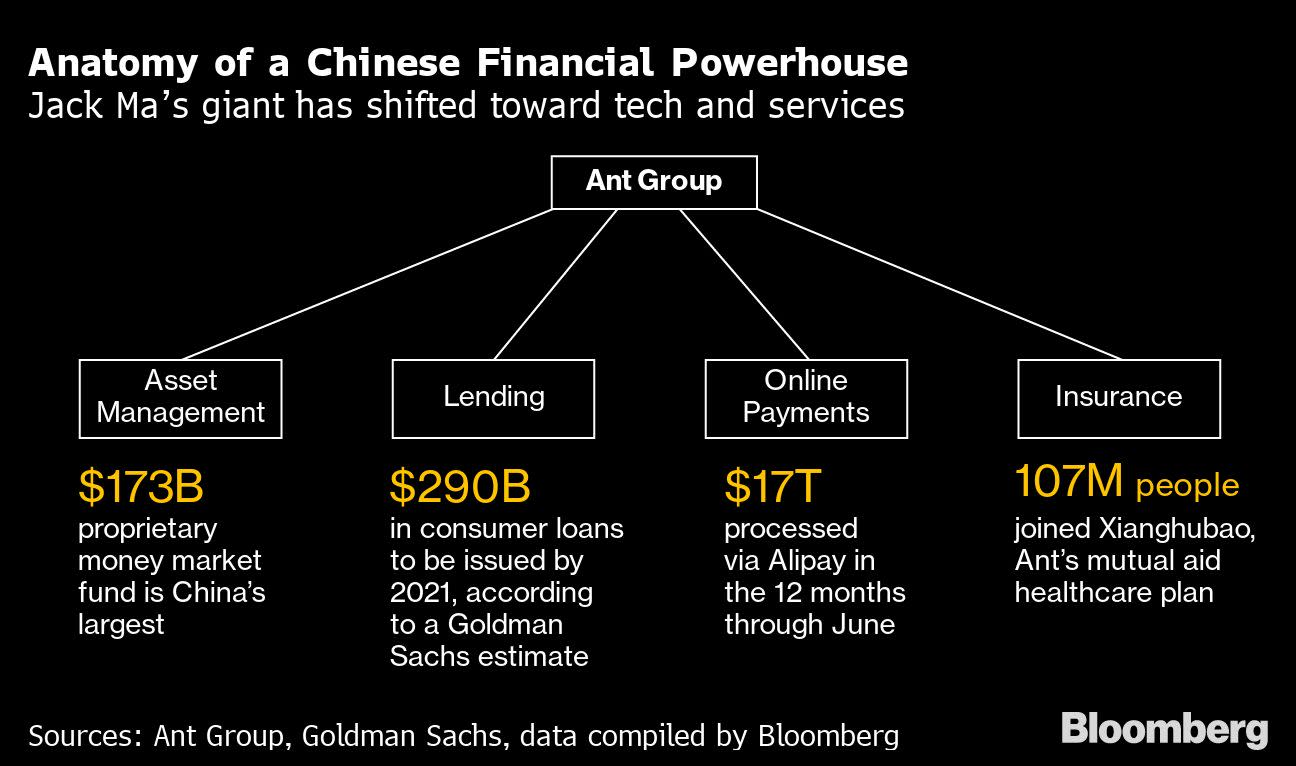

In addition to antitrust, government agencies are said to be investigating other parts of Ma’s empire, including Ant Group Co. consumer loans and Alibaba’s extensive media holdings. And the shock of the repression will still resonate with peers of Tencent Holdings Ltd. and Baidu Inc. to Meituan, which will force them to trade much more carefully for some time on extensions and acquisitions of affairs.

What Bloomberg Intelligence says

China’s record fine on Alibaba could lift the breach of regulations that have plagued the company since the start of an anti-monopolistic investigation in late December. The fine of 18.2 billion yuan ($ 2.8 billion), to penalize the anti-competitive practice of merchant exclusivity, equates to 4% of Alibaba’s domestic sales in 2019. Yet the company must be conservative with acquisitions and its broader business practices.

– Vey-Sern Ling and Tiffany Tam, analysts

Click here for the full research.

The investigation into Alibaba was one of the first salvos in a campaign apparently designed to curb the power of China’s internet leaders, which began after Ma infamous Chinese credit providers “pawn shop”, regulators who do not get the internet, and the “old men” of the global banking community.These remarks sparked an unprecedented regulatory outburst, including Ant’s initial $ 35 billion public offering.

It remains unclear whether the watchdog or other agencies can demand further action. Regulators, for example, are said to be concerned about Alibaba’s ability to hold public talks and that the company should sell some of its media assets, including the South China Morning Post, the leading English-language newspaper in Hong Kong.

Read more: China presses Alibaba on selling media assets, including SCMP

According to Bloomberg News, China’s leading financial regulators are now Tencent’s next target for increased oversight. And the central bank is said to be in talks to set up a joint venture with local technology giants to oversee the lucrative data it collects from hundreds of millions of consumers, leading to a significant increase in regulators’ efforts to seize about strengthening the country will be. internet sector.

“The high fine puts the regulator in the media’s spotlight and sends a strong signal to the technology sector that such exclusions will no longer be tolerated,” said Angela Zhang, author of “Chinese Antitrust Exception” and director of the Center for Chinese Law at the University of Hong Kong. “It’s a stone that kills two birds.”

For now, it seems that investors are just happy that it was not worse. In its statement, the state administration for market regulation concluded that Alibaba used data and algorithms “to maintain and strengthen its own market power and gain undue competitive advantage.” The practice of choosing retailers a ‘two-choice’ excludes competition in the local online retail market, according to the statement.

The firm is expected to implement ‘comprehensive corrections’, including strengthening internal controls, maintaining fair competition and protecting businesses on its platform and consumer rights, the regulator said. It will have to submit self-regulatory reports to the government for three consecutive years.

Alibaba said it would hold a conference call on Monday morning to address the decision of the antitrust watchdog. The company will have to make adjustments, but can now ‘start from scratch’, Zhang wrote in a memorandum to Alibaba’s employees on Saturday.

“We believe that concerns about the market over the anti-monopoly investigation into BABA are being addressed by SAMR’s recent ruling and fines,” Jefferies analysts wrote in a research note entitled ‘A New Startpoint’.

Indeed, The People’s Daily said in its comments on Saturday that the punishment was only intended to ‘prevent the disorderly expansion of capital’.

“This does not mean that the significant role of platform economy in the overall economic and social development is denied, nor does it indicate a shift in attitudes towards the country’s support for the platform economy,” the newspaper said. “Regulations are for better development, and ‘cleansing in’ is also a kind of love.”

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP