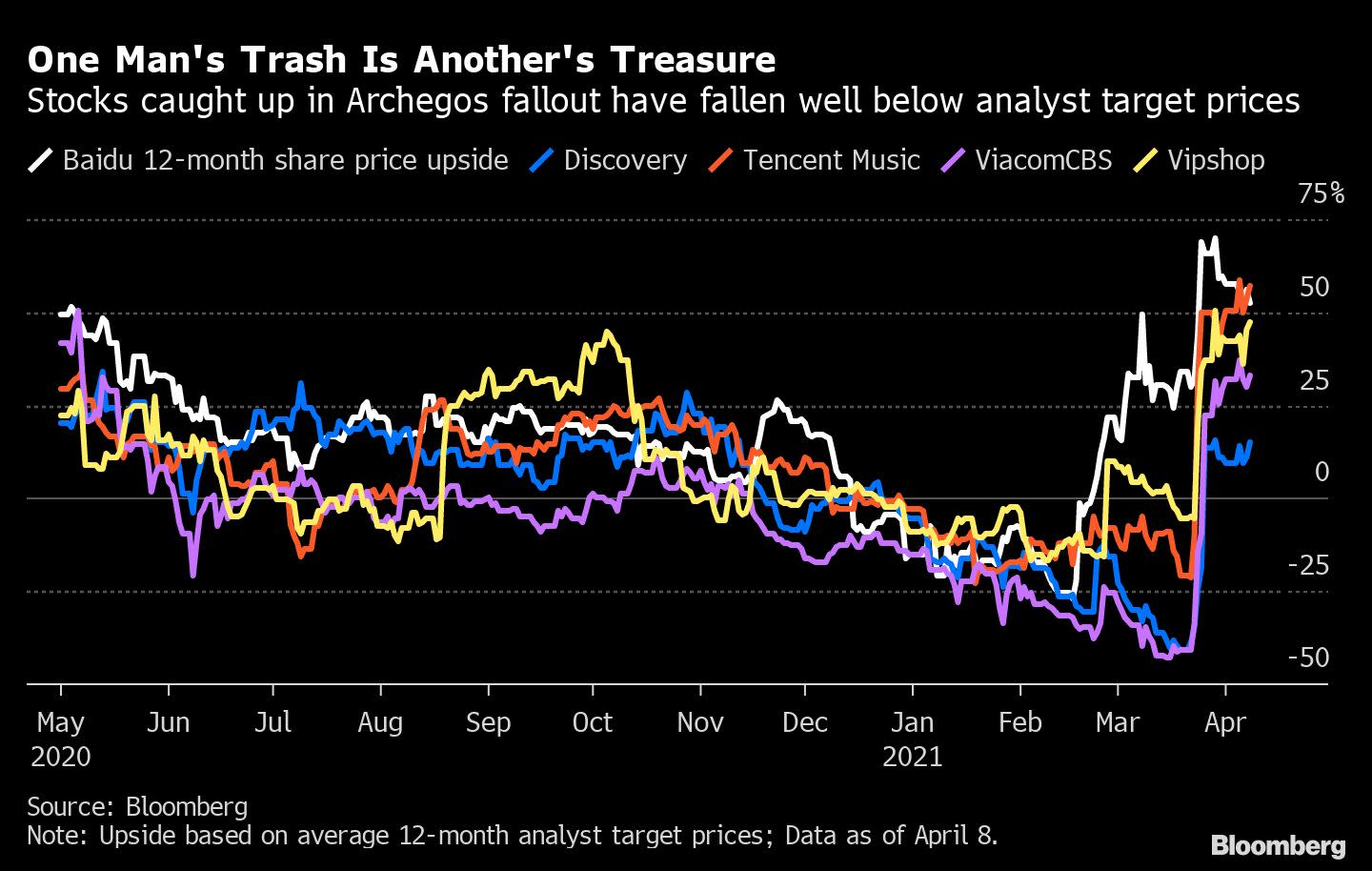

(Bloomberg) – The shares that were hammered as collateral damage in the liquidation of Archegos Capital Management see a silver lining of their slump: they become investable again.

Companies, including US media conglomerates ViacomCBS Inc. and Discovery Inc., as well as clothing retailer Farfetch Ltd., wiped out a total of $ 194 billion in market value as banks from New York to Zurich to Tokyo, despite leveraged funding by Archegos.

Initially, the forced sale in such a specific group of shares gave rise to fears of possible unknown issues with the shares, which incited even more losses. With that scenario now gone, and with the dust of Archegos inflating, analysts say investors need to look at some of these names again.

“Usually these disruptions where you are forced to sell for non-fundamental reasons are very good buying opportunities,” said Greg Taylor, chief investment officer of Purpose Investments in Toronto. ‘The counter to it is to find out how much of the start – up was due to the purchase that should not have been there either. So you have a balance between the two. ‘

Read more: Block-Trade Bevy erases $ 35 billion in inventory values per day

Take ViacomCBS, for example.

Until late March, the company, along with Discovery, was among the best-performing stocks in the standard S&P 500 index, which was stimulated in part by optimism about its flow strategy, but also thanks to a massive game by Bill Hwang’s Arch Hegang. The fund has at one point amassed $ 10 billion worth of ViacomCBS shares and colossal positions in a few other companies.

Read more: Bill Hwang was a $ 20 billion whale, and then lost everything in two days

Since Archegos’ inflation and after a 52% drop in ViacomCBS’s share over the course of a week – which in turn dropped its valuation by more than 50% from a peak on March 22 – at least six research firms have their ratings increase the company, according to data compiled by Bloomberg.

At Wolfe Research, analyst John Janedis said in a note that ViacomCBS shares are now a buying opportunity as the valuation of the media company appeared attractive after its sale. He also pointed out that the streaming business is it as a potential upwind.

A similar view also lurks behind Deustche Bank analyst Bryan Kraft this week to increase Discovery’s 12-month forecast to $ 60 from $ 35. The company’s improved growth prospects guarantee a higher valuation, he noted. Farfetch also received a ‘buy recommendation’ on Thursday from JPMorgan analyst Doug Anmuth, who said the stock offers a ‘compelling buying opportunity’.

No bargains

While the stocks trapped in the midst of the Archegos crisis are certainly suffering, they are not exactly cheap. Their average price-to-earnings ratio – a measure of how expensive a company is – is in line with the median of ten years, which indicates how high valuations were before the sale. Apart from ViacomCBS, Discovery and Farfetch, Chinese companies such as GSX Techedu Inc., Tencent Music Entertainment Group, Baidu Inc., VipShop Holdings Ltd. and IQiyi Inc. also trapped in the cross of Archegos.

To determine if selling a stock that was once overvalued is a good buy, it will have to dig in, said Barry Schwartz, chief investment officer of Baskin Wealth Management.

“If you have studied the company and you understand the business and you consider the price drop to be exaggerated, then take the opportunity to buy their shares,” Schwartz said by telephone. “If you have not done your homework yet and you think it is still a GameStop situation, you will be at the table.”

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP