© Reuters. A sticker contains crude oil on the side of a storage tank in the Perm basin

TOKYO (Reuters) – Oil prices resumed falling on Monday, falling by about 1% as concerns about a drop in demand for fuel products led to even more European closures dominating trade.

at 60 cents, or 0.9%, at $ 63.93 a barrel at 0136 GMT. U.S. oil declined 68 cents, or 1.1%, to $ 60.74 a barrel. Both contracts fell by more than 6% last week.

According to a draft proposal, Germany plans to extend the closure of COVID-19 infections to a fifth month, after the new cases are higher than the authorities will be the cause of hospitals.

“The reality is that we are still far from a complete demand recovery, and that it is the record levels of extractive production capacity that are the main prop for the oil market,” said Stephen Innes, Axi’s chief global strategist.

The Organization of the Petroleum Exporting Countries and its allies instituted unprecedented production cuts in an agreement to balance world markets after demand fell during the COVID-19 pandemic.

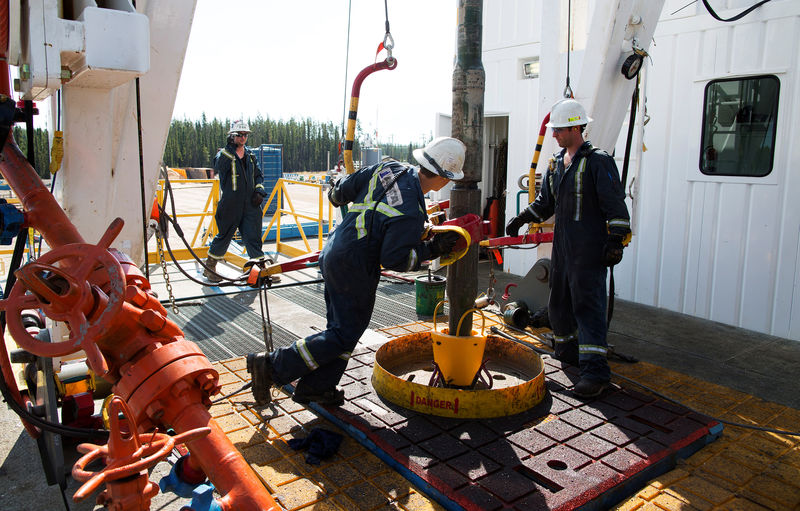

U.S. drillers are beginning to take advantage of an earlier rise in prices for optimism about the return of demand, adding most oil recovery equipment from January in the week to Friday.

The oil and gas drilling equipment, an early indicator of future production, rose by nine to 411 last week, the highest since April, energy services firm Baker Hughes Co said in its detailed report on Friday.

The count has risen over the past seven months and is nearly 70% higher than a record low of 244 in August.

Fusion Media or anyone involved with Fusion Media accepts no liability for loss or damage resulting from reliance on the information, including data, quotes, charts and buy / sell signals contained on this website. Please be fully informed about the risks and costs associated with trading the financial markets, this is one of the most risky forms of investment.