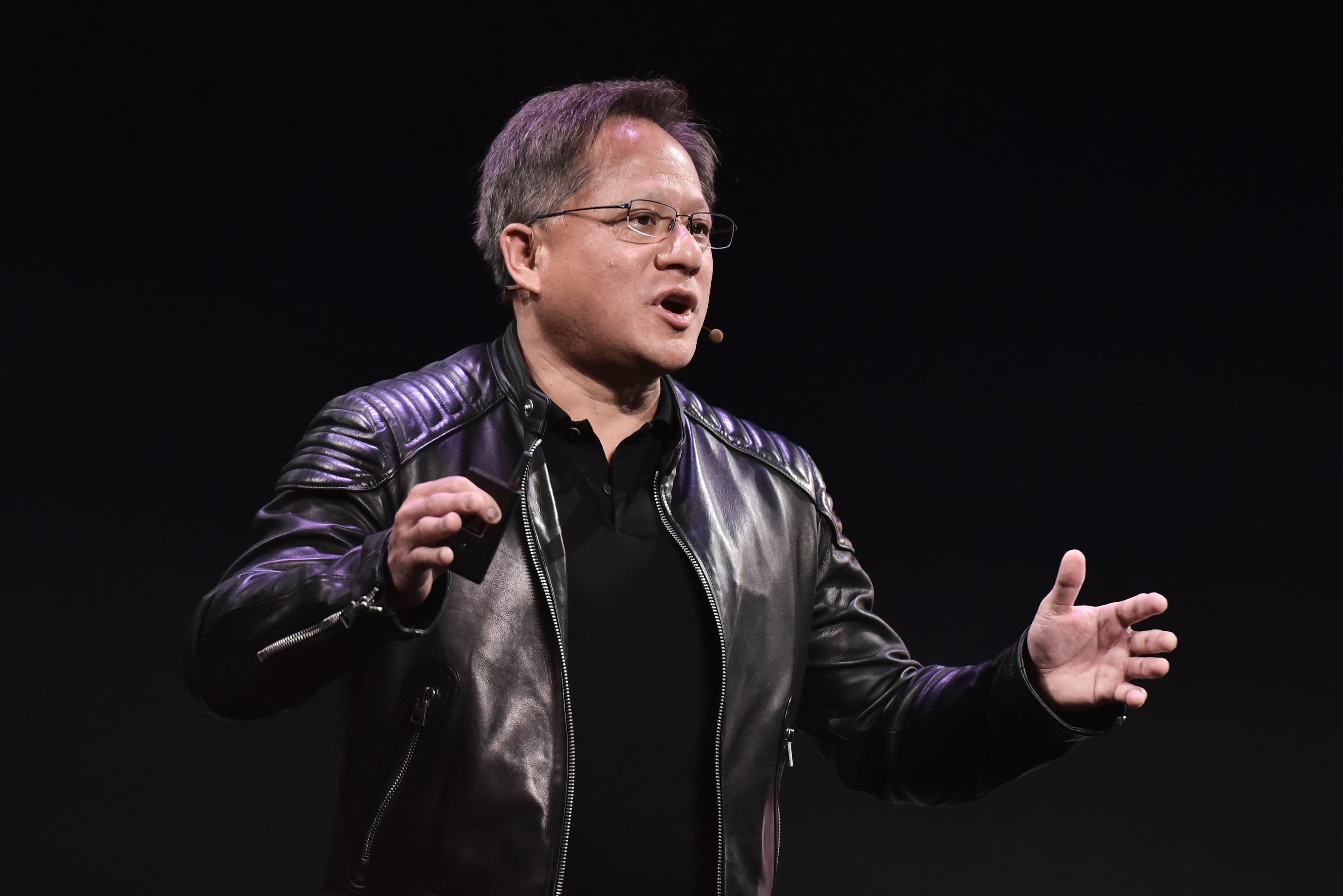

Nvidia Founder, President and CEO Jen-Hsun Huang

Getty Images

Nvidia beat analysts’ increased expectations for both earnings and revenue for the fourth quarter of its fiscal year, which ended in December.

Nvidia’s share rose below 2% in extensive trading.

Here’s how Nvidia did it:

- Earnings: $ 3.10 per share, adjusted to $ 2.81 per share as expected by analysts, according to Refinitiv.

- Income: $ 5.00 billion, compared to $ 4.82 billion, as expected by analysts, according to Refinitiv.

Sales were up 61% year-on-year.

Investors grew 55% more revenue last year and Nvidia beat expectations, even during a global semiconductor shortage.

Nvidia also suggested that its hot streak would continue by forecasting $ 5.3 billion in revenue for the current quarter, ahead of investor expectations of $ 4.51 billion.

Nvidia’s share has gained a lot of momentum in recent months, with the share rising more than 106% in the past year. Investors view the Santa Clara, California disc maker as a major provider to several new technology trends. It sells semiconductor components for games, artificial intelligence, data centers and automobiles.

Nvidia has two main segments: Graphics, which is primarily its graphics cards for consumers and professionals, and Compute and Networking, which includes chips for data centers, automobiles and robots.

Both had impressive quarters, which the company attributed in part to the impact of the Covid-19 pandemic. Graphics reported revenue of $ 3.06 billion, which is 47% higher than in the same period last year. Computer and Networks, the data center division, rose 91% year-on-year to $ 1.95 billion.

PC games were a hot market during the pandemic, and Nvidia is perhaps best known for its graphics cards that enable high-performance games. It has had trouble keeping its latest graphics cards in stock. Nvidia said the gaming performance was driven by sales of its latest graphics cards.

Nvidia’s automotive industry did not fare well during this quarter. It dropped 11% to $ 145 million, Nvidia said, and dropped by 23% for the full year.

Last September, Nvidia said it planned to buy ARM for $ 40 billion from Softbank in a deal with deep implications for the semiconductor industry. ARM develops low-level technology that is widely used in the industry to develop low-power chips for mobile devices – and provides technology to most of Nvidia’s competitors. Companies are already ready to object to the transaction through regulatory channels.

“We are making good progress with the acquisition of Arm, which will create enormous new opportunities for the entire ecosystem,” Nvidia CEO Jensen Huang said in a statement.