Modern (MRNA) was one of the most successful stories of the past year. The change between the top biotechnology a year ago compared to the current position, was easy to see in the company’s latest quarterly statement.

In 4Q20, Moderna generated revenue of $ 571 million, far from the $ 14 million in sales it reported in the same period last year. The figure is also well ahead of the street call for $ 279.4 million.

Of course, the massive change was due to the sale of the Covid-19 vaccine mRNA-1273, which granted emergency approval in December. The vaccine generated sales of nearly $ 200 million.

On the other hand, the company’s losses deepened. EPS of – $ 0.69 was worse than 4Q19’s net loss of $ 0.37 per share and missed the estimates by $ 0.28.

However, investors are not paying attention to the last time, due to the company’s prospects for the rest of the year. Specifically for the continued success of its Covid-19 vaccine, which is expected to generate more revenue than initially expected.

As of February 24, Moderna’s signed pre-sale agreements (APAs) for its vaccine are expected to yield $ 18.4 billion, compared to the ~ $ 11.7 billion expected at the beginning of the year. The new figure is based on growing demand and that Moderna is delivering more doses. The company increased the lower part of its FY21 target from 600 million to 700 million. By 2022, Moderna expects to produce 1.4 billion doses.

With eight commercial subsidiaries now based in North America / EU and a global presence will expand further, Oppenheimer analyst Hartaj Singh believes that the outlook is indeed very clear.

“We’re seeing an enterprise grow / accelerate in an unprecedented way, which will further fuel MRNA scarcity,” said the 5-star analyst. “We still see that mRNA-1273 has the best profile in its class. , with extra efforts (mutations / age groups / storage, etc.) that further distinguish the profile. In our opinion, the translation of mRNA-1273’s success in the pipeline candidates should not be overlooked with a platform technology, which is an important factor that retains further revaluation. ”

Not surprisingly, Singh rates MRNA as a better performer (i.e. buy) along with a price target of $ 106. Therefore, the analyst expects profit by ~ 30% over the next 12 months. (To see Singh’s record, click here)

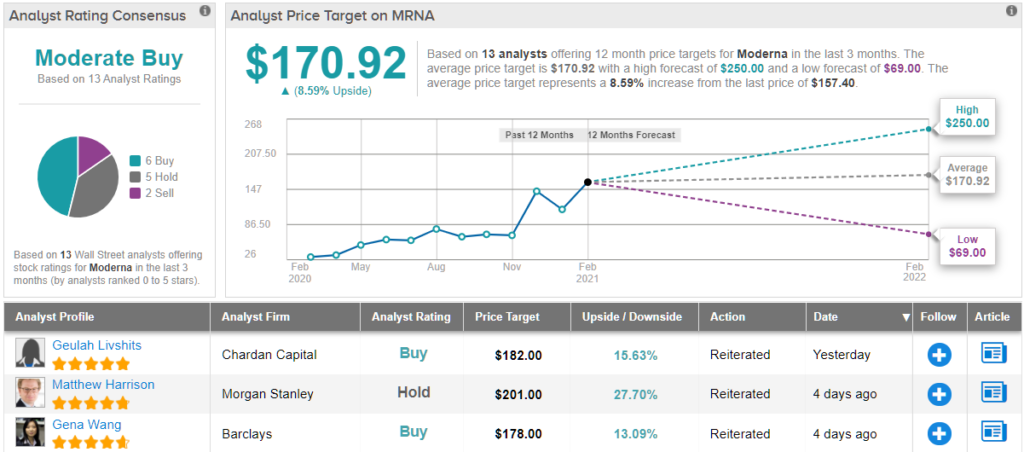

What does the rest of the street think? Looking at the consensus distribution, opinions of other analysts are more widespread. 6 buys, 5 investments and 2 sales are a moderate buying consensus. In addition, the average price target of $ 170.92 indicates an upward potential of 9%. (See MRNA stock analysis on TipRanks)

To find great ideas for coronavirus stocks trading at attractive valuations, visit TipRanks ‘best-selling stocks, a newly launched tool that combines all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are those of the proposed analyst. The content is for informational purposes only. It is very important to do your own analysis before investing.