The year 2020 will forever be captured in the minds of citizens around the world.

The stock market was not the main cause of the response to the pandemic and social unrest that arose, but it was one way in which Wall Street interpreted the pace of rapidly spreading contagion and human ingenuity that quickly provided solutions and drugs to resulted in combating. COVID-19.

Here are some key moments of a year in which the Dow Jones Industrial DJIA,

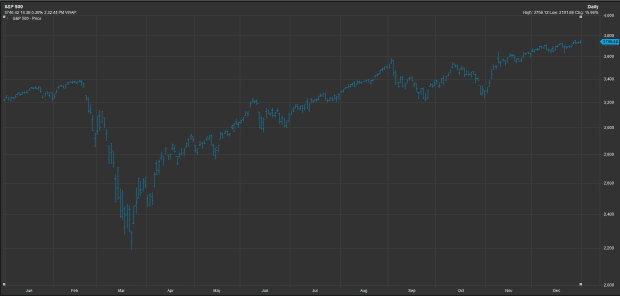

ends with an annual profit of about 7%, despite the fact that they plunged into a bear market eight months ago. The S&P 500 Index SPX,

achieved a return of almost 16% in 2020, while the Nasdaq Composite Index COMP,

increased by 43.4% and the Russell 2000 Index with small capitalization RUT,

climbed 19% on the year.

Fact sheet

-

January 2 was the first trading day in 2020 and the Dow discussed a 330-point rise, seemingly unaware, as China’s central bank stepped up stimulus measures amid the viral outbreak first reported in Wuhan and just ‘ a gleam was of what it would touch. the world.

-

Dow discusses a closing highlight on February 12th. The S&P 500 ends on February 19 at an all-time high.

-

On February 28, the Dow, S&P 500, experienced the weekly decline since 2008, as Federal Reserve Chairman Jerome Powell said the central bank was closely monitoring coronavirus spread.

-

On March 3, the Fed announces a half-percentage point cut in half an hour in the trading session, saying that the fundamentals of the economy remain strong, but that the coronavirus poses a developing risk to economic activity. hold. ” (A number of other central banks around the world have also lowered rates)

-

On March 11, the Dow ends up in the bear market for the first time in more than a decade, after the World Health Organization declared the worldwide spread of COVID-19 a pandemic.

-

March 12 is the worst day since the crash in 1987. As the risks of virus-driven recessions increase (market volatility has begun to cause limited trading to ease sales).

-

On March 15, the Fed lowered interest rates by a full percentage point on a Sunday night to almost 0% and began rolling out a number of programs aimed at halting volatile credit markets and supporting the economy.

-

The stock market hit its lowest point of the pandemic era on March 23rd.

-

March 26: Investors take comfort in the overnight $ 2 billion historic economic stimulus effort on the same day that a report shows that a record 3.28 million Americans applied for unemployment benefits

-

On April 3, stocks ended lower after the worst report in 11 years, which showed that 701,000 Americans lost their jobs in March.

-

April 29 is the largest drop in U.S. gross domestic product since 2008. GDP, the official scorecard for economic growth, shrank at an annual rate of 4.8%.

-

May 25 – The death of George Floyd causes social unrest around the world.

-

The National Bureau of Economic Research, or NBER, said in June that a 128-month extension – the longest dating back to 1854 – came to a halt in February and a recession began.

-

June 5: Investors welcome a May jobs report that unexpectedly shows a 2.5 million rise in non-farm payrolls and a drop in the unemployment rate. The Dow rose nearly 830 points, or 0.3%, while the S&P 500 rose 2.6% and the Nasdaq Composite peaked intraday.

-

June 16: data show US retail sales rose 17.7% in May as the economy reopened, arguably the shortest and deepest recession in U.S. history.

-

November 9: Trump’s vaccine tsar says first vaccine to be submitted for Thanksgiving emergency

-

November 15: Trump recognizes President-elect Joe Biden’s victory in 2020 for the first time – then says he ‘concedes nothing’, and reiterates the unfounded demand for ‘rigid’ votes

-

November 17: Moderna Inc. said the COVID-19 vaccine candidate reached its primary endpoint in the initial analysis of data from a phase 3 trial, showing 94.5% efficacy

-

December 3: UK authorizes Pfizer and BioNTech’s COVID-19 vaccine.

-

December 11: FDA grants emergency authorization of the Pfizer BioNTech vaccine.

-

December 18: FDA approves Moderna’s COVID-19 vaccine.

Quotes of the year:

“The outbreak of the coronavirus will be temporary and will not change the long-term improvement of the Chinese economy,” Pan Gongsheng, a deputy governor of the PBOC, said at a news conference in February.

“I’m telling investors to stick with it because this is the opportunity,” TCW senior manager Diane Jaffee told MarketWatch in late February.

“Monetary policy is an unlikely remedy for the coronavirus,” Mike LaBella, chief investment officer of QS Investors, a subsidiary of Legg Mason, said in a statement in March when the Fed made its first emergency rate cut in response to the coronavirus outbreak, eight. days before the WHO declared the new strain of coronavirus a pandemic.