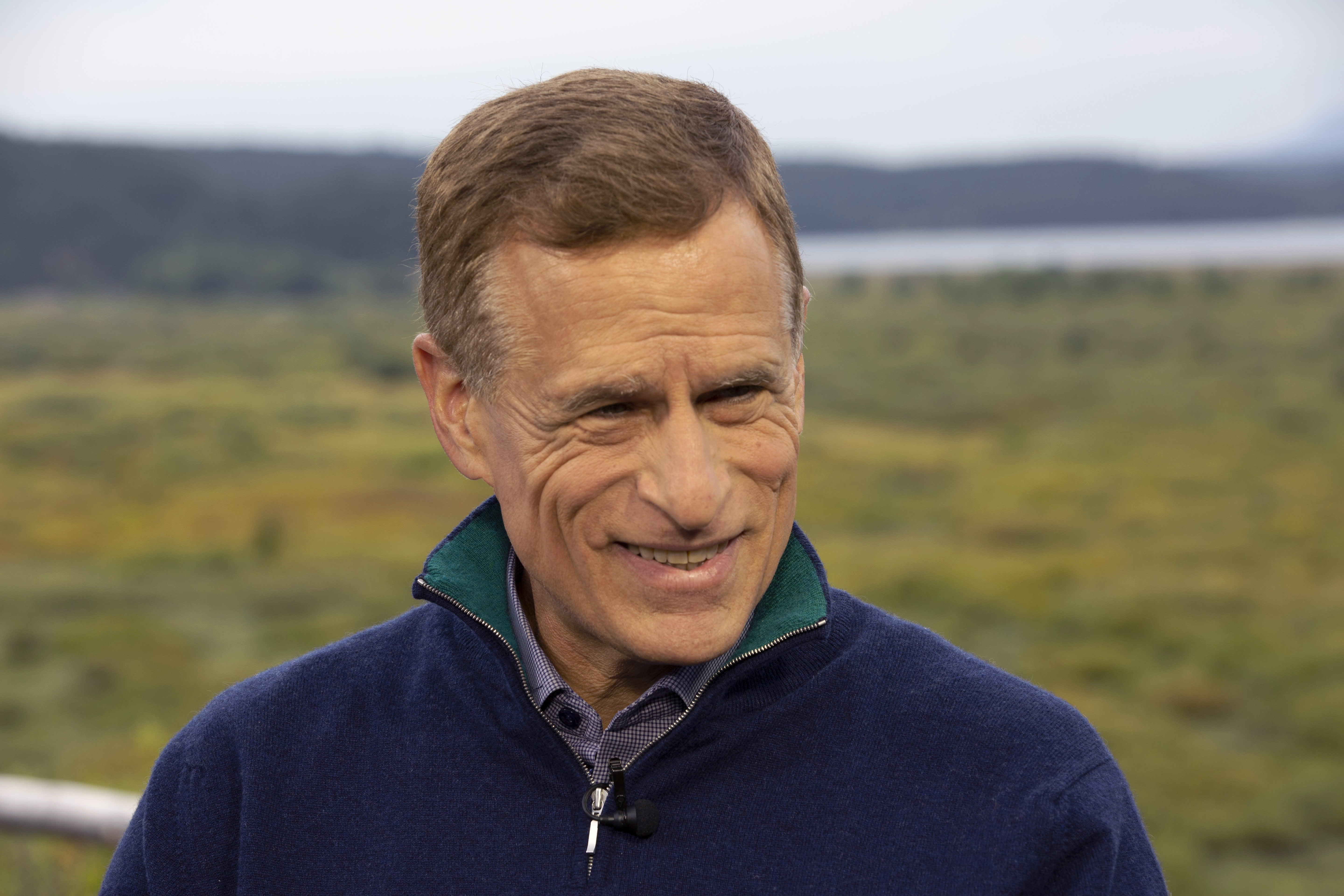

Dallas Federal Reserve President Robert Kaplan told CNBC on Tuesday that he would likely prefer an interest rate hike before the end of 2022.

Although he does not soon see inflation becoming a problem, the central bank official said he expects the economy to progress enough to pull the Fed back from the high levels of accommodation it has offered since the Covid-19 pandemic .

Kaplan acknowledged that he was one of the 2022 ‘points’ that came to light after last week’s Federal Open Market Committee meeting, suggesting it increased next year. Each quarter, the Fed publishes a bulletin of the expectations of individual members about where the rates will be during the next three years and beyond.

However, only three other 18-member FOMC officials agree with Kaplan’s position, and the plot generally still showed no increases until at least 2023.

“There were a few dots that started rising in 2022, and I’m one of those dots, yes,” Kaplan said on ‘Squawk Box’.

The FOMC’s economic forecasts do not contain the names of individual members, and it is unusual for committee members to disclose where their point is located.

But Kaplan said he was keen for the Fed to start normalizing policy, even though he did not think the day had yet arrived. Kaplan will not get a vote on the official committee policy and will only vote in 2023, although he still has input on decisions and makes an individual forecast on economic conditions and the trajectory of interest rates.

Three of the 2022 points indicated one increase, while the fourth pointed to two hikes. Kaplan did not indicate whether he was expecting two increases.

“The forecast has improved, my forecast has improved meaningfully,” Kaplan said, adding that he expects growth of 6.5% in gross domestic product in 2021, in line with the median committee estimate.

“That said, we are still in the midst of the pandemic and I want to see more of a forecast. I want to see real evidence that the forecast is going to unfold,” Kaplan added.

“As we do so and as we make significant further progress in achieving our dual mandate objectives, I will be a proponent of the process of launching some of these extraordinary monetary measures and doing so sooner rather than later,” he said. said. said. “But I have to see the results, not just a strong prediction.”

No inflation worries

The Fed lowered its short-term interest rate to near zero in March last year and bought at least $ 120 billion worth of bonds every month.

Some parts of the markets are worried that the Fed may hold the measures for too long, especially given the high level of fiscal stimulus. Congress recently passed a $ 1.9 billion stimulus package and will soon begin work on an infrastructure program worth up to $ 3 billion.

These concerns are focused on rising inflation expectations, as indicated by rising bond yields.

However, Kaplan said he was not worried about inflation, although he expected it to rise only temporarily this year.

He said that supply and demand unique to the pandemic would cause price increases, and that year-on-year comparisons would appear high, but only because inflation slowed significantly during the early days of the crisis.

Inflation, Kaplan said, “is not just one-off price increases. These are price increases year after year. I think the jury is very much on whether we are going to see it. This is not my basic case.”

Kaplan added that he would not be in favor of the Fed adjusting its asset purchases to try to reduce longer-term yields on government bonds. The rise in yields reflects the economic downturn, he said, and he expects them to continue to rise to where the 10-year note is about 2% higher.