An exciting start to the week is threatened, with stock futures lower. Some point to a top government official in China who has warned that bubbles are forming in US and European markets and elsewhere.

Whether you are restless or at ease, we call of the day, by Julien Bittel, fund manager of a multi-asset at Pictet Asset Management, is currently offering tailor-made advice: diversify the portfolio.

Bittel’s concerns stem in part from what he says is not bad news at the moment. “Given the speculative extremes that are currently going on, we feel that there could be a race to the exit, similar to what we saw in 1987, where you know the market could drop 30% quickly … in two months, “he told MarketWatch in a statement. maintenance.

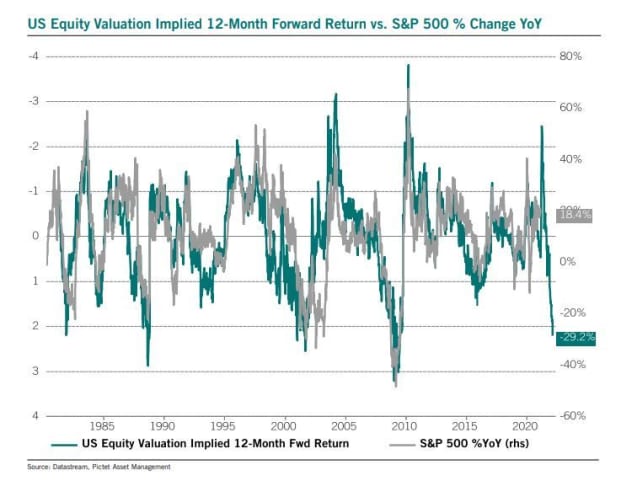

In a card storm, he walks through his view, starting with stock valuations, which he says shifts a bit aside about the view that earnings “are about to explode.” Its chart below contains a series of valuation measurements that have closely correlated with forward returns since the early 1980s.

“What you can see here is that at the current valuation extremes, it indicates that the return on equities will be around 29% on an annualized basis, 12 months ahead,” he said. Although by March it should be around 55% on an annual basis.

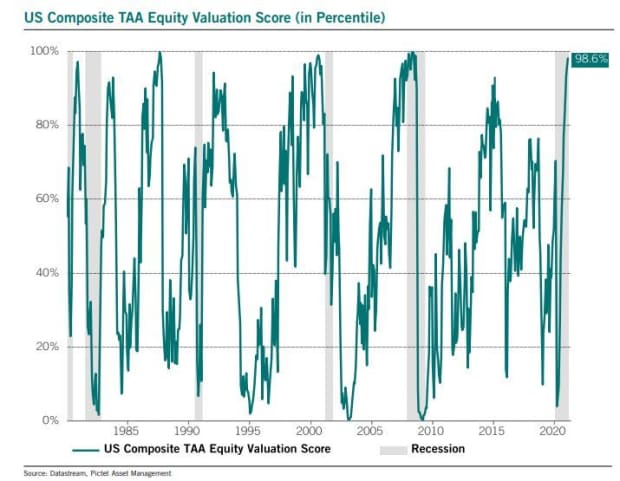

The following graph from Bittel shows a composite stock valuation score – currently in the 98th percentile. “So if it’s high, you know valuations are very expensive,” he said. Another way to look at it is that “only 1.4% of the time during the last forty years has been so expensive” based on this measure.

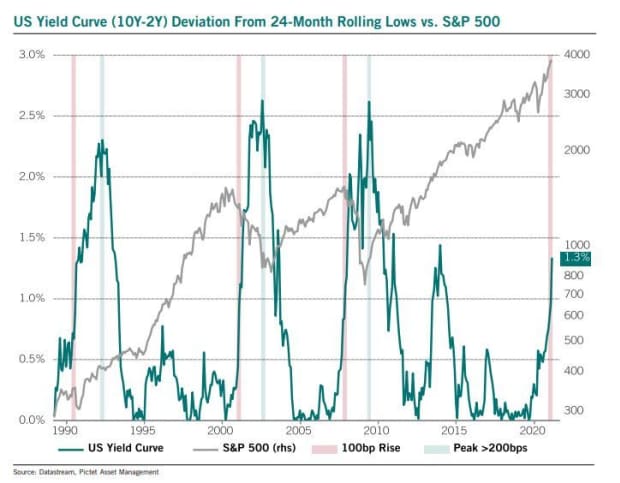

Rising bond yields, which are fueling the financial markets, are the subject of the following chart. “Here is the 10Y-2Y US yield curve, which is currently 130 basis points from the curve inversion lows in August 2019,” Bittel said. An inversion refers to when longer running times yield less than shorter dates.

The last three times this happened were in August 1990, February 2001 and November 2007, and ‘historically this degree of rising inversion to the yield curve has led to a turning point for stock markets,’ he said.

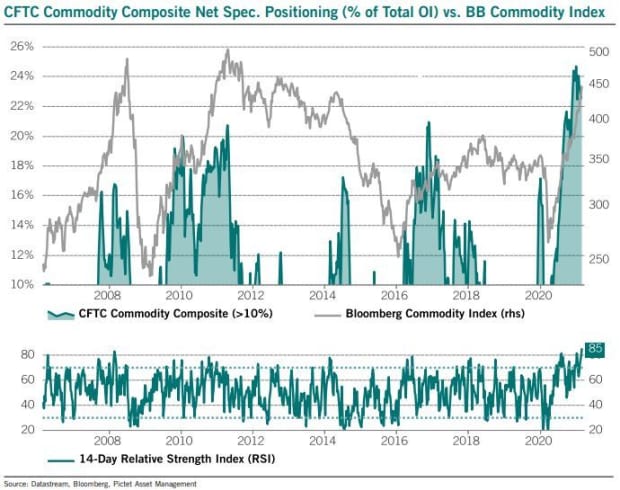

The following shows the most overbought commodities since March 2008 (see the 14-day relative strength index). For the assets to perform better, the ‘dollar must weaken further and the growth momentum of the world must surprise on its head,’ he said.

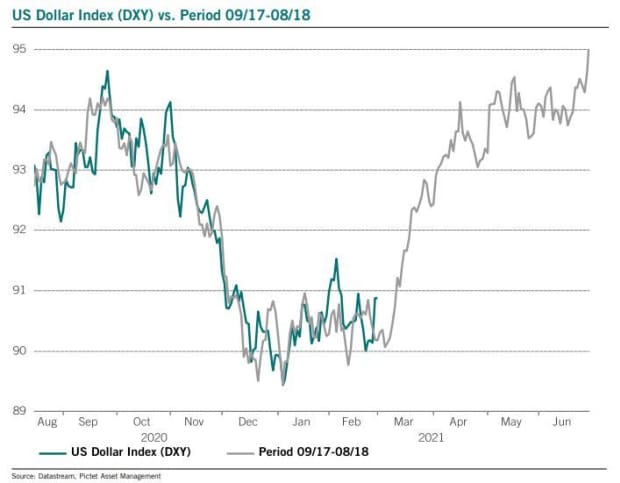

But he thinks a stronger dollar could be the big surprise for investors this year. The graph below follows an analogy from 2017 to 2018 and shows: “the train officially leaves the station in March.”

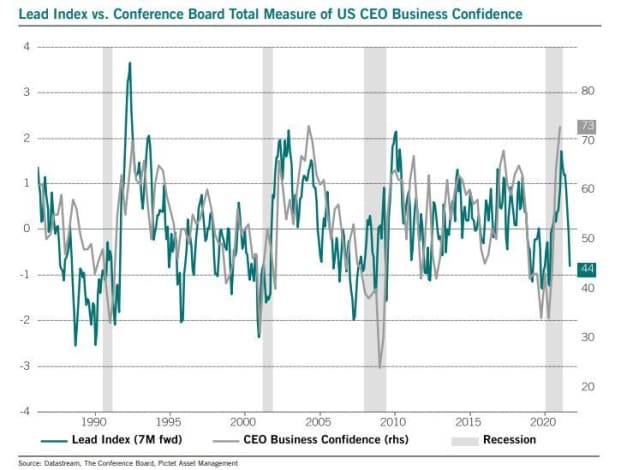

Finally, he is concerned about this graph showing the company’s CEOs’ confidence in 17 years. As in, they can not get much more optimistic.

He considers two things that many investors are unlikely to do: a stronger dollar by the end of the second quarter and a global growth momentum that is surprisingly on the downside in the second half of 2021. ‘The real blind spot for me is the impact it could have had on the reflection trade, ”he said.

Thus, diversification of Bittel’s advice is through a multi-asset product that offers stocks and bonds, which will benefit in times of surprising growth but also protect against bad things.

The markets

Equity futures contract ES00,

YM00,

NQ00,

slips to Monday’s bullish session. European equities SXXP,

on, while Asian markets mostly ended lower, following the bubble warning from Guo Shuqing, head of the China Banking and Insurance Regulatory Commission. Oil prices CL00,

lower, the dollar DXY,

is higher, and bitcoin BTCUSD,

prices are rising.

The buzz

Shares of retailer Target AT,

climbs to better than expected sales. In the same sector are shares of Kohl’s CSS,

is increasing the results. Information Technology Group Hewlett Packard Enterprises HPE,

will report after the report.

Shares of Zoom ZM,

rises, after the video communications group reported adjusted earnings nearly ten times higher due to the COVID-19 pandemic-related demand for its services.

All US Apple AAPL,

stores are open for business for the first time in almost a year.

A top official from the World Health Organization warns by the end of this year to declare victory over the pandemic. This is as global cases of coronavirus rose for the first time in seven weeks last week.

Random reading

Singer Taylor Swift is unhappy with Netflix’s NFLX,

“Ginny and Georgia.”

Two fruits, three vegetables a day = a longer life.

Need to start starting early and being updated to the opening clock, but sign up here to have it delivered to your inbox once. The version by email will be sent out around 7:30 p.m.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning information for investors, including exclusive comments from Barron’s and MarketWatch authors.