Investors are returning in an upbeat mood from the long holiday weekend, with some attributing optimism about an impending change of guard in 1600 Pennsylvania Avenue. And we have earnings and remarks from Biden’s top Treasury pick, Janet Yellen, ahead.

The S&P 500 SPX,

up 0.3% for the year following last week’s setback. It pales in comparison to some assets, with bitcoin BTCUSD,

increased by another 27% this year, to a yield of 300% in 2020. And the manufacturer of electric cars, Tesla TSLA,

has risen by 17% so far in 2021, after about 700% last year.

Read: Tesla’s new $ 950 share price target at Wedbush is the highest on Wall Street, but the analyst will still not say buy

On this note we move to our call of the day, which is all about bubbles. This comes from a poll recently published by Deutsche Bank, which asked, among other things, where investors now see foam.

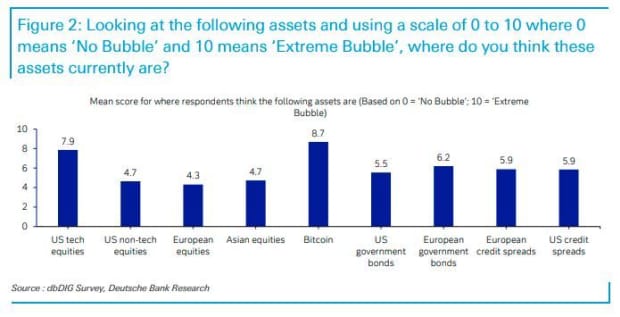

About 89% of respondents believe that markets are facing bubbles, and two stand out – US technology stocks and bitcoin. The latter comes close to the area of ’extreme bubbles’.

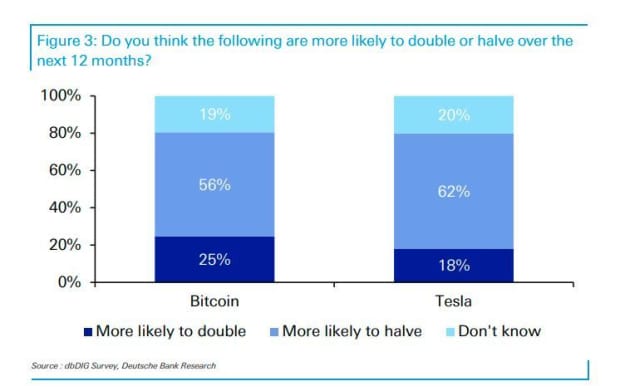

“On a specific question about the fate of bitcoin and Tesla, a sign of a potential technological bubble, of 12 months, a majority of readers think they are more likely to double than double these levels, with Tesla according to readers, more vulnerable. ” says strategist Jim Reid and research analysts Karthik Nagalingam and Henry Allen. Tesla will report fourth-quarter earnings on Jan. 27.

More bubble thoughts about bitcoin – the cryptocurrency allegedly topped the “most pressing position” in the monthly fund manager survey of Bank of America, which dropped the highest limit on technology stocks.

As for bitcoin, however, enthusiastic investors do not seem to be so easily startled:

Another question asked in the Deutsche Bank survey was whether one possible bubble button – the Federal Reserve reducing its asset purchase program – is likely.

71% of respondents do not believe that the Fed will decline before the end of the year, which is in line with what Fed governors said strongly at the end of last week, but a quarter of readers may think that economic growth / markets are possible force their hand, ”said Reid and the team.

Read: BlackRock CEO says a leading investor raises concerns about valuations and inflation

The markets

Futures for technical equities NQ00,

it is incidentally the lead higher, followed by Dow and S&P 500 futures YM00,

ES00,

with European shares SXXP,

and a mixed day for Asian markets. The International Energy Agency has lowered its forecast for oil demand in 2021. Crude prices CL.1,

looks intact.

The quote

“Only 25 doses were given in one country with the lowest income – not 25 million, not 25,000 – only 25. I must be blunt: the world is on the brink of a catastrophic moral failure.” This was the director general of the World Health Organization Tedros Adhanom Ghebreyesus, who had harsh words on Monday about global inequalities in vaccines.

The buzz

Bank of America BAC,

shares are lower after profit forecast, but disappointing on the revenue side, while Goldman Sachs GS,

shares are higher after strong results. Netflix NFLX streaming giant,

is due after closing. See the preview of earnings.

In a prepared statement before her confirmation hearings, Treasury nominee Yellen said U.S. policy should “act big” to help Americans who are struggling amid the COVID-19 pandemic. She is also expected to say that the US does not want a weaker dollar.

The incoming government of Biden says coronavirus travel restrictions remain for incoming travelers in Europe and Brazil, after President Donald Trump just lifted the ban. This is as COVID-19 deaths increase in 2/3 of the US states.

The California state epidemiologist has recommended rolling out more than 300,000 doses of biotech Moderna’s MRNA,

vaccine, after possible allergic reactions by some recipients.

Coherent COHR,

shares are flying after optical component maker Lumentum said it had agreed to acquire the laser maker in a $ 5.7 billion cash and inventory transaction.

Western Union’s WU,

shares are rising after the money transfer company announced it would be in the stores of retail giant Walmart WMT.

The tweet

The graph

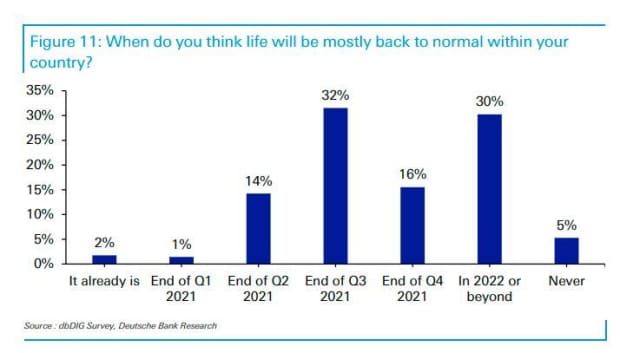

Also from the Deutsche Bank survey, there were some questions about COVID-19 vaccines and compounds. It later looks like life is expected to return to ‘normal’.

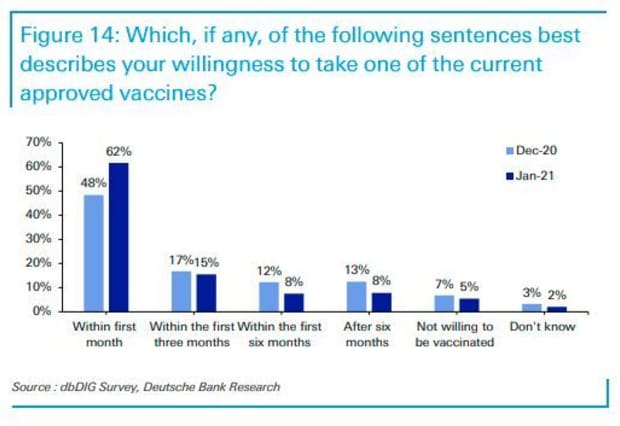

And when it comes to vaccine intake, it looks more like last month:

Random reading

Like in that Tom Hanks movie? A California man has made an airport his home for three months.

And at the moment, Redditors are raving about everything they love and miss about airports.

Need to Know starts early and is updated to the opening clock, but sign up here to have it delivered to your inbox once. The version by e-mail is sent in the Eastern direction at about 07:30.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning information for investors, including exclusive comments from Barron’s and MarketWatch authors.