Intel announced on Tuesday that it will spend $ 20 billion to build two new chip factories, called fabs, in Ocotillo, Arizona.

The announcement, which coincides with the first public remarks of the new CEO, Pat Gelsinger, since he took office, indicates that Intel will continue to focus on manufacturing during shifts in the industry, which has led to increasing competitors design separate slides and manufacture slides.

The news comes during a worldwide shortage of chips that are fueling industries from automobiles to electronics and that the US is lagging behind in the manufacture of semiconductors.

“Intel is and remains a leading developer of process technology, a major semiconductor manufacturer, and the leading supplier of silicon worldwide,” said Gelsinger.

Intel shares rose 5% on Tuesday with the news in extended trading.

Intel also said it would start acting as a ‘foundry’, or a manufacturing partner, for other chip companies that focus on semiconductor design but need a company to manufacture the chips. Intel has said its subsidiary is called Intel Foundry Services and will be led by Randhir Thakur, a current senior vice president of Intel.

Gelsinger said the foundry would compete by 2025 in a market worth potentially $ 100 billion. A slide show by Intel suggested that companies, including Amazon, Google, Microsoft and Qualcomm, could be customers for the business. Microsoft CEO Satya Nadella appeared at Gelsinger’s speech in evidence of support for Intel’s move.

Intel’s commitment to manufacturing holds national security. Intel has said it is partnering with IBM to improve chip logic and packaging technologies, which will improve the competitiveness of the U.S. semiconductor industry and support key U.S. government initiatives.

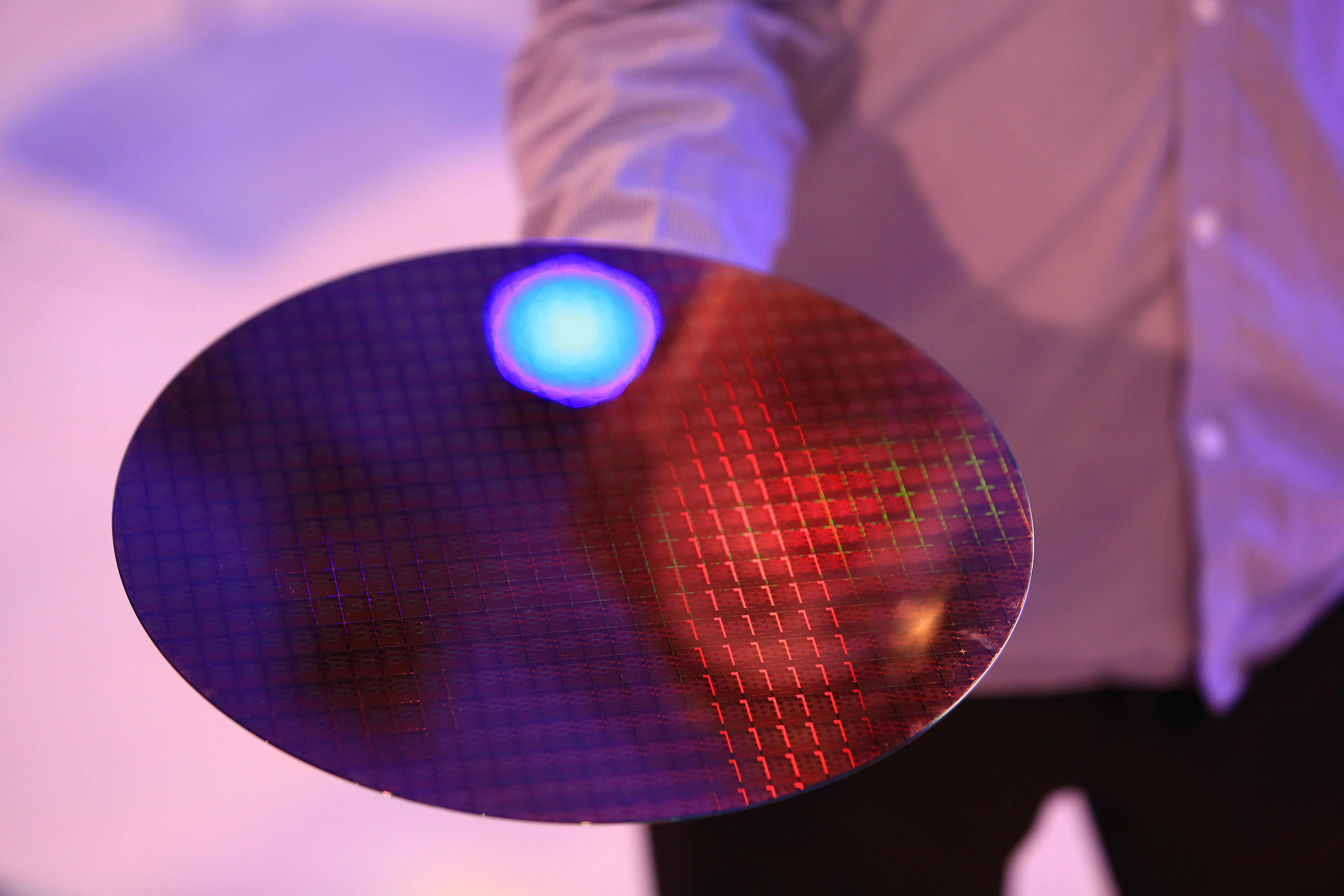

Intel currently operates four factories, called ‘wafer fabs’, in the United States. In addition to its Arizona site, which is expanding, it also has factories in Massachusetts, New Mexico and Oregon. It also makes chips in Ireland, Israel and has a single factory in China.

Intel’s foundry offers an American and Europe-based alternative to Asian chip factories.

In February, President Joe Biden said local semiconductor manufacturing was a priority for his administration. Its administration hopes to address the current shortage of chips and address the concerns of lawmakers as outsourcing chips has made the U.S. more vulnerable to supply chain disruptions.

In an executive action, Biden embarked on a 100-day review that could boost U.S. chip businesses with additional government support and new policies.

“Today’s executive order, combined with full funding for the CHIPS Act, can help level the playing field in the global semiconductor manufacturing leadership competition, enabling US companies to compete on an equal footing with foreign companies. to thing, “Intel said. the time in response to the executive order.

Gelsinger took over Intel from former CEO Bob Swan on February 15. Although recently CEO of VMWare, he began his career at Intel and his appointment was considered a homecoming.

He took over a business that faced various challenges. Intel has lost its semiconductor manufacturing to competitors in Asia, most notably TSMC. Intel’s most advanced chips use a process of 14 nanometers or a 10 nanometer. Intel designs both chips and then makes them in its own factories called fabs.

But competitors, including Intel customers like Apple and competitors like AMD, design the processor and then have it manufactured by an outside chip factory. These chip factories, such as TSMC and Samsung, use a more advanced 5-nanometer process, which is better because more transistors can fit in the same chip size, which increases power and efficiency.

Gelsinger said Tuesday that its 7-nanometer chips are on track to reach a milestone in the second quarter and that it plans to manufacture the majority of its products itself. Intel will continue to increase its use of third-party foundries, including TSMC, Samsung and GlobalFoundries.