Composer Andrew Lloyd Webber appeared on British television throughout the closing ceremony. From documentaries to competitions, Lloyd Webber has made the case that the devastated theater business needs to recover as COVID-19 restrictions are lifted.

It helps to get some Lloyd Webber for the call of the day. Rich Ross, a technical analyst at Evercore ISI, says the megacap technology stocks are poised to erupt. He calls the grouping FAAANTM (say it out loud – understand it?), Referring to Facebook FB,

GOOGL alphabet,

Amazon AMZN,

Apple AAPL,

Netflix NFLX,

Tesla TSLA,

and Microsoft MSFT,

“‘The Music of the Night’ has returned for Big Tech and ‘all I ask you’ is that you have an overweight big cap technology if it’s less loving and angry after months of consolidation with MSFT, GOOGL and FB, which all breaks out after all-time calculations, ”says Ross.

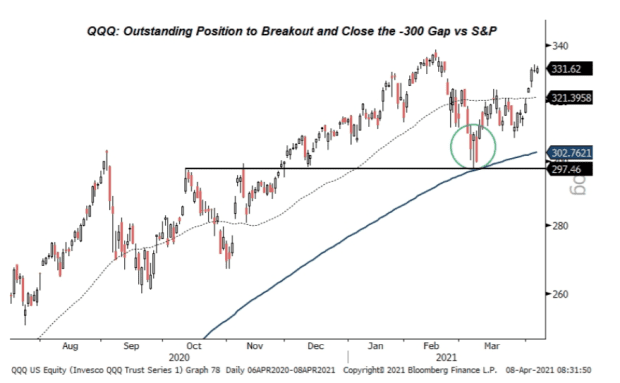

Seven months of consolidation and relative underperformance have lifted sentiment and positioning, and are set for what he says will be a spring boom. In conjunction with a double bottom technical formation in the dollar, trillions of dollars in liquidity, and a slow rise in interest rates and oil, he says the Nasdaq-100 QQQ,

exchange traded fund will close the underperformance against the S&P 500 SPX,

and reached 450 by year-end.

A megatech outbreak is not bad for the S&P, as it accounts for more than 21% of the index.

In addition to the FAANTM grouping – and he says Apple intends to rise from its base at the 200-day moving average, and that Amazon can reach $ 5,200 – it also highlights other technological stocks, including the maker of graphics chips Nvidia NVDA,

manufacturer of chip equipment Lam Research LRCX,

the manufacturer of communication chips Broadcom AVGO,

and Advanced Micro Devices AMD,

Adobe ADBE,

he adds, could come up to $ 750 “PDF” – a reference to the software format it popularized, which he said could also stand “fairly quickly” – after reaching the $ 500 level.

Inflation and current in the spotlight

Producer price data at 08:30 East may be important, given the focus on whether inflation will accelerate. China’s producer price index rose the highest in almost three years in March.

Sony SONY,

shares rose nearly 3% in Tokyo after Sony Pictures said it would stream movies exclusively on Netflix’s NFLX,

platform.

FuboTV FUBO,

shares can be active, as the sports steam service acquired the rights to the South American qualifiers before the Soccer World Cup.

Jeans manufacturer Levi Strauss LEVI,

increased its earnings and sales guidance and raised its dividend.

Household products manufacturer WD-40 WDFC,

may experience pressure after reporting worse-than-expected results, and the company notes supply chain constraints it is expected to resolve in the second half of its financial year.

Naked brand name, NAKD,

a clothing retailer popular with retailers could earn to the investment group Ault Global DPW,

announced that he had bought a 6.4% stake.

Prince Philip has died at the age of 99, Kensington Palace has announced. Here is a look back at his dramatic life.

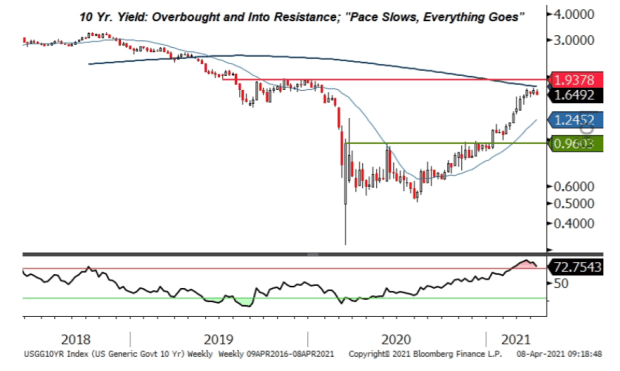

Yield rate higher

The yield on the standard ten-year treasury TMUBMUSD10Y,

increased to 1.67%. US futures contracts ES00,

NQ00,

saw little movement in the early morning hours.

Random reading

The worst drought in Taiwan in 56 years has led to a man recovering a phone he had dropped into a lake a year earlier. The phone is still working.

A software error resulted in a flight weighing approximately 1,200 kilograms (2646 pounds) heavier than expected, as all female passengers using the title ‘Miss’ were classified as children. The flight operator, Tui TUI,

was one of the heavily performing large-cap stocks in Europe after launching a € 350 million convertible.

Need to start starts early and is updated to the opening clock, but sign up here to have it delivered to your inbox once. The version by e-mail is sent in the Eastern direction at about 07:30.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning information for investors, including exclusive comments from Barron’s and MarketWatch authors.