See who’s back.

After a long absence, active individual investors returned with vengeance. And while that may literally be true to some extent in the GameStop Corp. GME,

the saga, the bigger questions for investors of all stripes are whether an apparent boom on the retail front will last and what it will mean for the stock market if the US benchmark index goes to all times.

It’s been a long time coming.

Equities saw the strongest bull market in history after the 2008 financial crisis “without any prominent retail stake in it”, Chris Konstantinos, chief investment strategist at RiverFront Investment Group, said in an interview.

He noted that the total flow of mutual funds since 2007 is almost $ 3 billion higher than the equity flow. In fact, individual investors appear to be in almost anything else, from real estate to cryptocurrencies, Konstantinos said.

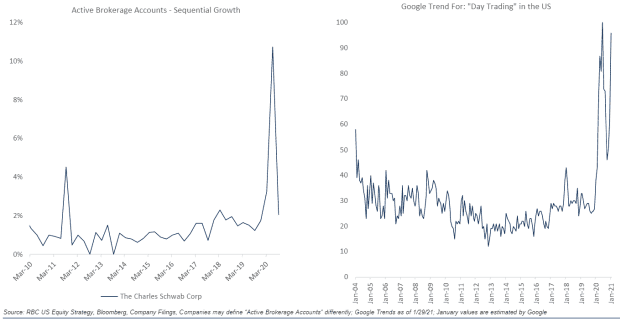

Last year, a shift began when the coronavirus pandemic took hold. Consecutive growth in accounts with brokers such as Charles Schwab Corp. SCHW,

‘was remarkable’ at the end of the second quarter of 2020 and followed by a large increase in growth in the following quarter, said Lori Calvasina, head of US equities strategy at RBC Capital Markets, in ‘ said in February. 2 note.

At the same time, Google’s search for ‘day trading’ is also increasing, she noted (see graphs below).

RBC Capital Markets

Calvasina and others acknowledged that a combination of boredom-related boredom and stimulus tests from the U.S. government likely played a role in the increase in individual investment interest.

The jury is out on whether the increase in retail interest will last, Ed Clissold, U.S. chief strategist at Ned Davis Research Group, said in an interview. It is unclear how much of the pickup in retail merely reflects individuals throwing extra money on the market via stimulus checks, he said.

That kind of trading feels more like gambling than investing, he said, pointing out that a frothy market action tends to disappear quickly.

But others have argued that individual investors are likely to stay.

‘Structural change’

Calvasina said RBC suspects that “structural change may be underway and that small investors are likely to remain bigger players in the US stock market in future.”

If this is the case, it will require an adjustment of attitude by Wall Street professionals, who have become accustomed to paying little attention to individual investors.

After all, powerful waves of passive and systematic investments have made individual investors largely irrelevant to analysts building up market forecasts, strategists at Société Générale wrote in a Thursday note.

But the volatility in the market caused by the GameStop situation has served as a wake-up call, analysts say.

While GameStop and other strongly abbreviated names have skyrocketed, hedge funds and other investors have been seen liquidating long positions elsewhere to make a profit and cover losses, putting pressure on stock markets. The key benchmarks end January on a sour note, with the Dow Jones Industrial Average DJIA,

S&P 500 SPX,

and Nasdaq Composite COMP,

with their biggest weekly declines since October.

See: ‘My family does not make me hungry’: two young traders reveal the dangers of trying to navigate the epic wave of GameStop

U.S. stocks have been booming again over the past week, with the benchmarks that have reached all-time highs when GameStop tumbled more than 80%.

Must know: GameStop’s meteoric gains have almost completely disappeared – here’s advice for those who did not come out in time

SocGen analysts see the phenomenon as part of a broader trend in which individual investors consider the demand for investments in terms of environmental, social and corporate governance standards or ESG.

“Instead of criticizing small investors and their behavior patterns, it is better to put them in the money equation,” they wrote. “After all, it’s not just office workers who are locked up at home on snowy days, but also very active day traders with access to cheap platforms.”

Cabin fever is hardly the only factor driving the renewed interest in the market by individual investors, whose ranks do not only consist of fast day traders.

Leveling the field

Some individual investors who have previously given up on stocks may eventually succumb to the idea that ultralow returns on bonds and elsewhere offer little alternative to the stock market. Equities still look attractive in terms of dividend or earnings returns, Konstantinos said.

In addition, over the past few decades, there has been an equalization of the playing field between institutional and individual investors. Regulation FD (for ‘full disclosure’) and other amendments by the regulations, as well as the rise of low-fee trading platforms, have put individual investors in a higher position than institutional investors than ever before, ”he said.

Indeed, some market viewers have argued that the conventional brand of individual investors as ‘stupid money’ still looks misleading, especially after the GameStop episode apparently shows ‘smart money’ investors shorting more than 100% of the company’s stock and opening them wide late. to a painful short pressure.

The frenzy in retail that has surrounded the short-term pressure on GameStop and a handful of other heavily shortened small-cap stocks have raised a red flag for investors on the lookout for the kind of foam that indicates a rally is entering the euphoric phase follow what is usually followed. by a setback.

Next leg?

While this may be the case in the short term, some investors claim that a sustained increase in active individual investment interests could help the next leg of a bull market.

Konstantinos says individual investors can still leverage interest in more value-oriented, smaller capitalization and higher volatility.

And continued interest in individual bonds could mean more ‘distribution’ or variation in returns between individual stocks and sectors, Clissold said – an element that has been lacking over the past decade to the pain of active fund managers.

Calvasina argued that retail interest in specific stocks is likely to decline, as in the past year, but is unlikely to disappear.

“Unless the door closes (ie due to a major change in regulation), we can not see why the interest of retail investors in the trading of specific names will go completely, given how much cash is on the sidelines among consumers,” he said. she wrote.