Inditex closed the 2020 ownership, the most complicated that it has found in its history, with a net profit of 1,106 million euros, which represents a 70% reduction. respect the previous year’s figures. A year marked by the pandemic, by the trend of tithes and the restrictions of schedules, and by a mayor demanding the channel online. All constituents mentioned in the results statement of the Galilee textile group, however, have considered the positive result. This is it, this is it more since the owner 2006. The actions of the company will increase by up to 1% at the beginning of the bursal session, moderating the recession to the media session and including increasing ligation.

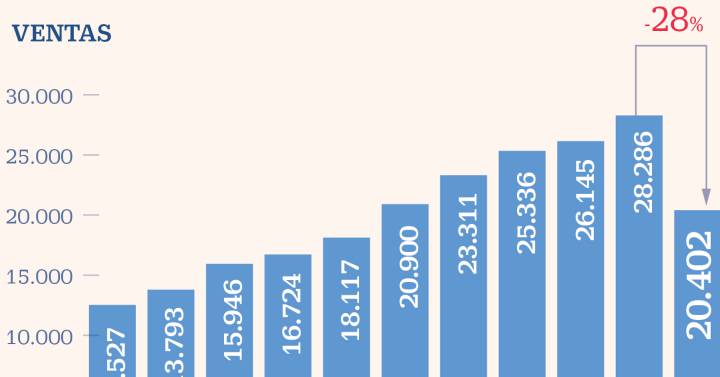

2020 will move to the history of the company by being the first in which its entrances will be reduced with respect to the previous year. Inditex invoice 20,402 million, and 28% menus, with the last of the first year of the year and a quarter quarter in which the recovery of the sales from a passing step. If, on the other hand, the debt has been reduced by 13.5%, at the end of the year, when Volvieron accentuates the restrictions, the 25% reduction will be charged to 6,317 million. The profit in this period was 435 million, a 53% menu. Following the company, on the 31st of this year, finalization of its tax assessment, holds 30% of its physical tens totally closed, according to the conclusion of the third quarter, this percentage was 8%. In addition to this, the sales hours will be reduced by 25.5% and the 100% of their rent will be reduced at some point in the year following the restrictions. January 31 its red of tens was 6,829 units, 640 menus that are not ante.

Anything that can be compensated in part for the crime of the venta online. It is now 77% worth 6,612 million euros, representing 32.4% of total sales, which has surpassed the market target of this channel surpassing 25% of billing in 2022. 2019 ese percentage era of 14%. The group also offers a 50% increase in visits to its virtual sites.

‘Inditex sells more fast of this year is difficult “, said the executive president Pablo Isla in the results. “The digital transformation strategy launched on the market in 2012 under the integrated and online platform has been demonstrated to be the right one”, added, concluding that Inditex is a more solid company that has two years, with a unique business model and a flexible and efficient global commercial platform, which puts us in an excellent position in the future ”.

Payment dividend

What elevates the textile is the dividend. Inditex wants to dedicate 60% of its shareholder benefit to its shareholder policy and will pay 0.70 cents per share with cargo by 2020. It is twice as much as the share paid in the past, when the dividend has been paid the vernacular union of vertebrates precedes the coronavirus infestation. In this case there is an ordinary dividend of 0.22 euros and another extraordinary of 0.48 euros, which are subscribed to equal payouts of 0.35 euros in May and November.

Without embarrassment, the payment of 0.30 euros, which remains for the dividend of 1 euro compromised for the years 2019, 2020 and 2021 to 2022, was announced.

Respecting other financial variables, Inditex closed the year with a gross margin of 11,390 million, or 55.8% on sales, a lower figure than in the previous year, and with a shareholding of 41% up to 4,552 million .

All indications are, however, that the figure for sales and benefits is due to the bloody forecast of Bloomberg in the last few days, which calculates a net result of between 1,300 and 1,400 million euros for the owner of the property, and a total increase for the 2020 ownership of around 21,000 million. According to analysts’ calculations, Inditex will not reach the 28,292 million invoices in 2019 up to 2023.

Home of the year

In addition to the balance sheet 2020, Inditex also issued the first slips regarding the initiation in February of its acquisition in 2021. Explain that the first collection will be “he is very well received by our customers”, and during the last one a media of 21 % of their tents are permanently locked. On March 8, this percentage increased to 15%.

The sale on auction and online in the first week of this month a 4% cash register. Excluding the top five markets with the majority of closed tenders, Germany, Brazil, Greece, Portugal and the United Kingdom, the sale increased by 2%, according to the company. Inditex calculates that on April 12, “practically” 100% of its stocks will be lowered.