The marijuana business is rightly described as a new industry. But what investors see as a potential promised land may go beyond what many people expect because federal legalization can take a long time.

The unfolding legalization of marijuana in U.S. states makes it a complex and potentially lucrative space for investors. Most marijuana ETFs are passively managed, which means they follow indices.

The following discussion points to an advantage for active managers of exchange traded funds that can adjust strategies as the legal landscape changes.

Meanwhile, investors need to think better about their focus on Canadian cannabis companies, some of which could be cut from much of the industry action. The devil is in the details.

For a wide coverage of the dynamic marijuana industry, see Cannabis Watch.

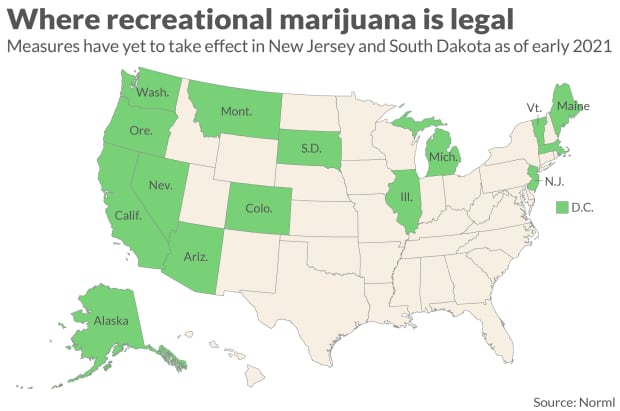

Marijuana is legalized for recreational use in 15 U.S. states and Washington, DC However, it remains illegal at the federal level. This led to a bizarre scenario.

The Canadian licensed producers (known as MPs) do not sell cannabis products in the US because it is against US law. But the top five stocks are listed on the Nasdaq Stock Exchange or the New York Stock Exchange:

Do not miss: To take advantage of the planned merger of Tilray and Aphria, buy Aphria, says the analyst

Meanwhile, the four largest U.S. companies selling marijuana products are in states (and Washington DC) where recreational use is legal is not listed on U.S. wallets because they engage in activities that are technically illegal at the federal level. They are listed without a counter. These companies are known as multistate operators (MSOs):

In a August 2013 memorandum to U.S. attorneys, now known as the “Cole Memo,” James Cole, then deputy attorney general, described the Justice Department’s position as relying on states that legalized marijuana for recreational use. to set up. schemes to ensure that the eight DOJ objectives set out on the first and second pages of the document are met.

Since then, the federal government has not tried to arrest people in those countries for purchasing small quantities of marijuana to use recreationally.

However, under the Investment Companies Act of 1940, mutual funds and exchange traded funds may still not own shares of the MSOs.

AdvisorShares was able to circumvent this problem by acquiring MSO shares for total returns in the AdvisorShares Pure Cannabis ETF YOLO,

and the AdvisorShares Pure US Cannabis ETF MSOS,

The Securities and Exchange Commission has required AdvisorShares to obtain an external legal opinion on the total return, which you can read on the AdvisorShares website. You should also read the prospectuses for YOLO and MSOS if you are considering investing in it to learn more about their investment methodologies and risks, just as you should read the prospectus for any other investment fund or ETF you are considering.

Dan Ahrens, the portfolio manager of YOLO and MSOS, said in an interview on February 12 that he does not expect Canadian LPs to sell marijuana in the US for the “foreseeable future” because “not the Democratic-controlled Congress President Biden also never called for the federal legalization of marijuana. “

This is where the arguments begin.

It is easy for a politician to say that he or she wants marijuana to be decriminalized in small quantities for recreation. But it is not full legalization, which not only allows the use of marijuana throughout the United States at leisure, but also allows banks to provide full services to marijuana producers and distributors in the United States, and to have their shares listed on public wallets.

Full legalization is also likely to open up the U.S. market for Canadian LPs.

Ahrens therefore expects the legalization to continue from state to state, with MSOs the biggest beneficiaries. He believes that the Canadian LPs are also worth investing in, which is why YOLO shares like it. Canopy Growth Corp is 38.6% owned by Constellation Brands Inc. STZ,

the brewery of Corona and Modelo beer, which has many other well-known consumer brands and holds guarantees so that it can take a majority stake in Canopy.

This gives Canopy deep pockets – the company has an agreement with Acreage Holdings Inc., ACRHF,

another U.S. MSO, through which Canopy Acreage Holdings would acquire in the event of ‘changes in U.S. federal law to permit the general cultivation, distribution and possession of marijuana or to regulate such activities from United States federal laws To remove states. ‘ The language comes from page 9 of Canopy’s 10k report for the financial year that ended on 31 March 2020.

MSOs already have a bigger business

Here is a comparison of the last four quarters’ sales data for the five MPs and four MSOs. The companies’ fiscal quarters are not uniform, so the date of the latest quarter’s data available on FactSet on February 18 is in the column on the right.

The most recent quarter is Q0, the previous quarter Q-1, and so on. All the data in all the tables is in millions of US dollars.

First, the Canadian LPs:

Scroll through the table to see all the data. The five LPs had a combined sales of $ 1.284 billion for four quarters, which was 24% higher than the previous four quarters. If we divide the combined market capitalization of $ 33.785 billion through sales over the past four quarters, the price-to-sales ratio for the group is 26.3.

And now the US MSOs:

You need to scroll through the table again to see all the data. The five MSOs sold $ 1.715 billion together for four quarters, an increase of 163% from the previous four quarters. If we divide the combined market capitalization of $ 21.862 billion through sales over the past four quarters, the price-to-sales ratio for the MSO group is 12.7

The MSOs therefore grow much faster and have a much lower valuation for sales.

Perhaps the valuation difference should not be such a surprise. The MSOs are traded over the counter only. Individual investors should therefore go out of their way to invest in it, or go with the YOLO or MSOS ETFs.

Here is another set of data that this time compares the net cash from operating activities for the two groups.

First, the Canadian LPs:

Although Tilray reported its 17th quarter results on February 17, the cash flow information above is only until September 30. This is because the February 17 report does not contain a cash flow statement.

According to FactSet data, the LPs as a group had negative cash flow from operations for all periods.

And now the US MSOs:

The MSOs as a group had positive cash flow from operations for three of the four quarters and for the combined four quarters.

A teen argument

YOLO and MSOS are actively managed. The only other actively managed Cannabis ETF is the Amplify Seymour Cannabis ETF CNBS,

You can read more about CNBS here.

During an interview on February 17, Tim Seymour, the portfolio manager at CNBS, said AdvisorShares has done a great job building a business where they have the ability to invest in companies I want to own. ‘

He also said that Amplify followed a “more conservative approach” when it established CNBS in July 2019 because the SEC did not make a broad statement about allowing mutual funds or ETFs to be included in MSO’s total return. do not exchange.

In addition to managing CNBS, Seymour is on the investment committee of JW Asset Management, a $ 2 billion hedge fund focused on the cannabis industry.

“I invest in companies that I think are representative of the best exposure to investors for the best returns at the moment,” Seymour said. He also stressed the importance of active management in space.

He agrees with Ahrens on the importance of the U.S. market, especially if and when Congress fully legalizes marijuana and enables financial services companies to treat the industry as with any other legal industry.

Canopy Growth Corp. is the bulk of CNBS and Seymour cited the Acreage Holdings agreement as an example of how a very well-funded Canadian MP can be instantly transformed into a major U.S. player with full legalization.

During an interview on February 16, Christian Magoon, CEO of Amplify ETFs, said CNBS was the best ETF in the United States during 2021 to February 15, excluding reverse and leveraged ETFs. He also said the firm was “actively investigating the possibility of CNBS investing in derivatives”.

It is therefore possible that at some point CNBS will also make indirect investments in the MSOs.

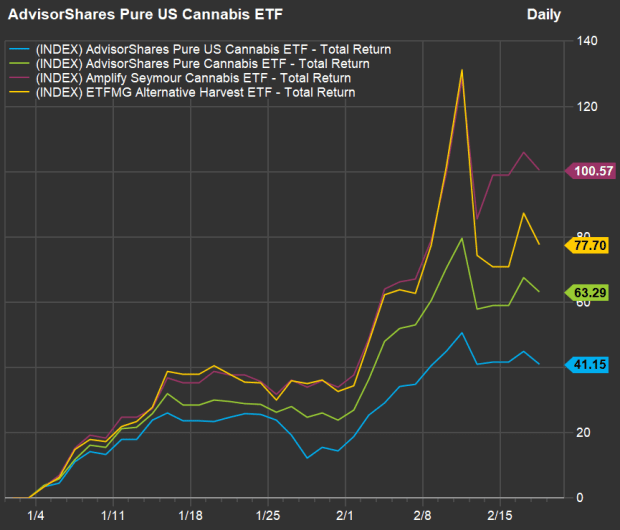

Proceeds from cannabis ETFs are actively managed

Here is a comparison of the total returns for the three actively managed ETFs, as well as the ETFMG Alternative Harvest ETF MJ,

which is passively managed and is the oldest ETF for cannabis.

(Fact sheet)

Everyone has made dramatic upward movements this year, but you can see that CNBS has doubled, followed by MJ and the two AdvisorShares ETFs.

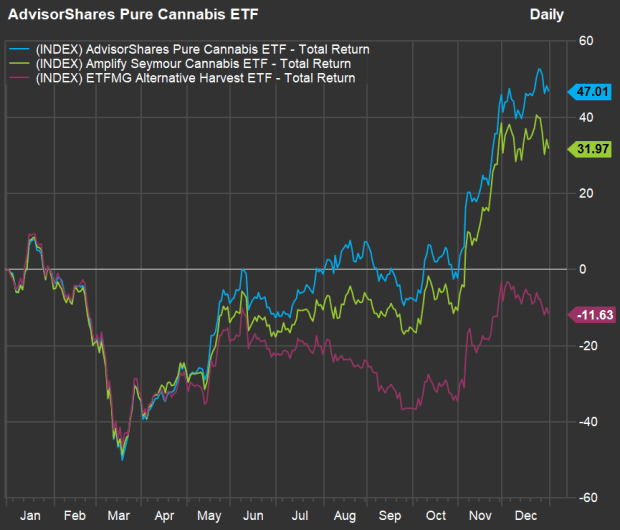

The AdvisorShares Pure US Cannabis ETF (MSOS) was established in September 2020. This following chart compares the total returns for the other three ETFs during 2020:

(Fact sheet)

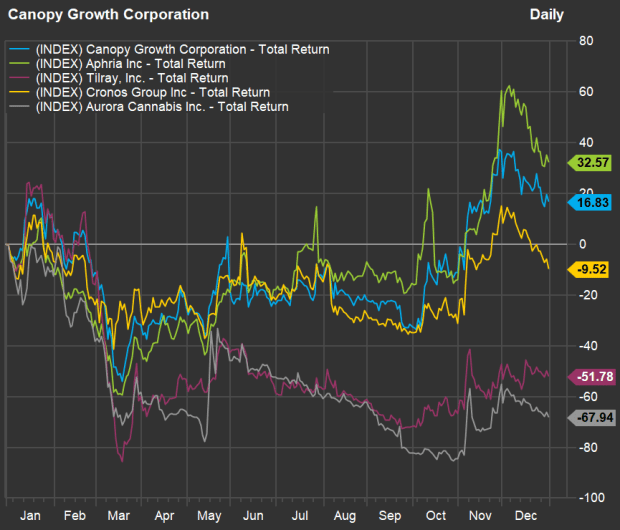

YOLO, which owns MSOs as well as MPs, was thus the best performer last year, while MJ’s passive approach underperformed. YOLO and CNBS both achieved significant returns, although all five MPs were mixed, with brutal declines for Tilray and Aurora Cannabis shares:

(Fact sheet)

Do not miss: I’m looking for a cannabis-friendly red lean state without government revenue – where should I retire at $ 60,000 a year?