(Bloomberg) – Six months after the Trump administration inflicted a crushing blow on Huawei Technologies Co.’s smartphone business, the Chinese telecommunications giant is turning to less glamorous alternatives that could eventually offset the decline in its biggest revenue contributor.

One of its newest customers is a fish farm in eastern China that is twice the size of Central Park in New York. The farm is covered with tens of thousands of solar panels equipped with Huawei’s inverters to protect the fish from excessive sunlight while generating power. About 370 miles to the west in Shanxi Province with coal, wireless sensors and cameras deep under the earth monitor oxygen levels and possible machine functions in mine wells – all powered by technological titanium. And next month, a shiny new electric car with its lidar sensor will launch at China’s biggest car show.

The Chinese corporation, once the world’s largest smartphone maker, has seen a series of US sanctions nearly wipe out its lucrative consumer business. As the Biden government continued to put pressure on Huawei, billionaire founder Ren Zhengfei instructed the company to expand its corporate customer base in transportation, manufacturing, agriculture and other industries. Huawei is the world’s leading provider of converters and is now trying to increase sales, along with its cloud services and data analytics solutions to help its 190,000 employees survive.

“It’s very unlikely that the US will remove us from the entity list,” Ren said last month during the opening of a mining innovation laboratory, partly sponsored by Huawei. “Right now we just want to work harder and keep looking for new opportunities to survive.”

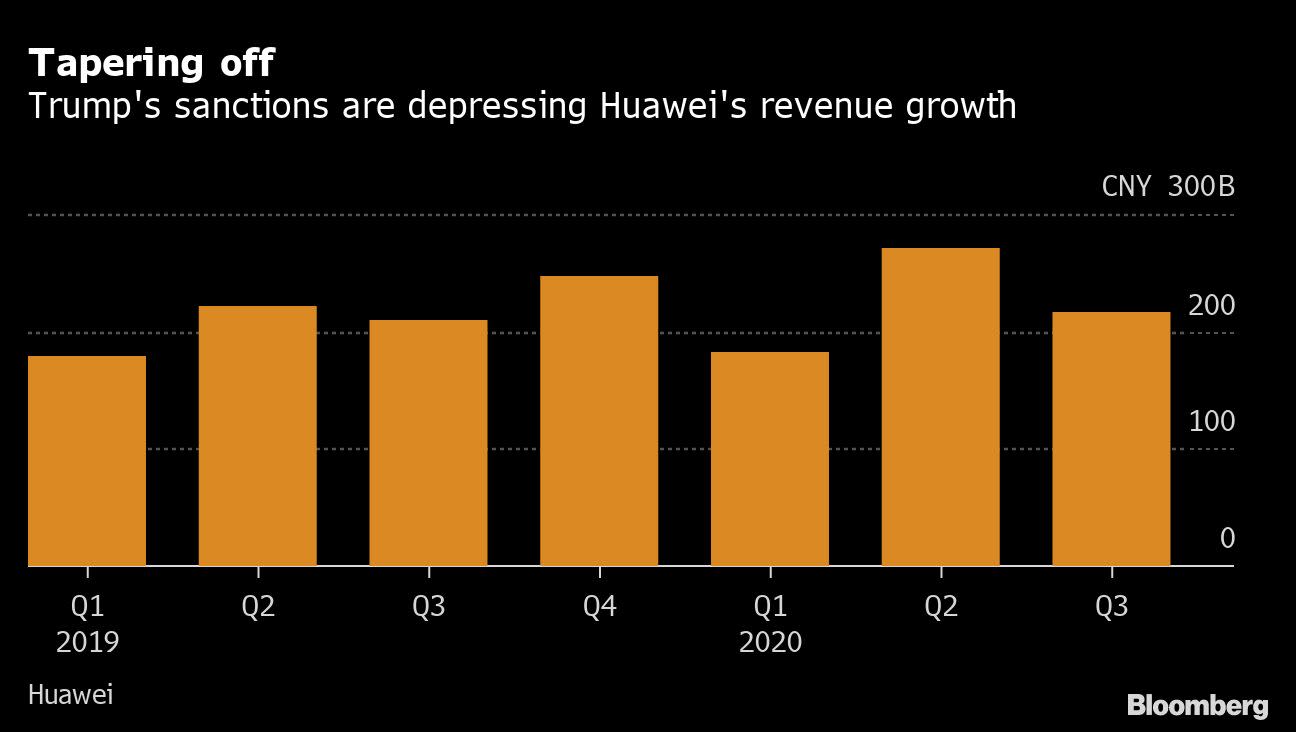

Ren said the new initiatives could offset the decline in its handset operations “more or less within this year”, although the company did not want to provide specific figures. Its consumer unit generated revenue of 256 billion yuan ($ 39 billion) in the first six months of 2020, more than half of the company’s total. It achieved ‘marginal growth’ in sales and profit last year, thanks to 5G base station orders and strong smartphone sales in the first half.

Huawei has been exploring business opportunities outside of telecommunications devices and smartphones for years, but efforts are gaining new urgency after phone shipments tumbled 42% in the last three months of 2020, largely due to a Trump-era order that shifts its ability to the most advanced semiconductors.

The Biden Administration has notified some vendors of stricter conditions on previously approved export licenses, according to those familiar with the use of items in or with 5G devices. On Friday, the US Federal Communications Commission also included Huawei in a list of companies whose telecommunications and video equipment “poses an unacceptable risk to national security”.

Read more: How Huawei ended up at the center of Global Tech Tussle: QuickTake

According to the person directly involved in the initiative, the US ban has a limited impact on Huawei’s emerging businesses, as the necessary components are available from Chinese suppliers. To meet the growing demand from contractors, including Huawei, local suppliers are pushing for better performance due to mature technologies that Washington has not banned, the person said, refusing to be identified to discuss internal matters.

The most advanced chips in Huawei’s converters, which are used to convert the electrical output of solar panels, rely on 28-nanometer technology, which Chinese companies can manufacture. Other components, such as power modules, can be manufactured with 90 nm technology or older. Yangzhou Yangjie Electronic Technology Co. and China Resources Microelectronics Ltd. is one of the leading producers of diode in China.

Each converter – slightly larger than an outdoor unit from a central air conditioner – can sell for more than 20,000 yuan, more than Huawei’s latest high-end Mate X2 folding phone. The company plans to expand more of its photovoltaic converters, as Beijing’s pressure to have carbon emissions in the world’s second largest economy peak by 2030 will result in investments in renewable energy.

Like the solar converter, the chips needed for Huawei’s automotive systems are less sophisticated than mobile phone processors and can be obtained in part from European suppliers, according to one person familiar with the matter. This allows Huawei to double the automotive industry, and move engineers from other business units to work on sensors for self-driving cars and power units for electric vehicles.

While the company denies that it intends to launch motor vehicles under its own brand, Huawei has worked with several manufacturers to test the autonomous technologies for driving and driving cars. Its entertainment features can be found in Mercedes-Benz sedans, and the firm has partnered with domestic car manufacturers such as BAIC BluePark New Energy Technology Co. to develop smart car systems. The first model under its partnership with Chinese EV manufacturer, the Arcfox αS HBT, will be unveiled at Auto Shanghai 2021 in April.

Another initiative called 5GtoB involves Huawei using 5G technology in areas ranging from healthcare to aircraft manufacturing. The company helped China build the largest 5G network in the world, delivering more than half of the 720,000 base stations nationwide. Now it’s trying to help the country’s 5G connectivity help companies affected by pandemics automate factory lines – to meet fellow technology needs like Xiaomi Corp. and Alibaba Group Holding Ltd to modernize manufacturing – and thus digitize labor-intensive industries, such as mining.

According to rotating chairman Ken Hu, Huawei has signed more than 1,000 5GtoB transactions in more than 20 sectors with the help of telecommunications servers and partners. Online education, entertainment and transportation is one of the sectors he plans to explore, he said. In January, the firm gave smartphone tsar Richard Yu a new role to take care of its fast-growing cloud and AI businesses.

“The acceptance of 5G in mining, medical services and manufacturing is becoming clearer and some of the applications are being used nationwide,” Liu Liehong, Deputy Minister of Industry and Information Technology, said at an industry event in Shanghai last month.

Ren personally leads the expansion to mining, meets with local officials and explores coal wells in Shanxi Province. “Most information technology companies did not think of mining as an area where they could make market breakthroughs, but we did,” the billionaire told reporters last month. ‘China has about 5,300 coal mines and 2,700 ore mines. If we can serve these 8,000 plus mines well, we can expand our services to mines outside China. ”

Read more: China’s coal industry fights for survival in a greener world

While Huawei’s bet that converters, electronic mining solutions and smart car software could compensate for the decline in smartphones, its long-term future – and its ability to continue to drive China’s 5G implementation – remain bleak. The HiSilicon subsidiary was the country’s most capable disk drive designer, making the best processors to power the company’s smartphones and wireless base stations, before Washington gained access to the latest software design software and contract manufacturers such as Taiwan Semiconductor Manufacturing Co.

For now, the company has told its wireless customers that they have enough communication chips to support base station constructions by 2021. But it is unclear how long the shares could last, and what options Huawei has once the stock is finally depleted. Wireless operators have been cautious about their 5G expansion and there is “a lot of uncertainty” as to whether Huawei will be able to continue delivering equipment in the longer term, Jefferies analyst Edison Lee wrote in a note earlier this month.

“The ongoing political friction has overshadowed the business operations of Huawei and other Chinese companies in the foreseeable future, and strategic investment in emerging technology is key to Huawei’s sustainable growth,” said Charlie Dai, chief analyst at Forrester Research Inc.

(Updates with FCC designation in the seventh paragraph, analyst comments in the last paragraph)

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP