It has become harder for Wall Street to see US Treasury yields climb without feeling a little uneasy.

After all, the Federal Reserve made cheap and plentiful credit an important part of its pandemic response, with the result that large U.S. corporations borrowed a record amount of debt last year at low rates to bolster their balance sheets during the crisis.

Low rates also helped set a record $ 4.3 billion in US home loans in 2020, with the year’s refinancing peaking at $ 2.8 billion as homeowners sought a break in their mortgage payments, according to a new Black Knight report.

And because COVID-19 vaccinations have accelerated under the Biden administration, it may come as no surprise that borrowing costs in both corporate debt and the U.S. housing market have become a little more expensive this year as Treasury long-term yields rise higher. .

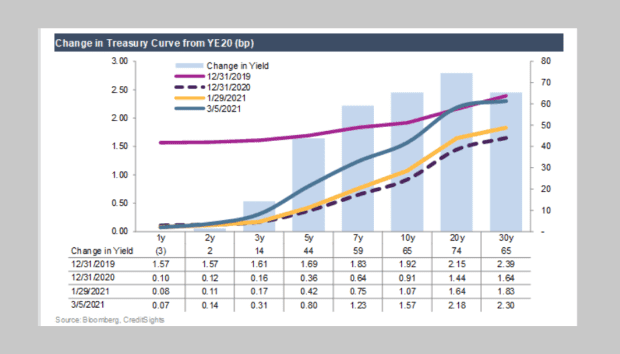

This CreditSights chart shows the 30-year treasury return TMUBMUSD30Y,

has risen by about 65 basis points to about 2.3% so far this year. This almost corresponds to the level from 31 December 2019, or before the first COVID-19 cases were detected in the USA

Treasury yields climb.

CreditSights, Bloomberg

Yields on the 10-year treasury note TMUBMUSD10Y,

was about 68 basis points higher on Monday, up 1.594%, according to Dow Jones Market Data.

According to a CreditSights team led by senior analyst Erin Lyons, it is still below the 1.92% level before the pandemic’s yield of ten years, which probably means the standard effect could rise even further.

Rising government bond yields have already been reflected in the rise in the 30-year fixed interest rate bond, which averaged 3.02% last week, a level not seen since July.

Read: Mortgage rates rise above 3% – how high can it be before they scare off home buyers?

Companies also rushed to borrow in the corporate bond market to reach possibly higher rates, with the yield of the ICE BofA US corporate index with the last check up to around 2.2%, compared to a recent low of 1.79% in January.

Bank of America Corp.. BAC,

According to the person who is aware of the transaction, he borrowed $ 5.5 billion in the corporate bond investment market on Monday, with his longest debt drive of 30 years.

But rising yields also caused a stock market rally, which helped the technological Nasdaq Composite Index COMP.

Monday in the correction area, as defined by a drop of at least 10%, but less than 20%, from the recent high.

The Dow Jones Industrial Average DJIA,

ended Monday about 300 points higher, but only 32,000, but investors are weighing the potential impact of an aggressive $ 1.9 billion stimulus package from Congress on consumer habits – and inflation – as the recovery gains steam.

So how high can the treasury returns be? “Given the current inflation expectation of the bond market of 2.25% (ie the 10-year break-even rate), there is still enough room for returns to climb,” James Paulsen, chief investment strategist at The Leuthold Group, wrote in a note on Monday. . .

“Our guess is that the yield for ten years will increase by 2% this year, but who really knows?”

Analysts point out that much will depend on whether the Fed is forced to pursue its easy monetary policy to combat persistent and persistent inflation outside its targets, perhaps by raising standard rates to the current level of 0% to 0.25%. sooner than expected, or by reducing the $ 120 billion-a-month sales program, which could drain liquidity from the financial markets.

“I think it is likely that the Fed will act if yields on the ten-year US Treasury rise rapidly from here and create disorderly markets,” Kristina Hooper, Invesco’s world market strategist, wrote in a letter on Monday.

However, Hooper also does not expect inflation to become ‘problematic’, namely due to the significant weakening in the labor market due to the pandemic, as well as long-term structural forces, including technological innovations, which are putting downward pressure on inflation.

Read next: Housing is a luxury? Here’s what the K-shaped real estate recovery means