A new month is starting strong, or so it seems, as stock futures rise to Friday’s better-than-expected 916,000 gain in March, supporting the investor for a strong rebound after COVID-19.

As for the data, there is a lot to like, according to Tim Duy, chief U.S. economist at SGH Macro Advisors.

‘I assume that the pandemic will only get more under control this year, and I suspect a significant obstacle limiting the pace of job growth this year is the pace at which businesses can hire employees. Dismissal is easier than hiring and employers are now scrambling to add workers, ”Duy said in a note to customers.

So look at the stories about the “we can not hire workers”, he says.

On us call of the day of Fundstrat Global Advisors, founder Thomas Lee, who says the recent face-ripper march shows no signs of easing. And there is a $ 4.5 billion reason to believe that the profits will last in April, he told customers.

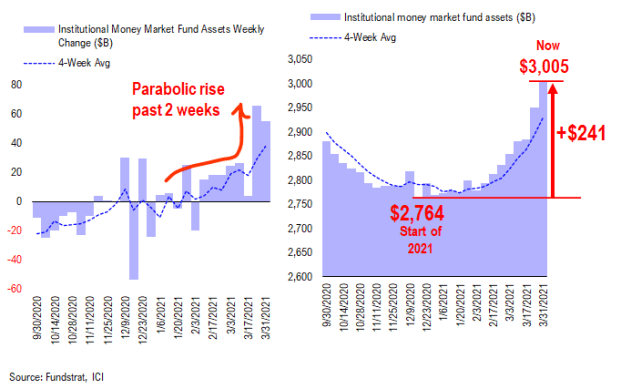

Aside from the positive results for this market – a strong economy and vaccine explosion – Lee points to a pile of institutional money on the sidelines, with a cash balance of $ 3 trillion, the highest since June 2020. It is at $ 2,764 trillion at the beginning. of 2021, a “dramatic” profit of 9% or $ 241 billion, Lee said.

A cautious attitude of institutions that became ‘parabolic’ in the latter half of March contributes to the $ 1.5 trillion in cash in the retail money market.

‘The total cash on the sidelines is $ 4.5 billion = tons and tons of firepower along the sidelines. It offers good benefits for the shares in April, ”Lee said.

Lee expects small business, energy and cyclical equities – aimed at an economic recovery – to continue in the second quarter.

‘Remember that cyclics are only 33% of the S&P 500 SPX,

total weight and more than 60% of the Russell 2000 Index RUT,

If Cyclicals, or Epicenter, works, small-cap stocks will perform better, ”he said.

Look at this graph

Adam Kobeissi, founder and editor-in-chief of The Kobeissi Letter, expects the bullish postal report to send the S&P 500 down to 4,035 to 4,050 in the short term, but from there he wants to see it retreat to 3,950 to 4,000. up for another higher low before moving to 4,100.

The Kobeissi letter

‘Therefore, we remain on the sidelines to start this week, as this is not an attitude we want to take in front of a market, and we will maintain a bullish medium-term outlook with the aim of getting back into our positive positions. to come. in the wake of a decline in the market, “Kobeissi told subscribers.

On the way to the open Dow Dow Industrial YM00,

futures increases by 200 points and S&P 500 ES00,

and Nasdaq-100 futures NQ00,

increased by 0.5% and 0.4% respectively. European markets were closed for a long Easter holiday, and most of Asia was also closed. The return on the ten years TMUBMUSD10Y,

‘s note was stable at 1.72%. The information available includes the March Services Index of the Institute of Supply Management and Factory Orders in February.

Oil prices CL00,

move to the decision of the Organization of the Petroleum Exporting Countries and Allies last week to increase production, and after Saudi Arabia reportedly increased prices for Asian customers.

Shares of electric car maker Tesla TSLA,

increases by 6% in pre-marketing. Tesla said Friday that deliveries in the first quarter totaled 185,000 cars, surpassing Wall Street’s forecasts. Wedbush upgraded Tesla to perform better than neutral and set a new $ 1,000 price target from $ 950.

GameStop GME,

The stock fell 10% after the game trader and one of the year’s popular stock shares said it would sell up to 3.5 million ordinary shares.

South Korean electronics giant LG 066570,

leaving the smartphone market.

Delta Luglyne DAL,

had to cancel 100 flights on Sunday due to staff shortages, and will open the middle seats earlier than expected.

The British government plans to offer two free virus tests a week to everyone in the country. Stocks in India IN: 1 tumbled 2% as daily COVID-19 cases hit 100,000, the second country to see the number of cases after the US

A Bitcoin revolution is underway and MarketWatch is gathering a group of crypto experts to explain what it all means. Sign up! Bitcoin BTCUSD,

in that regard, hold on to $ 57,422

Random reading

Redditors use trends we hate

TV version of the Soviet era of ‘Lord of the Rings’, rediscovered after 30 years: ‘Lord of the Rings’.

Need to start starting early and being updated to the opening clock, but sign up here to have it delivered to your inbox once. The version by e-mail is sent in the Eastern direction at about 07:30.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning information session for investors, including exclusive commentary from Barron’s and MarketWatch authors.