Rising Treasury yields have contributed to a sell-off due to the stock market’s pandemic, but according to one analyst, it will probably not be enough to spoil the attractiveness of equities over bonds in 2021.

U.S. equity investors ‘have been focused over the past week on the recent increase in ten-year treasury yields, which is all the way back to mid-February 2020 levels,’ wrote Lori Calvasina, head of U.S. equities strategy at RBC Capital Markets. in a Tuesday letter. Yields and bond prices have an inverse relationship.

The ten-year treasury return TMUBMUSD10Y,

comes from its biggest rise in six weeks, blaming it for a downturn led by technology stocks that benefited most from the stay-at-home dynamics created by the COVID-19 pandemic.

Related: Can the bull market in stock survive rising inflation and bond yields? Here’s what history says

The ratio was reversed on Tuesday, as the rise in yields yielded to the testimony of Federal Reserve Chairman Jerome Powell, who enabled major measures to wipe out or reduce significant losses. The technically heavy Nasdaq Composite COMP,

which led lower, caused a loss of almost 4% to decrease to 0.5% as yields decreased; the S&P 500 SPX,

gained a profit to lose a loss of five days, while the more cyclically oriented Dow Jones Industrial Average DJIA,

erased a loss of more than 360 points to end slightly higher.

Meanwhile, Calvasina said a look at what stocks offer in terms of dividend and earnings returns relative to bonds, as well as a reminder of what kind of bond movements made the stocks difficult, offers some reassurance that 2021 is unlikely to a lower year, she said.

Dividend yield

In terms of dividend yields, RBC measured the percentage of companies that still exceed the ten-year treasury yield. While it dropped to 51.5% from 64% at the beginning of the year, it is still within a range usually followed by a 17% increase for the S&P 500 over the next 12 months, she said. .

Earnings return

The earnings yield of the S&P 500 has also weakened and has been moving to the lower end of the range since the end of the financial crisis. It now stands close to the level seen in 2017-18, but remains within a range followed by the average 9.3% rise by the S&P 500 over the next 12 months, Calvasina said.

“In other words, this analysis provides evidence that the S&P 500 has been withdrawn in the short term, but does not necessarily indicate that investors should go into retirement in the long term,” she wrote.

Calvasina also highlighted a ‘significant difference’ between 2018, when the trade war posed a threat to the US and the world economy, and now, when the forecast of gross domestic product is rising rapidly.

Treasury returns and shares

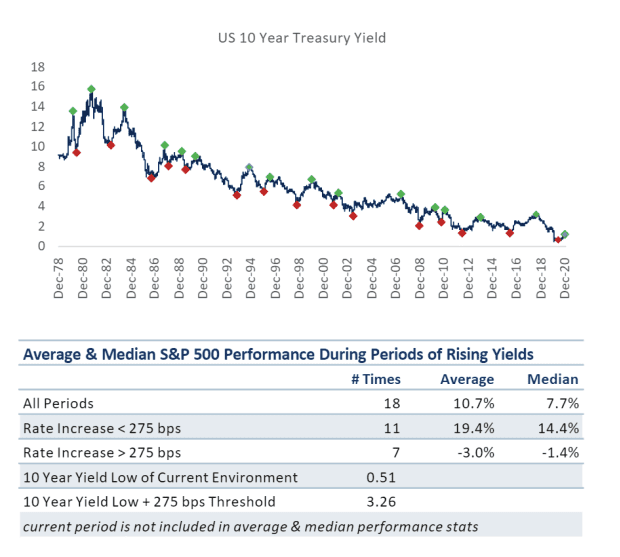

Finally, what about the rise in treasury yields? After all, many market viewers have argued that while yields remain low by historical standards, it is the size of the rise that could affect stocks the most. Calvasina broke down the relationship between yield movements and stock market performance in the chart below:

RBC Capital Markets

According to Calvasina, US equities tend to struggle if the 10-year yield rises more than 275 basis points, or 2.75 percentage points. If the low of 0.51% is lower, the yield of 275 basis points will increase the yield to about 3.26%. The ten year ends Tuesday at 1.363%.