(Bloomberg) – In the battle between short-selling Citron Research and an army of Reddit-charged day traders, GameStop Corp. s seemingly endless rally gave the bulls of the stock a victory, though not without controversy.

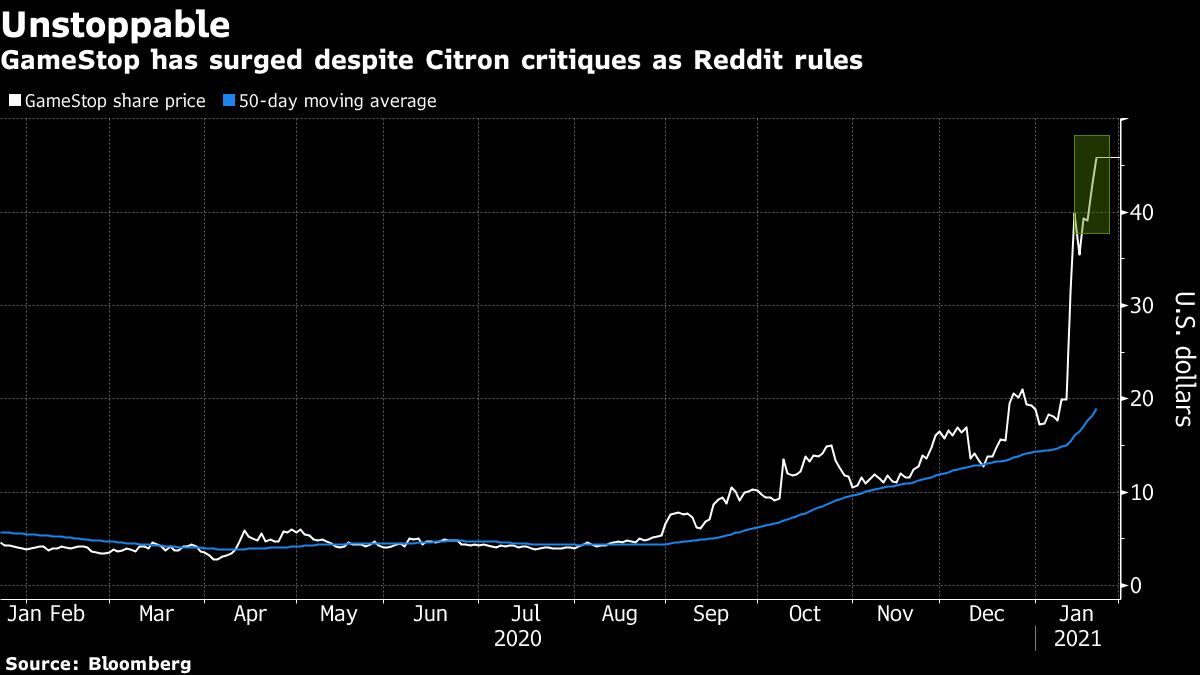

GameStop’s 45% increase to Friday comes after it more than doubled in the previous week and is the most volatile period of ten days recorded, according to data compiled by Bloomberg. The parabolic rise of the stock, amid steady and increased short-term interest rates and increasing volume, showed the separation between retail bulls and bears returning to reality on a rapid return.

A backlash against Citron by some of the outspoken Reddit users over their views on GameStop came to a head on Friday when the short seller said he would stop commenting on the stock following the actions of an angry crowd. .

“We are investors who put safety and family first, and if we believe it is being compromised, it is our duty to walk away from a share,” Citron’s managing partner Andrew Left wrote in a Friday letter.

The statement comes a day after Left said in a YouTube video that he “has never seen such an exchange of ideas from people who were so angry about someone on the other side of a trade,” and partly referred to Reddit users who were particularly outspoken on the social media site to promote their positive opinions about the stock of the video game.

GameStop has risen 174% so far in January, with its ten-day average daily volatility peaking in the nearly two decades the stock has traded, according to data compiled by Bloomberg. Friday’s fluctuation between profits and losses kept its market value above $ 3 billion.

GameStop representatives did not immediately send an email for comment.

While the saga unfolded this week, GameStop fans clashed with Citron after the short seller criticized the shares in a tweet on Tuesday and made plans for a Twitter Inc. the next day. The event was initially pushed back for the inauguration of President Joe Biden and then again on Thursday due to attempts to hack the short seller’s Twitter account.

Left posted a YouTube video on Thursday afternoon discussing the company, outlining five reasons why he thinks the shares of the Grapevine, Texas-based company, will ‘return to $ 20’. That’s less than half of the $ 49.58 at which the stock traded at 11:38 a.m. Friday morning.

Wall Street analysts have largely remained silent amid the recent volatility in the stock. CFRA research analyst Camilla Yanushevsky reiterated her sales rating on January 15, attributing most of the gains last week to a brief push after Chewy Inc. activist co-founder and co-founder Ryan Cohen joined GameStop’s board.

According to data compiled by S3 Partners, the bet has remained steady with 140% of the available GameStop shares currently being sold. According to the financial analysis firm, Bears had a market-to-market loss of $ 1.74 billion this year.

“While older existing shorts cover some of their positions due to a profit-loss-based short press, there is a queue of new short sellers who want to get short exposure to GME after the recent run-up,” said Ihor Dusaniwsky, management of S3. director of predictive analytics, emailed.

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP