– By Margaret Moran

After the closing clock on February 4, Ford Motor Co. (NYSE: F) reported earnings for the fourth quarter and full year of 2020.

The auto business blew analysts’ quarterly earnings and revenue estimates out of the water, causing stocks to trade after hours in response to the positive news.

Earnings results

In the full year 2020, revenue was $ 127.1 billion compared to $ 155.9 billion in 2019. On the earnings front, the GAAP loss per share was 32 cents compared to earnings of 1 cent per share last year, while the adjusted earnings per share 41 cents compared to up to $ 1.19.

For the fourth quarter, the company recorded a GAAP loss per share of 70 cents (28 cents lower compared to the same quarter of 2019), while adjusted earnings per share rose to 34 cents (22 cents). Revenue was $ 36 billion, which was 9% lower than the previous quarter. Analysts had expected an adjusted loss of 7 cents per share of $ 33.89 billion.

In its sales report last month, Ford said U.S. sales fell 9.8% in the fourth quarter to 542,749 vehicles, while sales in China fell 30% and sales in Europe 15%.

“The transformation of Ford is taking place, and so is our leadership of the EV revolution and the development of autonomous governance,” said Jim Farley, president of Ford. “We are now jointly allocating $ 29 billion in capital and tremendous talent to these two areas, bringing customers large, connected electric sport utility vehicles, commercial pickups and pickups.”

In the fourth quarter, the launch of three Ford vehicles was introduced that lay ahead as a ‘pivot point’ of its road: the 2021 F-150, a brand new and fully electric Mustang Mach-E crossover and the Bronco Sport SUV. Ford recorded slower production of the F-Series due to a measured increase for the new F-150 model, while the new Mustang Mach-E and Bronco models yielded higher-than-expected costs.

At the end of the quarter, the company had $ 14.34 billion in cash and equivalents compared to $ 9.06 billion at the end of the previous year. Meanwhile, debt amounted to $ 137.67 billion, slightly lower than $ 140.02 billion.

Looking forward

With its global redesign strategy and focus on EVs already showing success, the company plans to continue the strategy, focusing on strengthening the balance sheet, more efficient allocation of capital and investing in areas with high growth potential such as EVs. services and autonomous vehicles.

“We are radically changing the trajectory of our earnings force,” said John Lawler, CFO, “unlocking the tremendous value Ford can create for customers, shareholders and other stakeholders.”

In the first quarter of 2021, the company said it and other carmakers are now being forced to shut down some plants due to a global shortage of car chips. As a result of the Covid-19 pandemic, chipmakers pushed up the production of consumer electronics chips in anticipation of greater demand, and gave up the price of chips on the vehicle as demand for them would be expected. In the automotive industry, however, demand has fallen back rapidly after the first waves of the virus, and the unexpected revival is now clashing with a lack of supplies.

“The semiconductor situation is constantly changing, so it’s premature to try to determine the magnitude of the availability for our performance throughout the year,” Lawler said. “At the moment, suppliers’ estimates may suggest that we will lose 10% to 20% of our planned production in the first quarter.”

Due to the uncertainty created by the scarcity deficit, the company did not provide any concrete guidance, but did provide $ 8 billion to $ 9 billion in adjusted Ebit and $ 3.5 billion to $ 4.5 billion in adjusted free cash flow for the full year 2021, assuming continued Improvement of EBIT in all regions except South America.

Valuation

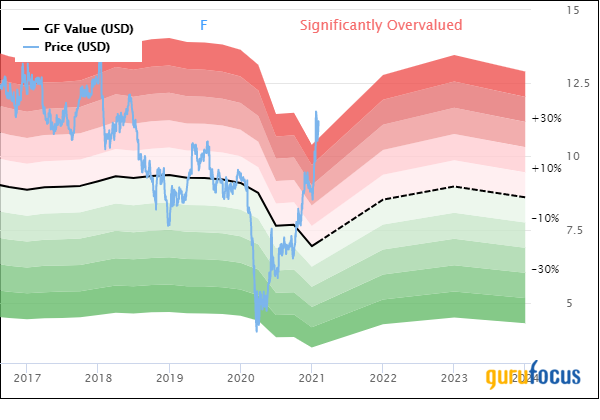

According to the GuruFocus Value Chart, Ford’s shares are significantly overvalued. Based on the combination of the company’s historical valuation multiples, past returns and growth and analytical estimates of future performance, the stock is likely to return poor returns in the long run if purchased at current levels.

To deliver significant returns for the price, the company will need to accelerate its growth above expectations. This scenario is not impossible, as the automotive sector is very cyclical, with Ford increasing investment in high-growth areas. As shown in the chart below, which compares the share price with earnings per share, the company has had several periods of higher earnings in the past, as well as periods of richer valuations.

Read more here:

Not a premium member of GuruFocus? Sign up here for a free 7-day trial.

This article first appeared on GuruFocus.