Subscribe to our Middle Eastern newsletter and follow us @media east for news about the region.

Turkish President Recep Tayyip Erdogan said authorities had used $ 165 billion in foreign exchange reserves from the central bank to reflect the development of weather conditions in 2019 and 2020, and they may “use it again when necessary”.

“The central bank currently has about $ 90 billion in reserves,” he told lawmakers in Ankara on Wednesday. “These reserves could be used again in the future if necessary, or they could rise above $ 100 billion,” Erdogan said, referring to the total gross reserves of the monetary authority.

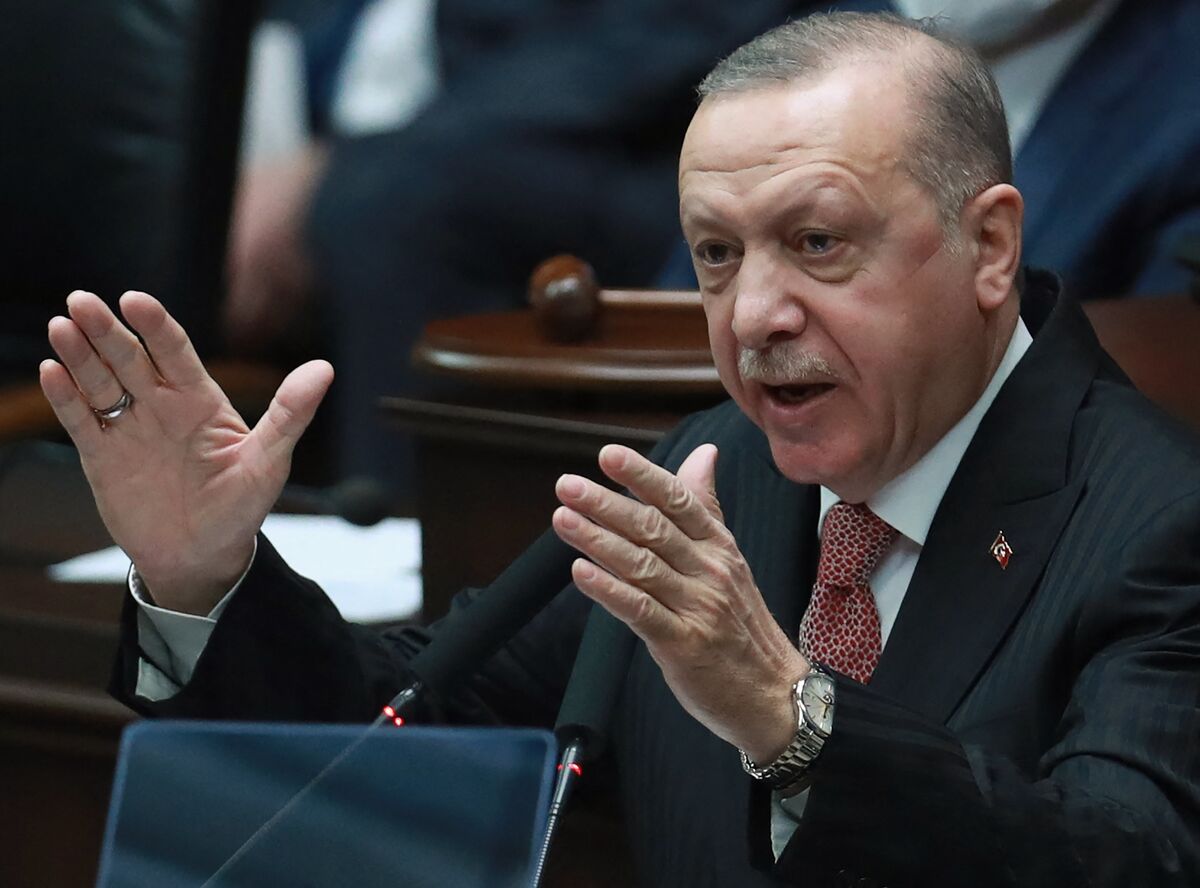

Recep Tayyip Erdogan on 21 April.

Photographer: Adem Altan / AFP / Getty Images

During its speech, the lira extended its decline against the dollar and traded 0.8% lower in Istanbul at 8.1771 at 16:10.

Turkey’s biggest opposition, the Republican People’s Party, is demanding officials declare a decline in foreign reserves during the period that Berat Albayrak, Erdogan’s son-in-law, treasurer and finance minister. He holds the post from July 2018 to November last year.

Erdogan accused the party on Wednesday of spreading a “big lie” by implying that $ 128 billion was “gone or stolen”.

Global banks, including Goldman Sachs, predict that more than $ 100 billion in central bank reserves were spent to prevent a disorderly depreciation alone last year, when the currency came under pressure following a series of major rate cuts to the economy. affected by the pandemic.

In 2019, Turkey initially increased foreign exchange sales when the lira weakened in the run-up to municipal elections, and continued with a revisit of the ballot in Istanbul that Erdogan’s AK Party lost. Geopolitical tensions with the US later that year hurt the currency.

Erdogan said on Wednesday that $ 165 billion in central bank reserves would be used to finance current account deficits and capital outflows, and to meet foreign exchange and gold demand from local investors. The president said much of the money remained in the country as the central bank conducted the exchange rate transactions through market maker banks.

Turkey’s total gross reserves, including gold and money owned by the central bank on behalf of commercial money lenders, fell by more than 15% from the beginning of 2020 to $ 89.3 billion in April. Net international reserves fell by more than 75% to $ 9.9 billion, while money borrowed from banks in short-term swaps reached tens of billions of dollars.

When the swaps are removed from net reserves, they fall below zero, according to Bloomberg’s calculations.

In a written interview following his appointment last month, the new governor Sahap Kavcioglu said that the central bank would maintain its goal of increasing foreign exchange reserves, and that it could use ‘reserve strengthening instruments’ under appropriate conditions.

(Updates with more details.)