(Bloomberg) – European stocks rose higher on U.S. futures on Wednesday as cyclical stocks outperformed and the rise in the technology sector appears to be losing steam.

The Stoxx Europe 600 index ranged between losses and gains, while carmakers, energy firms and banks led the benchmark. The exception was mining stocks, which reached a three-week low amid falling iron ore prices. Just got Eat Takeaway.com NV after announcing that they will accelerate further growth in orders in 2021 compared to last year.

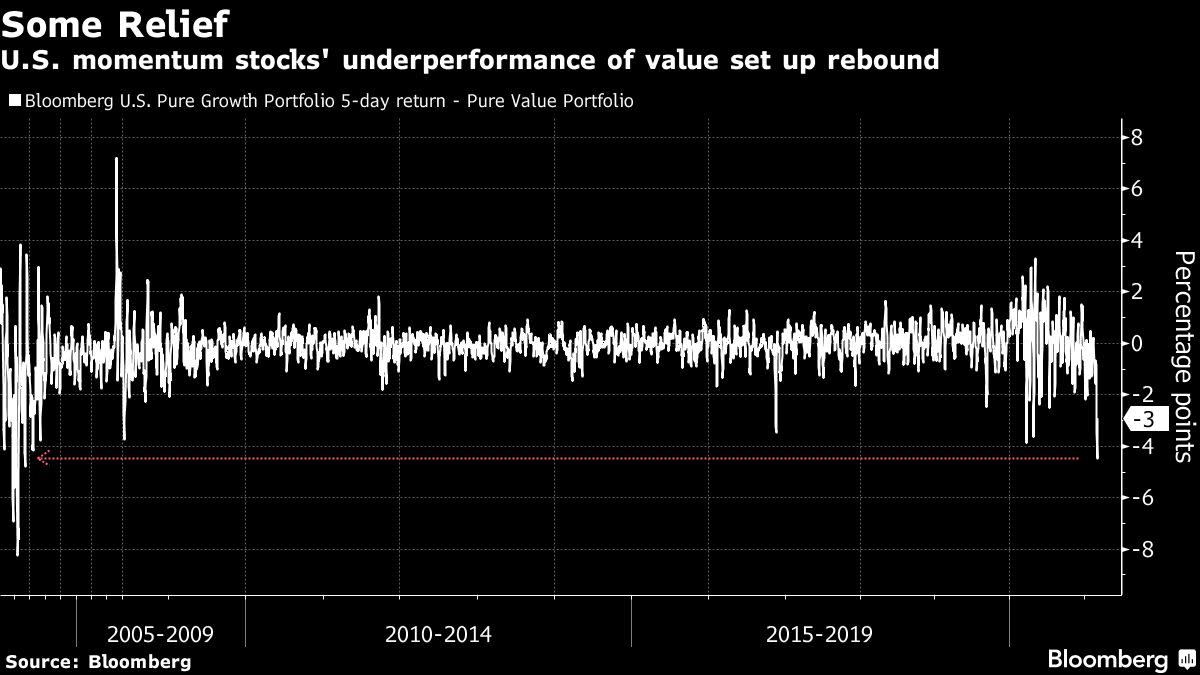

In the US, the futures contract on the Dow Jones industrial average and the Russell 2000 indices outperformed Nasdaq 100 contracts after the underlying benchmark rose nearly 4% amid an increase in growth stocks. Treasury yields have risen below their recent peaks as the first in a series of U.S. auctions went down without disrupting markets.

In Asia, China’s CSI 300 measure rose modestly after a slump on Tuesday that eluded the state’s efforts to slow the pace of losses.

While Tuesday’s downturn in treasury yields sparked a rush of home-stay winners, the reversal of growth in value stocks resumed on Wednesday. Congress is ready to send the $ 1.9 billion Covid-19 emergency relief plan to President Joe Biden for his signature, while the vaccinations pick up amid further signs of economic recovery. The expected consumer price data in the US is also expected to show a slightly faster increase per year.

The rising trend in bond yields is in line with economic growth expectations, says Lauren Goodwin, portfolio strategist at New York Life Investments. The background still favors cyclicals as defensive assets and ‘supports equities above bonds and a weaker US dollar’, she said.

Elsewhere, the oil was steady as the dollar strengthened. The Australian dollar fell after the governor of the central bank suggested that markets could move themselves forward by introducing an interest rate hike within the next few years.

Here are some key events to watch:

The report from the EIA crude oil stock is available on Wednesday. The US consumer price index in February presents the latest overview of the price pressure on Wednesday. The U.S. government’s auctions of 3-, 10- and 30-year treasuries. The European Central Bank is holding its monetary policy meeting and President Christine Lagarde is holding an information session on Thursday.

Here are the key movements in markets:

Stocks

The future on the S&P 500 index changed little at 09:04 London time. The Stoxx Europe 600 index rose 0.1%. The MSCI Asia Pacific Index rose 0.3%. The emerging market MSCI index rose 0.7%.

Currencies

The Bloomberg Dollar Spot Index jumped 0.1%. The euro changed little at $ 1.1898. The British pound changed little at $ 1.3889. The national yuan strengthened 0.1% to 6,505 per dollar. The Japanese yen weakened 0.2% to 108.71 per dollar.

Effects

The yield on 10-year treasury rose by two basis points to 1.55%. The yield on two-year treasury rose by less than one basis point to 0.16%. Germany’s 10-year yield reached less than one basis point to -0.30%. The annual return was unchanged at 0.727%. Japan’s 10-year yield reached less than one basis point to 0.128%.

Commodities

West Texas Intermediate Crude Oil changed little at $ 64 a barrel. Brent crude fell 0.2% to $ 67.41 a barrel. Gold weakened 0.1% to $ 1,713.56 per ounce.

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP