US equities traded higher on Thursday morning and the Dow broke an intraday record, despite a report showing that weekly unemployment benefit claims had risen to their highest level since August last year as business closed again in some states is to combat the coronavirus pandemic.

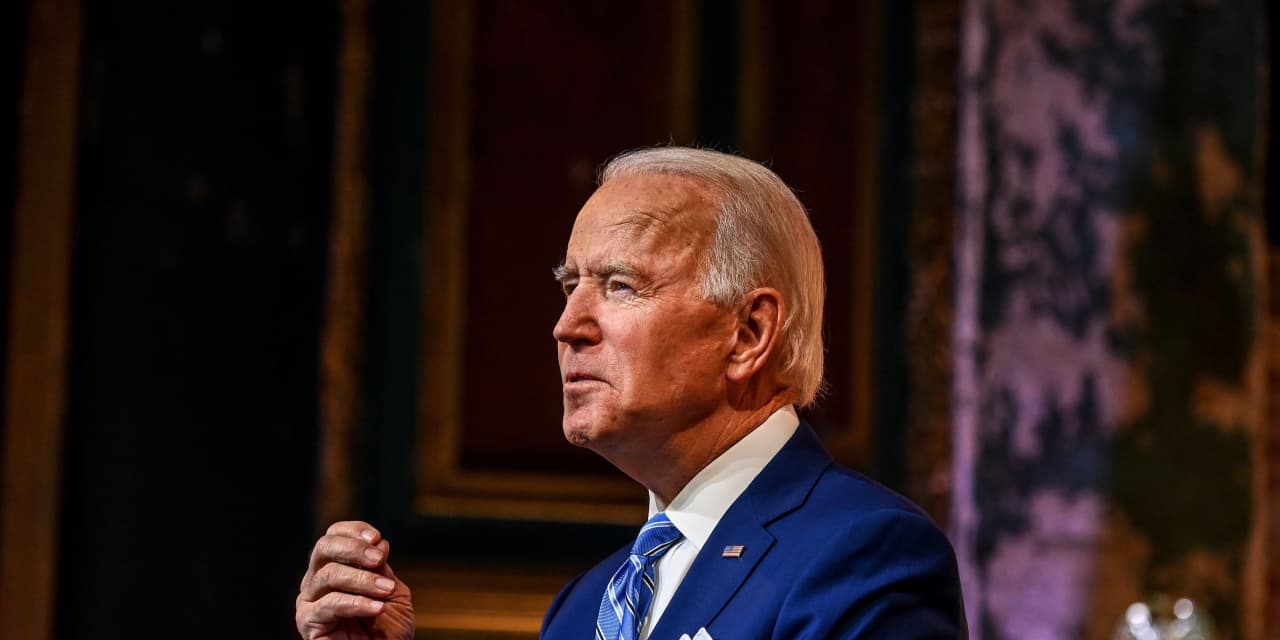

However, investors are focused on the prospects of further financial assistance from the government, with President-elect Joe Biden outlining the details of more fiscal stimulus on Thursday night.

What do important criteria do?

-

The Dow Jones Industrial Average DJIA,

+ 0.35%

rose 144 points, or 0.5%, to 31,203, setting an intraday record at 31,223.78. -

The S&P 500 Index SPX,

+ 0.26%

traded 12 points, or 0.3%, at 3,822. -

The Nasdaq Composite Index COMP,

+ 0.66%

rose 74 points, or 0.6%, to 13,203.

The Dow DJIA,

fell less than 0.1% on Wednesday before a vote in the House to accuse President Donald Trump of inciting the Capitol riots on January 6, while the S&P 500 SPX,

and Nasdaq Composite COMP,

ended slightly higher.

What drives the market?

CNN reported that Biden, who will speak in Wilmington, Delft, is ready late Thursday to set out a spending package that will include more direct payments to U.S. families and significant state and local funding.

Another round of large, direct payments to households could be the hardest part of the package, FXTM chief market analyst Hussein Sayed said in a letter because most Republicans and some Democrats in the Senate are against it. go ‘.

“On the other hand, choosing a small package will disappoint investors and lead to profit-taking in stock markets,” he said. “The right balance will not be easy.”

The discussion of additional federal spending comes as a report on U.S. weekly unemployment benefit claims was highest in early January since the end of August, rising 181,000 to 965,000 as the COVID-19 pandemic caused renewed closures across the country , the Department of Labor reported Thursday. Economists, on average, estimated that claims would amount to 800,000.

According to a New York Times report, the U.S. added at least 230,476 new cases on Wednesday and counted at least 3,922 deaths, after setting a record of more than 4,400 on Tuesday, the most in one day since the outbreak began .

However, the higher unemployment benefit figures for early January could help bolster the argument among those who argue that the economy needs more fiscal aid as the virus gains a new spread.

‘At some point, difficult numbers like what we saw this morning may be the focus for those who want a correction, but the market’s view seems to be that the light at the end of the tunnel remains in sight, despite a exhaustive vaccination, ”writes Mike Loewengart, investment strategist at E-Trade Financial, by e-mail.

“Furthermore, a report with a darker than exceptional jobs translates a greater likelihood of a full-throat stimulus package, which perversely serves as a headwind for the market,” he said.

Optimism for new aid supports optimal forecasts for market performance in 2021. David Kostin, Goldman Sachs, plans to end the S&P 500 2021 at 4,300.

Meanwhile, investors will also be watching the yields of bonds, which pulled higher last week and early this week in a move that blames concerns that another fiscal package could fuel inflation. This can make equities difficult because higher returns make the valuation of the shares more difficult to justify. Investors may also fear that an increase in inflation will cause the Federal Reserve to relax its bond-buying program faster than expected.

In other economic news, the US import price index rose by 0.9% in December and 0.4% in December, excluding fuel prices.

Investors will also pay close attention to a speech by Fed Chairman Jerome Powell at 12:30 Eastern.

Which companies are in focus?

-

BlackRock Inc.

BLK,

-3.53%

the shares fell 3.7% after the asset manager, with $ 8.7 trillion in assets under management, reported fourth-quarter earnings and revenue that beat expectations. -

Shars van Tesla Inc.

TSLA,

+ 0.64%

was 1.2% lower. The National Highway Traffic Safety Administration has sent a letter to the manufacturer of electric vehicles requesting a voluntary recall of 158,000 Model X units from the 2016, 2017 and 2018 model years over a possible defect affecting safety functions, including the operation of the rear camera. -

Google Parent Alphabet Inc. part GOOG,

+ 0.73% GOOGL,

+ 0.63%

may be in focus after the company said it had completed the acquisition of fitness tracking company Fitbit. Alphabet’s A and C shares rose 0.4%. -

Cisco Systems se

CSCO,

+ 0.29%

shares were in focus after CNBC reported that it had a higher offer forAcacia Communication

ACIA,

+ 31.82% .

Cisco shares decreased 0.3%, while Acacia’s share increased 31%. -

Shares of Virgin Galactic SPCE,

+ 19.96%

jumped more than 20% after ARK Investment Management filed with the Securities and Exchange Commission to launch an exchange-traded fund.

How do other assets trade?

-

The yield on the American treasury note TMUBMUSD02Y for ten years,

0.149%

increased by 1 basis point by 1.10%. -

The ICE US Dollar Index DXY,

+ 0.05% ,

a measure of the currency against a basket of six major competitors, rose by 0.2%. -

Oil futures traded lower, with US benchmark CL.1,

-0.55%

0.3% lower at $ 52.77 a barrel. Gold futures GC00,

-0.47%

traded 0.6% lower at $ 1,843.70 per ounce. -

The pan-European Stoxx 600 index SXXP,

+ 0.72%

increased by 0.4%, while the FTSE 100 UKX in London,

+ 0.71%

increased by 0.5%. -

In Asia, the Shanghai Composite SHCOMP,

-0.91%

closed 0.9% lower, while the Hang Seng index HSI in Hong Kong,

+ 0.93%

climbed 0.9% and the Japanese Nikkei 225 index NIK,

+ 0.85%

achieved 0.9%