(Bloomberg) –

Even as China grows in economic and military power, perhaps nothing shows the weaknesses of Beijing more than US control of the global financial system. China recently sought ways to counter US sanctions after the Trump administration targeted Chinese officials and companies over policies from southern China. See Xinjiang. Hong Kong leader does not have access to a bank account and a top manager at Huawei Technologies Co. is being held in Canada. Even China’s state – owned banks comply with US sanctions. This is one of the reasons why the Biden government is starting to investigate whether the development of a digital currency will make China more difficult for the US to apply sanctions, Bloomberg reported earlier this month. The digital yuan, which could have a wider expansion at the 2022 Winter Olympics in Beijing, is also encouraging the US to create a digital dollar.

But instead of challenging the dominance of the US dollar and neutralizing sanctions, the digital yuan may seem more geopolitically important than leveraged financing over multinational corporations and governments that want access to China’s 1.4 billion consumers. Since China has the ability to monitor transactions involving the digital currency, it may be easier to retaliate against anyone who disapproves of Beijing over sensitive issues such as Taiwan, Xinjiang and Hong Kong.

“If you think the United States has a lot of power through our treasury authorities, you have not seen anything yet,” Matt Pottinger, former US deputy national security adviser to the Trump administration, said during a government hearing last week. -Assisted Economic and Security Review Commission between the US and China. “The currency can be turned off like a light switch.”

So far, China has mostly resisted beating foreign companies in response to U.S. action against companies like Huawei, and has designed the release of an “unreliable list of entities” to punish anyone who harms national security. Every step to prevent access to the digital yuan has a similar interest, which foreign investors may have to pack up and leave.

But Beijing has sued companies like Hennes & Mauritz AB for statements on human rights issues, even while government officials were careful to avoid a boycott being directly endorsed. In a Weibo post last month, the Communist Party Youth League declared: ‘Do you want to make money in China while spreading false rumors and boycotting Xinjiang cotton? Wishful thinking! “

Controlling access to the massive market in China remains the best way to hit Beijing in the US: As long as Chinese companies still want access to the broader financial world dominated by the US and its allies, Washington can effectively impose sanctions against almost all who do not. does not work exclusively in the orbit of China. And Beijing has little incentive to avoid the dollar.

While President Xi Jinping has called for greater self-sufficiency in key technologies such as advanced computer chips, a US financial decoupling would only harm China’s economy and possibly expose the Communist Party more to destabilizing attacks. After Xi Hong Kong’s autonomy effectively ended last year with a comprehensive national security law, the US refrained from reducing the area’s access to US dollars due to the possible devastation to the global financial system.

‘Great commercial risk’

Widespread use of the digital yuan – also known as the e-CNY – could potentially give China’s central bank more financial transaction data than the major technology giants, enabling the Communist Party to strengthen both its grip on power and its policies. to refine. to strengthen the economy. While this level of control may promote growth in the world’s second largest economy, it also runs the risk of companies and governments already fearing China’s history of intellectual property, economic coercion and the rule of law.

H & M’s state-sponsored boycott shows a huge commercial risk for companies using the digital yuan, said Yaya Fanusie, deputy senior fellow at the Center for a New American Security in Washington. If foreign traders had to use the e-CNY, he said in a separate email, the government could ban transactions with H&M wallets and the store could disappear from digital yuan programs.

“This is the other side of the coin – Beijing is not a sanctions evader, but more empowered to exercise its own financial muscle,” said Fanusie, who wrote extensively on how the central bank’s digital assets US may affect financial sanctions. “China’s digital currency is as much about data as it is about money,” he added. Foreign companies using the digital yuan can “eventually hand over a lot of real-time data to the Chinese government that they cannot use efficiently through conventional banking technology.”

According to Emily Jin, a research assistant at the Center for a New American Security, China’s ability to see every transaction can make it difficult for foreign banks to use the digital yuan and still comply with the confidentiality rules in their home countries. But, she added, the currency may appeal to some regimes that prefer privacy protection.

“It may be easier for them to convince governments more authoritarianly that it helps to monitor activities or to stop or stop them quickly before they happen,” Jin said. “They’re not going to market it to everyone.”

According to Mu Changchun, director of the central center, the digital yuan will serve as an aid to the Alipay and WeChat Pay of Ant Group Co., Alipay and Tencent Holdings Ltd., bank’s Institute for Digital Currency Research. Last month, he said the electronic yuan has the “highest level of privacy protection” and that the central bank will not know the identity of users directly, but the government can get the information from financial institutions in case of illegal activities.

Dollar Challenge

Chinese policymakers have also repeatedly stressed that the digital yuan is not meant to challenge the dollar, and Deputy Governor Li Bo of the People’s Bank of China said last weekend that the motivation for the e-CNY was primarily for domestic use. is. Former PBOC Governor Zhou Xiaochuan underestimated the risks of the global financial system technology on Wednesday at the Boao Forum, saying the digital yuan will be used primarily for small retail payments.

The Chinese currency now accounts for about 2% of global foreign exchange reserves compared to nearly 60% for the US dollar, and most of Beijing’s trade and loans in Xi’s Belt-and-Road Initiative are paid out in dollars.

Any serious challenge to the dollar’s position as the world’s reserve currency will also require significant policy changes from China, including the lifting of capital controls that help the Communist Party keep a lid on sudden outflows that could lead to a financial crisis. cause. Even if the digital yuan could trade cheaper outside of US-controlled payment systems, it is unclear whether anyone would use it.

“The dollar is not the dominant reserve currency because the Americans say it should be,” said Michael Pettis, a professor of finance at Peking University and a senior fellow at the Carnegie-Tsinghua Center in Beijing. ‘The dollar is the dominant reserve currency, because the Chinese, the Europeans, the Japanese, the South Koreans and so on. Say it should be. It’s the rest of the world that imposes it because they think it’s the safest place to park money. ‘

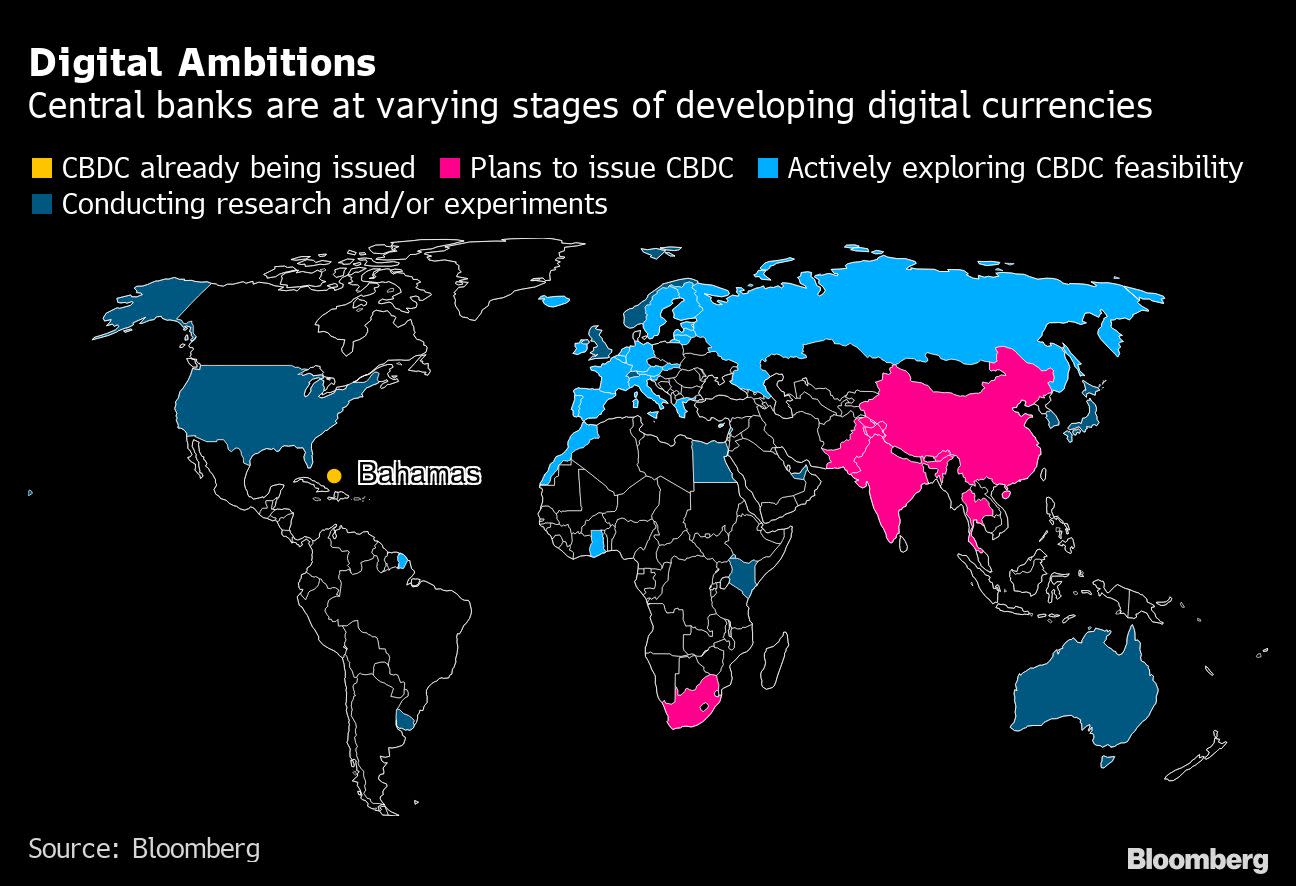

The US still has an incentive to set standards for digital currencies. In a survey last year among 65 central banks representing 91% of global economic output, the Bank of International Settlements found that more than half had experimented with digital currencies and that 14% were moving forward to pilots. The US itself takes a cautious approach: Federal Reserve Chairman Jerome Powell said policymakers should understand the costs and benefits of a digital dollar last month, and not rush the ‘very, very big, complicated project’ not.

‘Wake Up Call’

China began investigating the digital yuan as early as 2014, immediately after the price of Bitcoin rose from $ 13.40 to more than $ 1,000, increasing the risk that digital currencies could affect Beijing’s control over monetary policy. It began technical testing with Hong Kong for cross-border payments and is working with Thailand and the United Arab Emirates on real-time foreign exchange settlements. Authorities are also studying how the digital yuan can be combined with 5G networks and the Internet of Things.

According to Josh Lipsky, director of the Atlantic Council’s Geoeconomic Center, China could have a greater influence on how other countries around the world design digital currencies, especially when it comes to issues of surveillance, privacy and anonymity.

“China is really leading the way in this area and it should be a wake-up call for the US and Europe,” Lipsky said. “There is a serious benefit to the first car, not because of what China is going to do, but what other countries are going to do.”

(Updates with comments for former PBOC governor Zhou Xiaochuan in the 16th paragraph)

Visit us at bloomberg.com for more articles like this

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP