When America’s amusement parks and baseball stadiums no longer have to serve as COVID-19 mass vaccination sites, some investors believe that households that are pocketing financial pandemic support from the government could possibly start flushing.

Although a consumer party may initially strengthen the parts of the economy devastated by the pandemic, a greater concern for investors is that sustained spending could also lead to a dramatic rise in prices for goods and services, financial asset values may decrease and eventually increase costs. of life for all.

“I do not think inflation is dead,” said Matt Stucky, equities portfolio manager at Northwestern Mutual Wealth Management Company. ‘The desire of key policymakers is to have it, and it’s the strongest it has ever been. You will see rising inflation. ”

Wall Street investors and analysts have been gripped over the past few weeks over the potential for the Biden administration’s planned $ 1.9 billion fiscal stimulus package aimed at easing hard-hit households to get inflation out of control.

Economists at Oxford Economics said on Friday they expected “the longest inflation to reach above 2% since before the financial crisis, but it is unlikely to exceed 3% sustainably.”

Severe inflation can hurt businesses by raising costs, lowering profits and lowering stock prices. The value of savings and bonds can also be carried away over time by high inflation.

Another concern among investors is that runaway inflation, which took hold in the late 1970s and pushed the 30-year mortgage lending rate to nearly 18%, could force the Federal Reserve to close its $ 120 billion-a-month bond purchase program. reduce or increase its default interest rate. above the current target of 0% to 0.25% sooner than expected, caused the markets to haunt.

At the same time, it is not far-fetched to argue that some financial assets have already been inflated by the Fed’s pedal-to-the-metal policy of low rates and easy credit flow, and this may be due to cooling.

US equities, including the Dow Jones Industrial Average DJIA,

S&P 500 index SPX,

and Nasdaq Composite COMP,

Friday closed at an all-time high, while debt-laden companies can now borrow in the corporate “junk” bond, or speculative, market at a record low rate of around 4%.

Read: Stock market fueled by stimulus hope – what investors are counting on

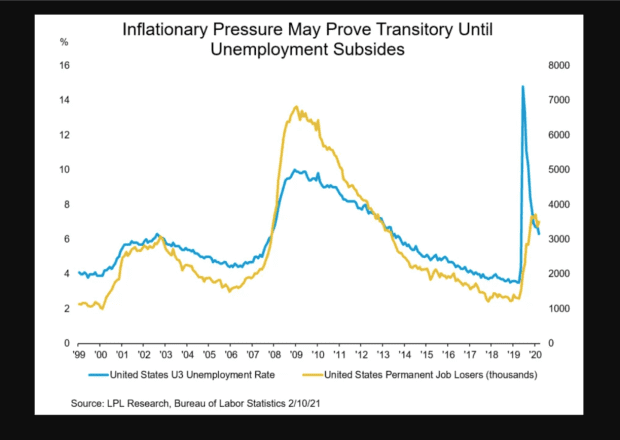

In addition to rising stocks and bonds, house prices in the US also went through the roof during the pandemic, despite the fact that the US still had to earn almost as many jobs from the COVID-19 crisis as during the worst of the global financial crisis. crisis in 2008.

This graph shows that jobs lost by the pandemic remain close to levels seen in the aftermath of the last crisis.

Job losses must be tamed

LPL Research, Labor Statistics Bureau

Fed Chairman Jerome Powell said on Wednesday that he did not expect a “major or sustained” outbreak of inflation, while also stressing that the central bank remains focused on recovering lost jobs during the pandemic, such as which the US wants to make serious progress in its vaccination. program by the end of July.

Finance Minister Janet Yellen on Friday reiterated a call for the time for more, major fiscal stimulus now.

“The cost is overall, it costs me more to live a year from now than a year before,” Jeff Klingelhofer, co-head of investments at Thornburg Investment Management, said in an interview with MarketWatch on inflation.

“I think what we need to keep an eye on is wage inflation,” he said, adding that higher wages for higher incomes have mostly been the same over the past decade. Many lower-wage households hardest hit by the pandemic have also been left out of the rise in financial asset prices and house values over the past decade, he said.

“For those who have not yet embarked on the journey, it feels like a continuation of inequality that has been playing out for some time,” he said, adding that the “only way to get broad inflation is through” a broad overheating of the economy. We have exactly the opposite. The bottom third is not nearly overheated. ”

Klingelhofer said that it is probably also a mistake to pay attention to the ten-year rate of return by the treasury for signs that the economy is overheating and for inflation, because it is not a proxy for inflation. “This is just a mandate for how the Fed can respond,” he said.

The ten-year treasury return TMUBMUSD10Y,

climbed 28.6 basis points from Friday to 1.199% as of Friday.

But with the sharp price rises of last year, is the US housing market at least at risk of overheating?

“Not at current interest rates,” said John Beacham, founder and CEO of Toorak Capital, which finances apartment buildings and single-family homes, including those going through rehabilitation and construction projects.

“Over the course of the year, more people will return to work,” Beacham said, adding that it was important for policymakers in Washington to provide a bridge for households through the pandemic, until there is spending on socialization, sporting events, concerts. and more may again seem like a time before the pandemic.

“It is clear that consumption is likely to increase in the short term,” he said. “But then it normalizes.”

The US stock market and bond market will mostly be closed on Monday for the President’s holiday.

On Tuesday, the only amount of economic data comes from the Federal Reserve’s manufacturing index of the Federal Reserve in New York, which is followed on Wednesday by a number of updates on U.S. retail sales, industrial production, data for homeowners and minutes from the Fed’s most recent policy meeting. Thursday and Friday bring in more jobs, housing and business, including existing home sales for January.