In one draft of the proposal, the IRS would pay checks worth $ 300 each month per child under 6 and $ 250 per month per child between the ages of 6 and 17. and $ 3,600 per child under 6 years of age.

The source also confirmed to CNN that Massachusetts House Ways and Means Committee Chair Richard Neal is directly involved in the effort to write the child tax credit extension, as well as Connecticut House Credit Committee Chair Rosa DeLauro.

The drafting of the proposed legislation was first reported by The Washington Post.

To be eligible for the benefit, similar to the stimulus checks, the family’s income for the previous tax year would be based and phased out at a certain income. Under the draft legislation, according to the newspaper, families would be eligible for the full monthly benefits, even if they owe more tax than the credit value.

A White House official did not respond to a request for comment from CNN.

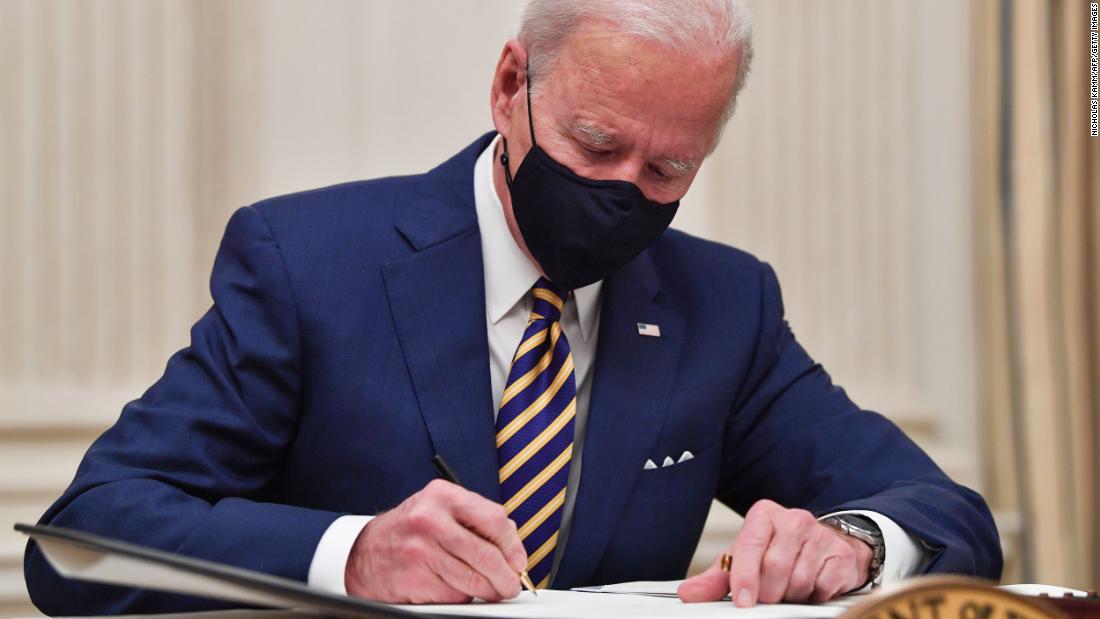

Biden had earlier said it wanted to increase the child tax credit and last week announced a $ 1.9 billion proposal that includes the expanded benefits, along with $ 1,400 stimulus checks and increased unemployment benefits. The package, considered the U.S. bailout plan, supplemented many of the measures in the historic $ 3 trillion coronavirus bill of March and in the $ 900 billion legislation from December, which was scaled back to support Republican Senate to obtain.

CNN reported that Biden’s stimulus proposal already faces Republican objections, and that the Senate Democrats have laid the groundwork to use a rare procedural tactic, known as reconciliation, to pass most of the package if Republicans stop their efforts.

The White House urged patience when it comes to negotiating and approving the stimulus plan through the usual Senate process, but Biden’s team said they were not prepared to ‘take tools off the table’.

The current child tax credit provides up to $ 2,000 per child under the age of 17. The credit phase is deducted for single parents with an adjusted gross income of more than $ 200,000, and $ 400,000 for married couples.

CNN’s Tami Luhby and Katie Lobosco contributed to this report.