(Bloomberg) – The damage control work at Credit Suisse Group AG due to some disasters that stunned the banking world will soon give way to the question of how the 165-year-old institution will restore its business and reputation.

A new chairman, Antonio Horta-Osorio, head of Lloyds Banking Group Plc, arrives in three weeks to begin searching for answers to the failures of Archegos Capital Management, a New York family office, and Greensill Capital, a lending equipment company. give, include. has wiped out more than a year’s profits.

Horta-Osorio has a number of possible courses, including: a household cleaning that shrinks the Credit Suisse balance sheet and reduces the capital allocated to the investment bank; selling parts of the business to deepen the focus on wealth management and rebuilding capital; commitment to an acquirer; or merges with its larger neighbor in Zurich, UBS Group AG.

With a write-off of 4.4 billion francs ($ 4.7 billion) linked to the losses of Archegos, the collapse of the Greensill Capital collapse, and a dividend reduction and suspension of share buybacks, frustrations are boiling under stakeholders about. There is widespread speculation about the future of the investment bank, the asset management unit and the fate of top executives, according to interviews with a dozen bankers, analysts, consultants and executives who asked not to be named. hypothetical scenarios and non-public affairs:

Self help

After consultation with managers and staff, the new chairman’s first step could involve the 440 billion fr asset management unit. The business is too small to compete worldwide and its leaders are distracted by the fallout from Greensill. Although a variety of outcomes are possible, including a partial sale or listing, the sale of the entire unit could fetch as much as 5 billion francs – a figure based on previous transactions in the industry.

According to people informed about the discussions, Allianz SE is one of the companies that has shown interest in Credit Suisse’s asset management business. BlackRock Inc. is also among potential buyers, Reuters reported Friday. Spokesmen for Allianz and BlackRock declined to comment.

A spokesman for Credit Suisse said the bank did not intend to sell the asset management business or any part of it.

Horta-Osorio’s initial decisions may depend on whether Swiss regulator Finma requires Credit Suisse to hold more capital against its credit or operational risks, just as UBS lost about $ 2 billion a decade ago on unauthorized trading. by London dealer Kweku Adoboli.

For now, Credit Suisse is good news that it remains financially sound. The capital ratios are only slightly lower than the average for European counterparts and above the regulatory minimum. With capital largely intact, an investment bank that remains competitive in areas such as advice, a top wealth management business and a profitable Swiss business, Horta-Osorio may get a new blow on what its predecessors tried to do: shrink the investment bank – to download the main brokerage of the entire investment or the entire property, marry directly to wealth managers, abandon credit trading and reduce exposure to debt financing. Horta-Osorio could not be reached for comment.

A more radical option would be to leave or sell the investment bank, a move that has historically been proven difficult and could limit the products available to ultra-rich wealth management clients.

A takeover, a breakup

Hostile takeovers in banking are rare, but situations such as those in which Credit Suisse finds itself are equally uncommon.

The market values it at about half its book value, and the American giant JPMorgan Chase & Co. and Morgan Stanley has shown interest in asset collections.

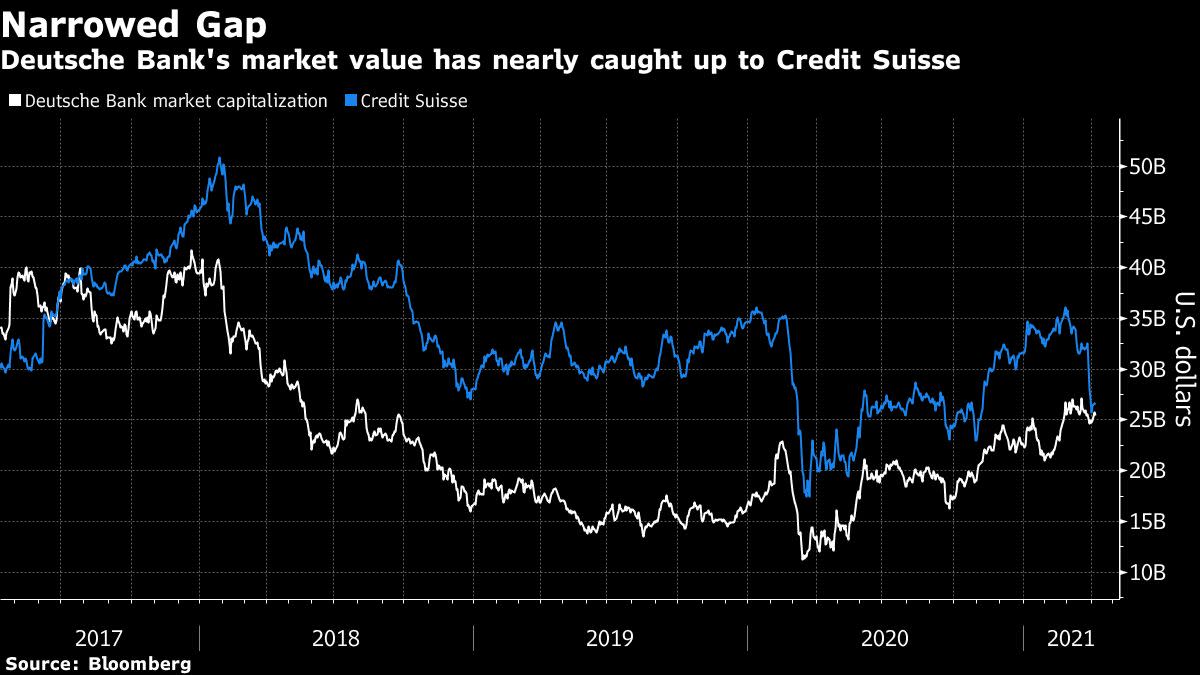

Bankers used the numbers on Credit Suisse as a potential acquisition target even before the collapse of Archegos. Deutsche Bank AG could investigate a deal to create a European investment banking champion with one of the world’s largest wealth managers. BNP Paribas SA, one of the few European banks that can make a deal, can expand rapidly in Asia as its investment banking expands.

For long-suffering Credit Suisse shareholders, a sell-off or break-up could be a way to ultimately yield the investment. It was a lost decade under chairman Urs Rohner. Rohner raised billions in capital, while the share price lost 70% during his tenure.

The bank may also attract the attention of an activist investor, who could pressure the board to expedite their discussions on staff and strategy.

What Bloomberg Intelligence says:

A potential sale of Credit Suisse’s asset management unit of more than $ 450 billion for $ 3.7- $ 4 billion could make sense, as the unit is likely to face a cost related to Greensill-related risks after a unrelated 4Q impairment of $ 458 million. An implied price of less than 1% of assets seems low to mediocre compared to recent management transactions and may reflect an operating discount. The structure of legal obligations is important. Several bidders, reported by Reuters, could increase the price and thus replenish capital.

– Alison Williams, senior banking analyst at BI

Click here to read the research.

The Swiss solution

UBS and Credit Suisse investigated a merger last year, people familiar with the discussions said. The main reason is cost savings that can amount to billions.

Any transaction will be complicated and means years of integration. Credit Suisse will first have to withdraw from its Swiss unit for antitrust reasons. The combined bank will add even more scale to wealth and asset management, and could also see the global increase in investment banking services.

There are pitfalls. UBS has scaled down its fixed-income business. A combination with Credit Suisse would be a complete reversal of that, and it is unclear whether the Swiss regulator – which is itself undergoing a leadership transition – wants an even bigger investment bank balance after the UBS bailout a decade ago.

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP