Currency exchange Coinbase Global Inc. (NYSE: COIN) started strong on Wall Street after a direct listing of its shares last week.

The Coinbase Analyst: Rosenblatt Securities analyst Sean Horgan has started covering Coinbase with a Buy rating and $ 450 price target.

The Coinbase thesis: Rosenblatt is positive in the long run for Coinbase because it will benefit from the growing acceptance and acceptance of cryptocurrency, Horgan said. The company’s short-term view is cautious as the stock poses a downward risk due to a decline in the price of crypto, he added.

Sustainable long-term growth is less uncertain, given the upside risk of institutional adoption and subscriber growth, the analyst said.

Related link: Why Square, PayPal is the best choice in the Fintech space before earnings

Horgan listed the following as reasons for holding Coinbase shares:

• Coinbase’s current 11% stake in the cryptocurrency market leaves the stock market in a pole position to capitalize on long-term growth, the analyst said. The key to long-term success is maintaining market share, investing in infrastructure to accelerate the acceptance of institutional enterprises and expanding its range of subscriptions and services to gain new customers and increase average revenue per user, he added.

• The security infrastructure of the exchange is the distinguishing one, and it is the deepest economic trench the company owns, according to Horgan.

• The analyst says there is room for gradual compensation from the current 55-60 basis points to 35-40 basis points by 2025.

• The analyst sees Coinbase in a unique position to make money in its retail user base through complementary financial services such as credit / debit card, stock trading and consumer loans, similar to what Square Inc.’s (NYSE: SQ) Cash app and PayPal Holdings Inc.’s (NASDAQ: PYPL) Venmo did.

Cryptocurrency has reached a turning point on its path to legitimacy, according to Rosenblatt, and it is a long-standing disruptive trend only in the early turn.

“Net / net, we are buyers of COIN as a long-term category leader and a cryptocurrency stock,” the firm said.

COIN PRICE ACTION: With the latest check, Coinbase shares fell 2.77% to $ 311.92 on Wednesday night.

Related link: The Coinbase IPO ushers in the next phase of the Crypto Bubble: Invest as in 1929

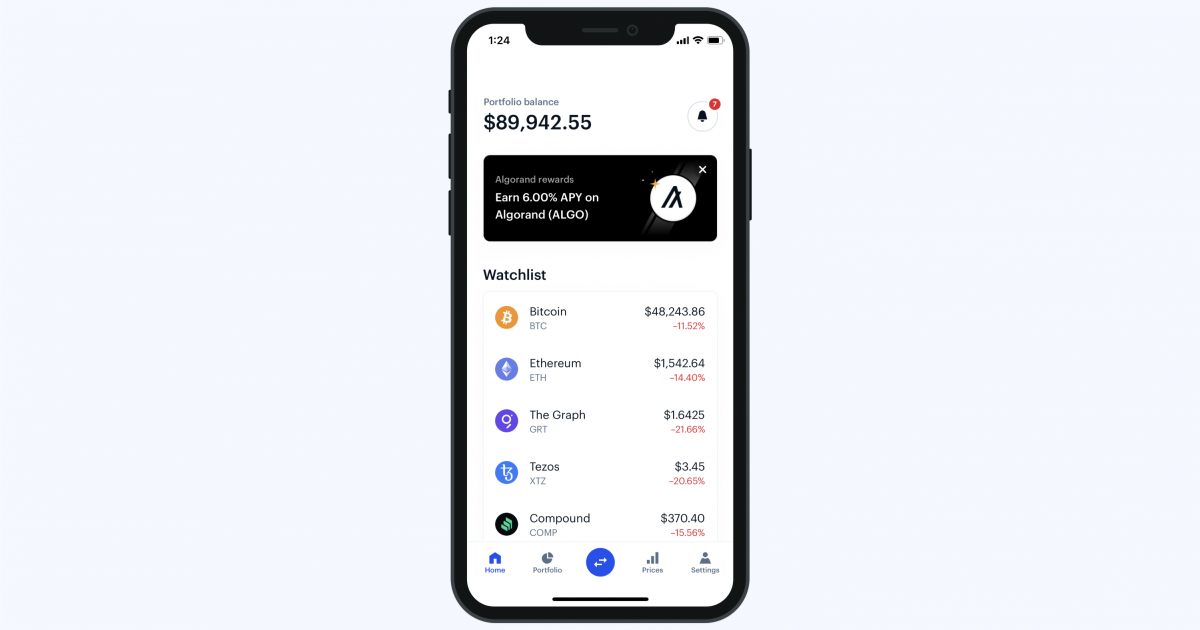

(Photo: Coinbase)

Latest ratings for COIN

| Date | Company | Action | Of | On |

|---|---|---|---|---|

| 2021 April | Rosenblatt | Initiate coverage | Buy | |

| 2021 April | Lus Hoofstad | Initiate coverage | Buy | |

| 2021 April | DA Davidson | Maintain | Buy |

See more analysis ratings for COIN

Check out the latest analytics ratings

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.