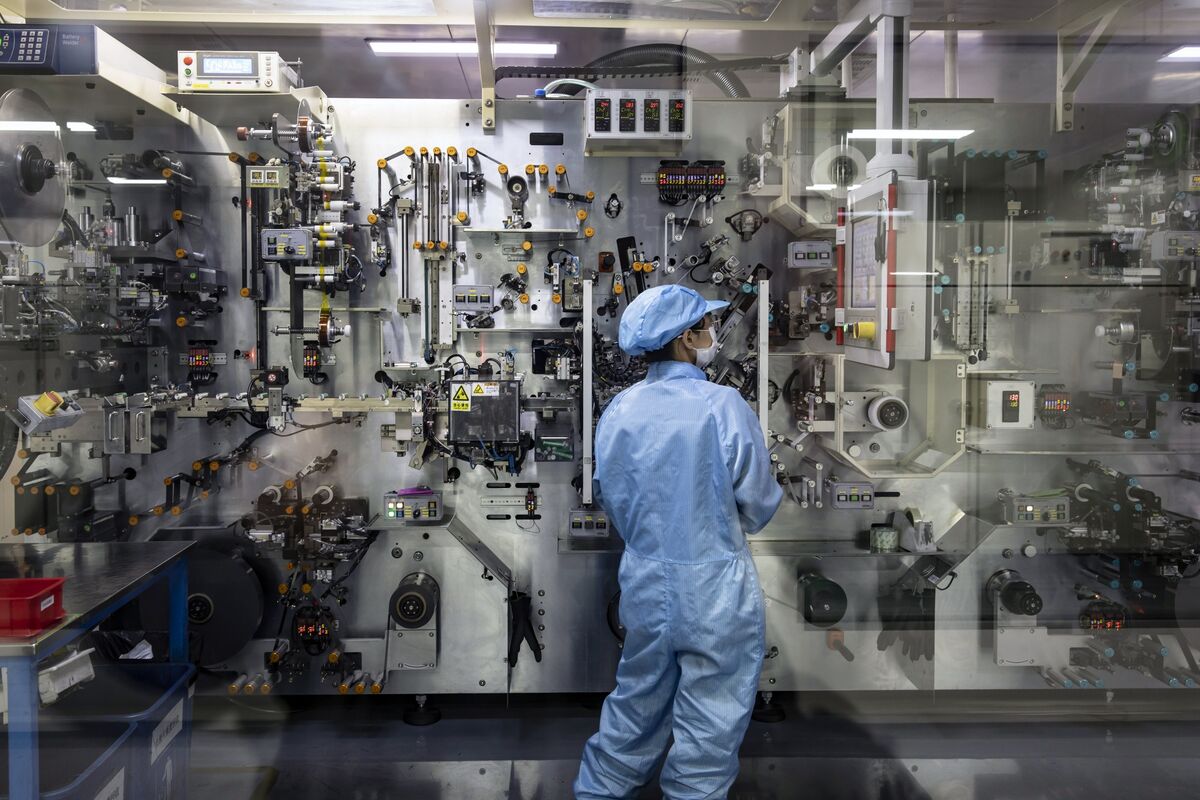

The production line on April 14 at the Tianneng Battery Group Co. plant in Huzhou, Zhejiang Province.

Photographer: Qilai Shen / Bloomberg

Photographer: Qilai Shen / Bloomberg

The Chinese economy rose in the first quarter as consumer spending intensified, joining production a year ago and recovering from the Covid slump.

Gross domestic product rose 18.3% in the first quarter from a year earlier, largely in line with the 18.5% forecast in a Bloomberg survey of economists. The figures are skewed by comparisons from a year ago when the economy was in a trap. A better reading of the economy’s momentum is the result of quarter-on-quarter growth, which has slowed to 0.6% from 2.6% in the previous three months.

| Other important highlights |

|---|

|

The Chinese economy gradually picked up pace after a historic contraction in the first quarter of last year, recovering all its lost ground by the end of September. The rebound was led by strong industrial production and robust exports, as the pandemic fueled demand for Chinese manufactured medical goods and electronic devices.

Decline and setback

The expected increase in growth is a reflection of last year’s slump

Source: National Bureau of Statistics

“We are seeing a bit more balanced recovery in the Chinese economy,” said Wang Tao, China’s chief economist. UBS AG, said in an interview with Bloomberg TV. As policies begin to normalize, real estate and infrastructure investments will slow in the coming quarters, she said. “So that the early pick-up in the construction industry will make more household consumption,” she said.

China’s benchmark CSI 300 Index wiped out an earlier loss of up to 0.6%. The 10-year futures contracts in China also reversed losses in the past to rise to 0.1%, while the yield on standard 10-year government debt fell by one basis point to 3.165%. The national yuan lost 0.17%, the first drop this week, to 6.5329 per dollar.

Bumper GDP growth, rising inflation and rising debt levels have put policymakers on their guard. Beijing has indicated it wants to downsize fiscal and monetary stimulus now that recovery is accelerating, tightening regulatory oversight in areas such as lending and real estate. The central bank has asked banks to curb lending growth in the coming months, although officials have stressed a gradual weakening of policy.

Worldwide, vaccine deployments are helping to strengthen the world economy and support China’s growth. In addition, the Biden administration’s massive fiscal stimulus is expected to spread widely to the rest of the world, particularly China, the world’s largest exporter. Bloomberg Economics’ Chang Shu upgraded her growth forecast for China for this year to 9.3% from 8.2% previously. The government’s the official target is to grow more than 6% this year.

– With the help of James Mayger, Lin Zhu, Lianting Tu, Livia Yap and Catherine Ngai

(Updates with comments from the economist and the market response.)