Beijing reported on Monday that China’s GDP grew by 2.3% last year, averting the recession that gripped much of the world as the coronavirus pandemic spread. GDP grew by 6.5% in the fourth quarter, compared to a year earlier.

Of great help were the Chinese the government’s decision to invest heavily in infrastructure projects. Industrial production rose by 7.3% last month compared to a year earlier. And crude steel production reached a record 1.05 billion tons for the year, an increase of 5% over 2019.

The country cannot sustain the kind of production without iron ore that it needs to make steel for roads, bridges and buildings. China imported 17% more iron ore last year than in 2019.

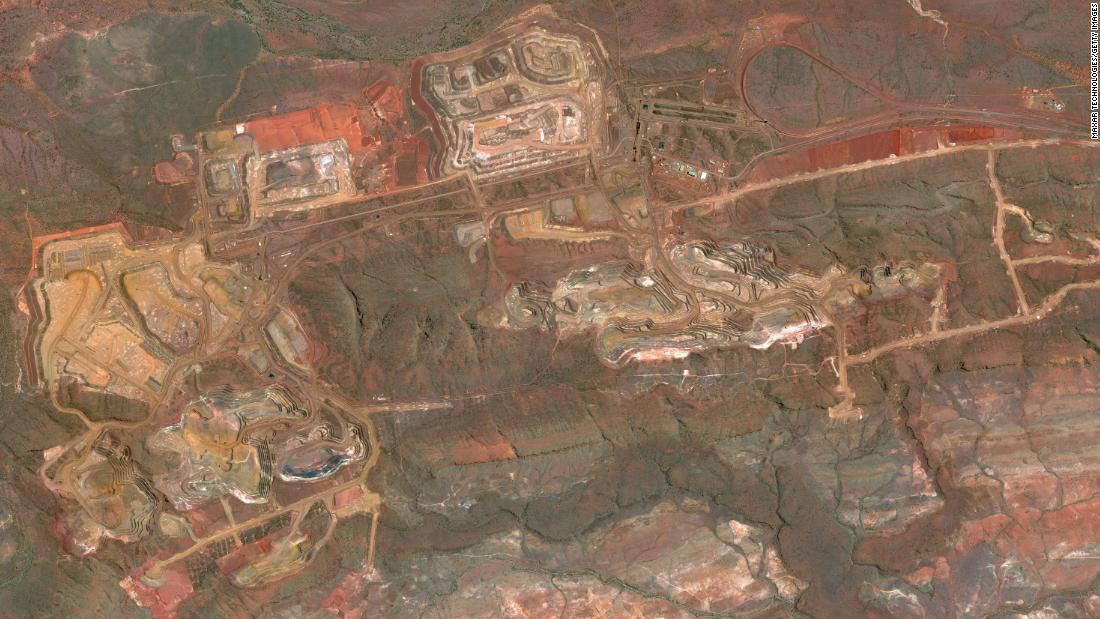

Australia is a big winner of the growing demand and is responsible for about 60% of the iron ore that China imports.

“China’s impressive industrial recovery has boosted demand for steel production, and Australia is a major supplier of steel production to China,” said Sean Langcake, senior economist at Oxford Economics.

China’s dependence on raw materials from Australia stands in stark contrast to China efforts that Beijing has made to put pressure on Canberra. After the Australian Government called for a international investigation into the origins of the pandemic last year, China has hit heavy tariffs or bans on imports of wine, beef, barley and apparently coal.

Meanwhile, Australia’s dependence on iron ore remains strong. Mynreus Rio Tinto (RIO) reported on Tuesday that shipments of the material increased by 2.4% last quarter, aided by ‘robust purchases’ from China.

“In China, the industrial sector has recovered and is now at the pre-Covid level due to the rapid deployment of stimulus,” the company said in a statement.

Fortescue Metals Group (FSUGY), another major Australian iron ore miner, reported in October that China’s strong demand helped the company achieve record shipping for the material. It later reported that it had signed as many as $ 4 billion worth of deals with major Chinese steel mills for iron ore exports.

Australia is not the only country to supply this important raw material to China. But it is by far the largest source, and according to one analyst, it will be difficult to replace if relations between the two countries continue to sour.

“If iron ore shipments from Australia were restricted, China would be forced to pay a higher price for iron ore imports from elsewhere,” Langcake said.

Brazil is one option – about 20% of the iron ore used by China comes from there. But analysts at Changjiang Futures, a security firm in Wuhan, point out that the alternative has problems. Major Brazilian mining company Vale (VALE)for example, struggled with interruptions to provide after a spate of coronavirus infections among its workers last year.

“There is still uncertainty about supply in Brazil in 2021, as the pandemic was not yet effectively under control and Vale SA is less mechanized than its Australian competitors,” Changjiang Futures analysts wrote in a research note earlier this month.

Chinese state media also acknowledged that the country is heavily dependent on Australia for the resource. The International Business Daily – the official newspaper of the Ministry of Trade in the country – suggested so much in an article published in November, pointing out that China needs to import the vast majority of the iron ore needed to make the economy rumble.

“As the Chinese economy continues to recover from the pandemic … the country’s demand for iron ore will increase further in the future,” the article reads.

.Source

Related