(Bloomberg) – A 20% drop in its everyday highs left Cathie Wood’s flagship exchange-traded fund with the least profits for 2021. It increasingly saw a risk on Thursday.

The Ark Innovation ETF (ticker ARKK) fell 5.2% in New York at 10:18 p.m. Assuming the decline continues, the $ 22.9 billion fund will easily obliterate all of its price advances for the year – the latest point on the way to what is still one of Wall Street’s hottest products.

ARKK is caught in a sell-out in expensive parts of the market, especially the technology sector, as the fear of inflation grows and the yield of bonds rises. ARKK’s largest stake, Tesla Inc., fell lower on Thursday after a sharp drop a day earlier. Of the fund’s other major investments, Square Inc. has decreased by 7% and Roku Inc. it decreased by 4.9%.

“In a world of low growth with low rates, low inflation expectations and low GDP growth, such companies have performed well,” Ross Mayfield, Baird’s investment strategy analyst, said of the ARKK’s interest. “If bond yields rise, if economically sensitive parts of the market like energy and finance outperform, these are the kind of companies that can take it on board first.”

Even with the recent decline, ARKK’s performance over the past year is still noticeable to almost any extent. The fund has risen more than 240% since its low in March nearly 12 months ago, and assets have risen from $ 1.5 billion.

ARKK and the $ 7.8 billion Ark Next Generation Internet ETF (ARKW) remain, according to Bloomberg Intelligence data, two of the best performing funds in the US $ 5.8 billion US ETF industry.

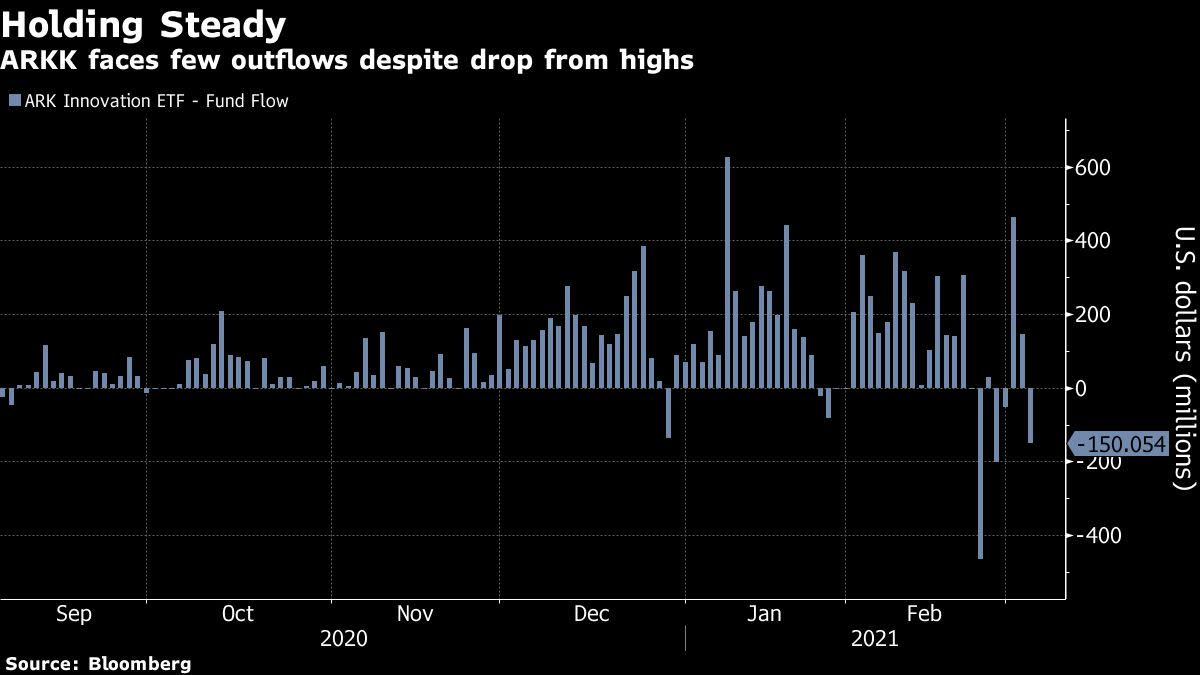

Investors mostly held on during the sale of ARKK, with a combined amount of $ 611 million traded on Friday and Monday. It compensates for the $ 150 million raised on Tuesday, the latest day for which data is available.

“After the impressive 2020 and continued gains in 2021, some digestion is to be expected, given ARKK’s focus on high-growth companies,” said Todd Rosenbluth, head of ETFs and mutual fund research at CFRA Research. “It will be interesting to see if investors show relative patience if there is a decline in days.”

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP