(Bloomberg) – This is the latest corporate strategy for companies from Tesla Inc. to Square Inc: Shifts a portion of the cash reserves to cryptocurrencies as digital assets become more mainstream.

There is still little that they have as far as MicroStrategy Inc. went. The software industry has a Bitcoin value of more than $ 5 billion eight months after the first investment.

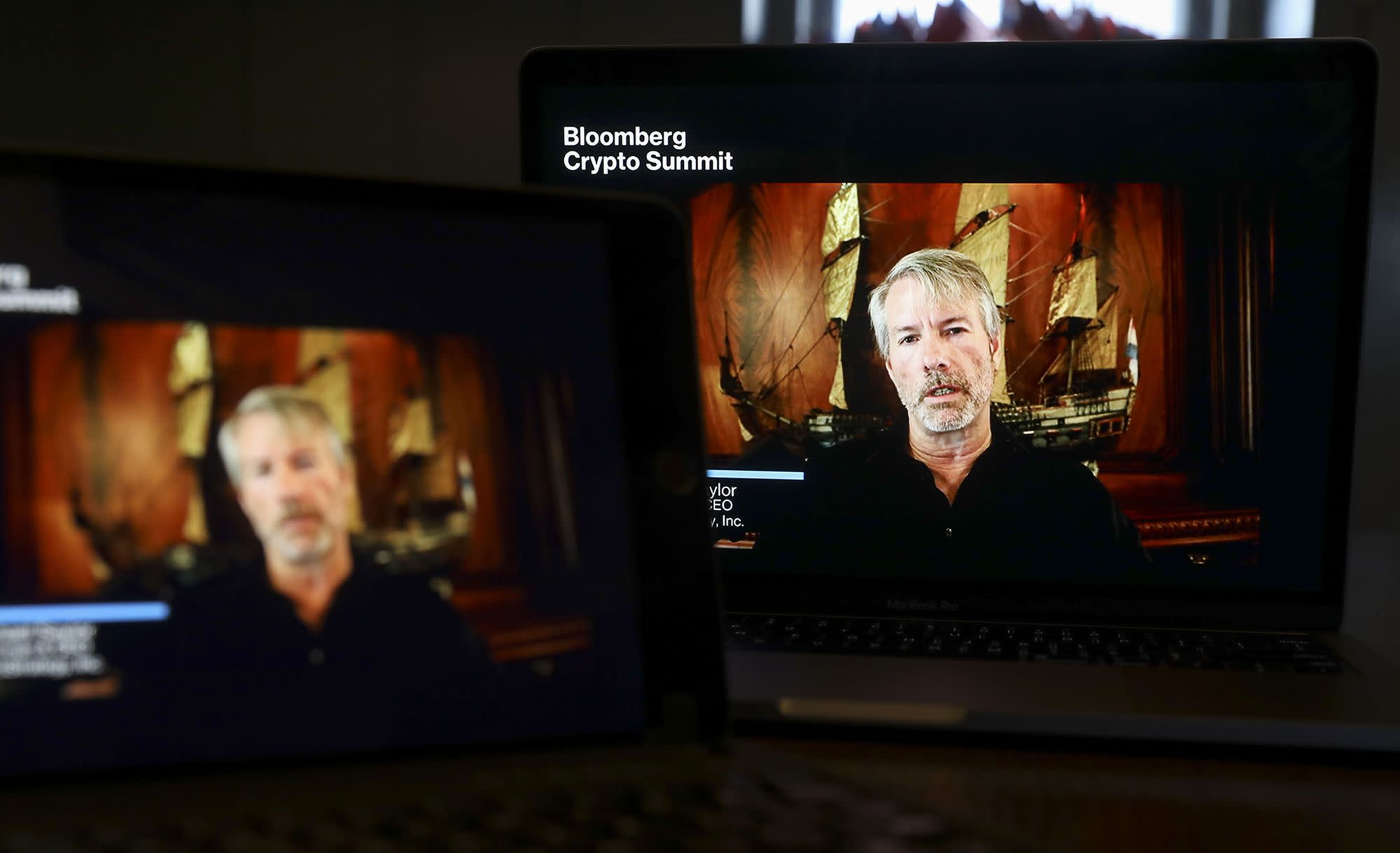

Shares in MicroStrategy have risen nearly 600% since mid-July, raising the founder of Michael Saylor, a billionaire to an accounting scandal in 2000. of the world’s richest crypto-holders, a list that is not definitive, as some fortunes cannot be identified or verified.

MicroStrategy’s crypto-fixation began shortly after the pandemic hit when the company found it had a cash-flow problem: there were just too many of them. After the Tysons Corner, Virginia business, cut 400 jobs unsuitable for homework, he sat on a $ 550 million cash stack with no place to put it. Saylor, 56, turned his attention to Bitcoin.

“People are still not sure: are we crazy or are we not crazy?” Saylor said. ‘The only way to get economic security is to invest in scarce assets that will not be hampered by currency expansion. This is the environment that led us to decide to consider Bitcoin as a treasury reserve asset. ”

‘Every scar’

Not everyone agrees with the strategy.

“Saylor equated Bitcoin to a bank – it’s just ridiculous,” said Marc Lichtenfeld, chief revenue strategist at Oxford Club, a financial research firm with no interest in MicroStrategy. “If you put money in a bank, its value does not increase by 10% per day.”

Saylor has clashed with investors before. In 2000, a shareholder filed a class action lawsuit against MicroStrategy, alleging that he was misleading investors about the company’s earnings by discussing early earnings to increase profits.

MicroStrategy agreed to adjust its revenue figures and Saylor, once called the richest man in Washington, DC, with a fortune of $ 7 billion, almost lost it within a few weeks after the shares fell by 95%. He and his co-managers, without acknowledging or denying the allegations, paid $ 11 million to the Securities and Exchange Commission in December 2000, including $ 1 million in fines.

“It made us careful and humble and focused,” Saylor said. “Every scar lets you know, and I would not be who I am without experiencing the experiences.”

Stable income

Saylor continued to run the analytics software he founded in 1989, overseeing annual revenue streams of approximately $ 500 million over the past decade, although sales have declined over the past year.

The price of Bitcoin has risen over the past few months, reaching a record high of more than $ 58,000 last month as large investors accumulated and the asset class declined.

Saylor raises his concern about the volatility of Bitcoin and says crypto-critics are sitting behind the curve. He said he also poured his own money into the digital asset and amassed a personal interest of more than $ 1 billion.

“If you go back ten years, how many people agree that Facebook, Google, Apple and Amazon will own the world?” he said. ‘Who were the last people to adopt it? Senior members of the enterprise. ”

Increase debt

Saylor’s appetite for acquiring Bitcoin did not stop after the company’s first purchase. When the majority of MicroStrategy’s cash reserves were depleted, Saylor raised a $ 650 million corporate bond and used it to buy more.

Saylor said he now would rather spend debt on future cash flows than save over five years to buy Bitcoin, if he thinks it will be more expensive.

In February, the company raised another $ 1.05 billion in a bond-for-Bitcoin offering, and on March 5, it announced even more purchases. On Friday, Saylor tweeted that MicroStrategy had purchased 262 additional Bitcoins for $ 15 million in cash, bringing the total to about 91,326. The company’s shares closed up 2.5% to $ 784 in New York.

Read more: MicroStrategy CEO will consider acquiring more debt to buy Bitcoin

The move led to MicroStrategy becoming a dual-purpose company: part-software maker, part-Bitcoin investor. Although the firm has been transparent about this change in disclosure regulations, it is not something that investors are used to dealing with with two different goals.

“If you are a hedge fund and you want to make the kind of concentrated bet, you are entitled to do so,” Lichtenfeld said, “but as a software company to make this kind of bet, it is completely irresponsible.”

‘Critical point’

Saylor said the company has been in advance with investors throughout. When MicroStrategy increased its Bitcoin stake, it held a Dutch auction to give shareholders time to sell their shares.

“Everyone had enough time to digest the news and decide if they were on or off,” Saylor said.

With all the attention he has drawn, Saylor wants to do more than just defend a radical investment strategy. He has become something of a global Bitcoin ambassador over the past few months, appearing regularly on crypto podcasts, and YouTube programs advocating investing in digital assets.

“This is a very critical point in human history,” he said. “We will build a better world on it as soon as people understand it. We are still very early. This will be the decade. ”

(Updates with additional purchases in the 17th paragraph.)

For more articles like this, please visit us at bloomberg.com

Sign up now to stay ahead of the most trusted business news source.

© 2021 Bloomberg LP